-

Oil slides, gold loses lustre as Iran threat recedes

Oil slides, gold loses lustre as Iran threat recedes

-

Russian captain found guilty in fatal North Sea crash

-

Disney earnings boosted by theme parks, as CEO handover nears

Disney earnings boosted by theme parks, as CEO handover nears

-

Sri Lanka drop Test captain De Silva from T20 World Cup squad

-

France demands 1.7 bn euros in payroll taxes from Uber: media report

France demands 1.7 bn euros in payroll taxes from Uber: media report

-

EU will struggle to secure key raw materials supply, warns report

-

France poised to adopt 2026 budget after months of tense talks

France poised to adopt 2026 budget after months of tense talks

-

Latest Epstein file dump rocks UK royals, politics

-

Arteta seeks Arsenal reinforcement for injured Merino

Arteta seeks Arsenal reinforcement for injured Merino

-

Russia uses sport to 'whitewash' its aggression, says Ukraine minister

-

Chile officially backs Bachelet candidacy for UN top job

Chile officially backs Bachelet candidacy for UN top job

-

European stocks rise as oil tumbles, while tech worries weigh on New York

-

England captain Itoje on bench for Six Nations opener against Wales

England captain Itoje on bench for Six Nations opener against Wales

-

Rahm says golfers should be 'free' to play where they want after LIV defections

-

More baby milk recalls in France after new toxin rules

More baby milk recalls in France after new toxin rules

-

Rosenior will not rush Estevao return from Brazil

-

Mercedes ready to win F1 world title, says Russell

Mercedes ready to win F1 world title, says Russell

-

Germany hit by nationwide public transport strike

-

Barca coach Flick 'not happy' with Raphinha thigh strain

Barca coach Flick 'not happy' with Raphinha thigh strain

-

WHO chief says turmoil creates chance for reset

-

European stocks rise as gold, oil prices tumble

European stocks rise as gold, oil prices tumble

-

Rink issues resolved, NHL stars chase Olympic gold at Milan

-

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

-

Rodri rages that officials 'don't want' Man City to win

-

Gaza's Rafah crossing makes limited reopening after two-year war

Gaza's Rafah crossing makes limited reopening after two-year war

-

African players in Europe: Ouattara dents Villa title hopes

-

Liverpool beat Chelsea to Rennes defender Jacquet - reports

Liverpool beat Chelsea to Rennes defender Jacquet - reports

-

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

-

Trump says US talking deal with 'highest people' in Cuba

Trump says US talking deal with 'highest people' in Cuba

-

Trump threatens legal action against Grammy host over Epstein comment

-

Olympic Games in northern Italy have German twist

Olympic Games in northern Italy have German twist

-

Bad Bunny: the Puerto Rican phenom on top of the music world

-

Snapchat blocks 415,000 underage accounts in Australia

Snapchat blocks 415,000 underage accounts in Australia

-

At Grammys, 'ICE out' message loud and clear

-

Dalai Lama's 'gratitude' at first Grammy win

Dalai Lama's 'gratitude' at first Grammy win

-

Bad Bunny makes Grammys history with Album of the Year win

-

Stocks, oil, precious metals plunge on volatile start to the week

Stocks, oil, precious metals plunge on volatile start to the week

-

Steven Spielberg earns coveted EGOT status with Grammy win

-

Knicks boost win streak to six by beating LeBron's Lakers

Knicks boost win streak to six by beating LeBron's Lakers

-

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

-

Japan says rare earth found in sediment retrieved on deep-sea mission

Japan says rare earth found in sediment retrieved on deep-sea mission

-

San Siro prepares for last dance with Winter Olympics' opening ceremony

-

France great Benazzi relishing 'genius' Dupont's Six Nations return

France great Benazzi relishing 'genius' Dupont's Six Nations return

-

Grammy red carpet: black and white, barely there and no ICE

-

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

-

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

-

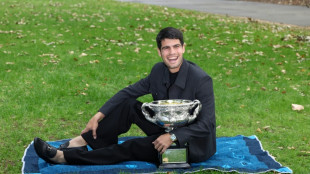

Hatred of losing drives relentless Alcaraz to tennis history

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

| RBGPF | 0.12% | 82.5 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| RYCEF | 4.19% | 16.7 | $ | |

| AZN | 0.84% | 192.06 | $ | |

| CMSC | -0.17% | 23.71 | $ | |

| BTI | 0.25% | 60.845 | $ | |

| GSK | 1.84% | 52.58 | $ | |

| RELX | -0.52% | 35.62 | $ | |

| RIO | 1.75% | 92.705 | $ | |

| BCC | 1.94% | 82.425 | $ | |

| NGG | -0.12% | 85.16 | $ | |

| BCE | 0.1% | 25.871 | $ | |

| CMSD | -0.03% | 24.092 | $ | |

| VOD | 1.51% | 14.875 | $ | |

| JRI | 0.48% | 13.14 | $ | |

| BP | -0.22% | 37.795 | $ |

China cuts lending rates, boosting property firms

China further reduced bank lending costs Thursday in the latest move to boost its stuttering economy, providing some much-needed support to the country's beleaguered developers.

Property firm shares and bonds surged on the fresh rate cut from People's Bank of China -- the second in two months -- days after Beijing reported slower growth in the final months of 2021.

The slowing real estate industry has put downward pressure on growth, with several large companies including debt-laden development giant Evergrande defaulting in recent months.

The central bank said it had lowered the one-year loan prime rate (LPR) to 3.7 percent, from 3.8 percent in December.

It had reduced the LPR -- which guides how much interest commercial banks charge to corporate borrowers -- in December, for the first time in 20 months, as the economy was threatened by the real estate crisis and coronavirus flare-ups.

The launch of a regulatory drive last year to curb speculation and leverage had cut off avenues to crucially needed cash, sparking a crisis in the property sector.

But investors regained confidence amid expectations of regulatory easing with shares in Hong Kong-listed Agile Group up more than six percent and Country Garden climbing 7.4 percent.

Property developer bonds also surged Thursday on news of the rate cut, in what Bloomberg said was a record-breaking rally, highlighting the huge sums of money primed to flow into distressed securities if the property sector crackdown was eased.

Thursday's move comes after the world's second-biggest economy reported strong 8.1 percent growth in 2021, but with the first half of the year accounting for much of that growth.

The central bank also cut the interest rate on its one-year policy loans on Monday -- the first drop in the key rate for loans to financial institutions since early 2020.

- 'Targeted support' -

China was the only major economy to expand in 2020, after quickly bringing the outbreak under control.

But the country is now battling several localised virus clusters as it deals with the ongoing property market slump and fallout from a wide-ranging regulatory crackdown last year.

"Today's reductions to both the one-year and five-year Loan Prime Rates (LPR) continue the PBOC's efforts to push down borrowing costs," said Sheana Yue, China economist at Capital Economics.

She said the cuts mean "mortgages will now be slightly cheaper, which should help shore up housing demand."

"Targeted support for property buyers does appear to be limiting one of the more severe downside risks facing the economy."

Hong Kong-listed China Aoyuan Group became the latest major developer to miss bond payments, saying in a filing it would be unable to pay two notes due Thursday and Saturday, amounting to $688 million in total.

Fitch Ratings also downgraded its rating for real estate giant Sunac China Holdings, warning the developer would have to use its cash reserves to pay off debts maturing soon.

Y.Bouchard--BTB