-

European stocks rise as oil tumbles, while tech worries weigh on New York

European stocks rise as oil tumbles, while tech worries weigh on New York

-

England captain Itoje on bench for Six Nations opener against Wales

-

Rahm says golfers should be 'free' to play where they want after LIV defections

Rahm says golfers should be 'free' to play where they want after LIV defections

-

More baby milk recalls in France after new toxin rules

-

Rosenior will not rush Estevao return from Brazil

Rosenior will not rush Estevao return from Brazil

-

Mercedes ready to win F1 world title, says Russell

-

Germany hit by nationwide public transport strike

Germany hit by nationwide public transport strike

-

Barca coach Flick 'not happy' with Raphinha thigh strain

-

WHO chief says turmoil creates chance for reset

WHO chief says turmoil creates chance for reset

-

European stocks rise as gold, oil prices tumble

-

Rink issues resolved, NHL stars chase Olympic gold at Milan

Rink issues resolved, NHL stars chase Olympic gold at Milan

-

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

-

Rodri rages that officials 'don't want' Man City to win

Rodri rages that officials 'don't want' Man City to win

-

Gaza's Rafah crossing makes limited reopening after two-year war

-

African players in Europe: Ouattara dents Villa title hopes

African players in Europe: Ouattara dents Villa title hopes

-

Liverpool beat Chelsea to Rennes defender Jacquet - reports

-

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

-

Trump says US talking deal with 'highest people' in Cuba

-

Trump threatens legal action against Grammy host over Epstein comment

Trump threatens legal action against Grammy host over Epstein comment

-

Olympic Games in northern Italy have German twist

-

Bad Bunny: the Puerto Rican phenom on top of the music world

Bad Bunny: the Puerto Rican phenom on top of the music world

-

Snapchat blocks 415,000 underage accounts in Australia

-

At Grammys, 'ICE out' message loud and clear

At Grammys, 'ICE out' message loud and clear

-

Dalai Lama's 'gratitude' at first Grammy win

-

Bad Bunny makes Grammys history with Album of the Year win

Bad Bunny makes Grammys history with Album of the Year win

-

Stocks, oil, precious metals plunge on volatile start to the week

-

Steven Spielberg earns coveted EGOT status with Grammy win

Steven Spielberg earns coveted EGOT status with Grammy win

-

Knicks boost win streak to six by beating LeBron's Lakers

-

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

-

Japan says rare earth found in sediment retrieved on deep-sea mission

-

San Siro prepares for last dance with Winter Olympics' opening ceremony

San Siro prepares for last dance with Winter Olympics' opening ceremony

-

France great Benazzi relishing 'genius' Dupont's Six Nations return

-

Grammy red carpet: black and white, barely there and no ICE

Grammy red carpet: black and white, barely there and no ICE

-

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

-

South Korea football bosses in talks to avert Women's Asian Cup boycott

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

British singer Olivia Dean wins Best New Artist Grammy

-

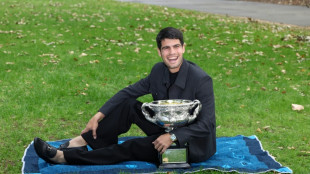

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

-

Surging euro presents new headache for ECB

-

Djokovic hints at retirement as time seeps away on history bid

Djokovic hints at retirement as time seeps away on history bid

-

US talking deal with 'highest people' in Cuba: Trump

-

UK ex-ambassador quits Labour over new reports of Epstein links

UK ex-ambassador quits Labour over new reports of Epstein links

-

Trump says closing Kennedy Center arts complex for two years

-

Formerra and Evonik Expand Distribution Partnership for Healthcare Grades

Formerra and Evonik Expand Distribution Partnership for Healthcare Grades

-

Hans Vestberg, Former Verizon Chairman and CEO, Joins Digipower X As Senior Advisor

-

Reigning world champs Tinch, Hocker among Millrose winners

Reigning world champs Tinch, Hocker among Millrose winners

-

Venezuelan activist ends '1,675 days' of suffering in prison

-

Real Madrid scrape win over Rayo, Athletic claim derby draw

Real Madrid scrape win over Rayo, Athletic claim derby draw

-

PSG beat Strasbourg after Hakimi red to retake top spot in Ligue 1

Money laundering probe overshadows Deutsche Bank's record profits

Deutsche Bank said Thursday it aimed to become a "European champion" after reporting record profits in 2025, even as the results were overshadowed by a money-laundering probe reportedly linked to Russian billionaire Roman Abramovich.

Germany's biggest lender reported pre-tax profits of 9.7 billion euros ($11.6 billion) for last year, an 84 percent jump on 2024, extending a run of good performance in part due to higher long-term interest rates.

But the shine was taken off the results by the money-laundering investigation, which saw prosecutors and police raid the bank's headquarters in Frankfurt and its office in Berlin on Wednesday.

Media reports said it was linked to Abramovich, who has been sanctioned by the European Union.

The investigation is a blow for a bank that had worked hard in recent years to shed its reputation as a magnet for scandals, and CEO Christian Sewing sounded disappointed.

"We had actually hoped that your full attention this week would be focused on our annual results," he told reporters.

"Since yesterday, we know that this is not entirely the case," he added, while refusing to answer questions when asked about the bank's past business with Abramovich.

Sewing nevertheless struck an upbeat note about Deutsche Bank's results and future prospects, saying it had hit all its 2025 goals.

"This gives us the strongest possible foundation for the next phase of our strategy," he said, adding that the bank aimed to become "the European champion".

Earnings rose last year across all main divisions, including investment and corporate banking as well as asset management, and revenues were up seven percent to 32.1 billion euros.

Net profit attributable to shareholders was 6.1 billion euros, more than double that of 2024, when it was weighed down by legal costs related to a troubled takeover.

Its shares fell two percent in Frankfurt Thursday after the results were released.

- Run of scandals -

The Sueddeutsche Zeitung newspaper reported details of the money-laundering probe, which it said involved the bank's dealings with companies linked to Abramovich.

Abramovich, who had ties to Russian President Vladimir Putin and is the former owner of English football club Chelsea, was sanctioned by the EU following Russia's full-scale invasion of Ukraine in 2022.

Prosecutors have not confirmed who was being targeted.

Sewing said the probe involved allegations that a report related to suspected money-laundering was filed late, and concerned transactions between 2013 and 2018.

"We are of course cooperating fully with the authorities," he added.

Deutsche Bank has faced scrutiny on several occasions in recent years over suspicious transactions, and has previously been fined for failing to report suspicious activity quickly enough.

The bank also ran into trouble after expanding aggressively in the early 2000s in a bid to compete with Wall Street giants.

It was drawn into multiple scandals, and was hit in 2017 with a multi-billion-dollar fine in the United States to settle lawsuits over its role in the "subprime" mortgage crisis, which contributed to the global financial crisis.

The lender, which has almost 90,000 employees, has undergone a major restructuring under Sewing, focusing more on Europe and corporate and retail banking, and shifting away from overly risky investment banking activities.

I.Meyer--BTB