-

Vonn claims third podium of the season at Val d'Isere

Vonn claims third podium of the season at Val d'Isere

-

India drops Shubman Gill from T20 World Cup squad

-

Tens of thousands attend funeral of killed Bangladesh student leader

Tens of thousands attend funeral of killed Bangladesh student leader

-

England 'flat' as Crawley admits Australia a better side

-

Australia four wickets from Ashes glory as England cling on

Australia four wickets from Ashes glory as England cling on

-

Beetles block mining of Europe's biggest rare earths deposit

-

French culture boss accused of mass drinks spiking to humiliate women

French culture boss accused of mass drinks spiking to humiliate women

-

NBA champions Thunder suffer rare loss to Timberwolves

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

-

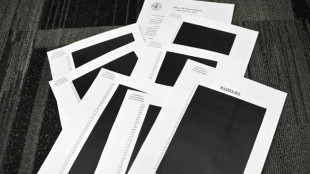

Epstein files opened: famous faces, many blacked-out pages

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

World stocks plunge, oil tops $105 as Russia invades Ukraine

Oil surged past $105 per barrel and equities tumbled Thursday after key crude producer Russia sent forces into Ukraine, accelerating fears of a major war in eastern Europe.

Asian and European stock markets nosedived -- with Frankfurt shedding five percent in mid-afternoon trading -- as investors fled risky equities, while haven investment, gold, rose to just over $1,955 per ounce.

After weeks of warnings from the United States and other powers, Russian President Vladimir Putin ordered a wide-ranging offensive into its neighbour, sparking fury from other world leaders and vows to ramp up sanctions on Moscow.

In reaction, oil rocketed more than eight percent, with European benchmark Brent prices briefly cruising past $105 per barrel for the first time since 2014, while aluminium and wheat surged to record peaks on fears over output from major exporter Russia.

- 'Sea of red' -

"There is a sea of red across global markets," said Interactive Investor analyst Victoria Scholar.

"After Russia's invasion sparked an initial spike higher, oil prices have continued to travel north as markets assess the hit to energy supply that is likely to come as a result of the conflict."

Asian equities plunged, with Hong Kong, Sydney, Mumbai, Singapore and Wellington down at least three percent, while there were steep losses in Tokyo and Shanghai.

London shed more than three percent in mid-afternoon trading, as fears grew of a broader conflict.

Wall Street followed, with the Dow slumping about two percent shortly after opening.

Analysts pointed to fear of the unknown driving the markets, especially over retaliatory sanctions by the West and how Russia will respond.

"There is uncertainty about how much lower stock prices will fall, so there is a bit of a sell-first-ask-questions later mentality in the market right now," analyst Patrick J. O'Hare at Briefing.com said.

- Russia-exposed firms hit -

Companies with the biggest presence in Russia were among those whose share prices were getting hammered.

Shares in Russian metal giants Polymetal and Evraz tanked by 49 percent and 29 percent respectively in London.

"With tough incoming sanctions expected, their businesses are likely to take a major hit with little respite in sight given the seriousness of the situation," said Hargreaves Lansdown analyst Susannah Streeter.

French carmaker Renault, which owns a majority stake in Russia's Avtovaz, the maker of the Lada, saw its shares skid 11 percent.

Also in Paris trading, Societe Generale dived 12 percent on concerns over its Russian retail banking subsidiary Rosbank.

"There will be pressure on (European) banking stocks, particularly banks in France and Austria as they have the largest exposure to Russian loans," added Streeter.

Germany's Deutsche Bank also shed 11 percent.

Other haven assets profited, with the Swiss franc hitting a five-year peak versus the euro.

The ruble fell nearly six percent to 86.7 rubles to the dollar, while the Moscow stock exchange's MOEX index plunging 34.9 percent after suspending trading early in the day.

"It is hard to find any reasons for the selloff to reverse now that it appears the tanks are rolling," said OANDA's Jeffrey Halley.

"Stronger sanctions are to come on Russia and energy prices will inevitably head higher in the short term."

- Gas prices spike -

European natural gas prices vaulted higher on disruption worries, particularly after Germany this week halted the approval of the Nord Stream 2 pipeline from Russia.

Europe's reference Dutch TTF gas price jumped about a third to hit more than 126 euros per megawatt hour.

Domestic energy prices had already rocketed in Europe during recent months, fuelling decades-high inflation that has caused central banks to raise or prepare to raise interest rates, which could in turn slow the economic recovery.

- Key figures around 1430 GMT -

Brent North Sea crude: UP 7.6 percent at $104.20 per barrel

West Texas Intermediate: UP 7.7 percent at $99.20 per barrel

London - FTSE 100: DOWN 3.3 percent at 7,248.38 points

Frankfurt - DAX: DOWN 5.1 percent at 13,887.39

Paris - CAC 40: DOWN 4.3 percent at 6,486.65

EURO STOXX 50: DOWN 4.6 percent at 3,791.55

New York - Dow: DOWN 2.1 percent at 32,421.63

Tokyo - Nikkei 225: DOWN 1.8 percent at 25,970.82 (close)

Hong Kong - Hang Seng Index: DOWN 3.2 percent at 22,901.56 (close)

Shanghai - Composite: DOWN 1.7 percent at 3,429.96 (close)

Euro/dollar: DOWN at $1.1148 from $1.1307 late Wednesday

Pound/dollar: DOWN at $1.3349 from $1.3544

Euro/pound: UP at 83.54 pence from 83.48 pence

Dollar/yen: UP at 115.02 yen from 115.01 yen

burs-kjm/rl

C.Meier--BTB