-

Oil slides, gold loses lustre as Iran threat recedes

Oil slides, gold loses lustre as Iran threat recedes

-

Russian captain found guilty in fatal North Sea crash

-

Disney earnings boosted by theme parks, as CEO handover nears

Disney earnings boosted by theme parks, as CEO handover nears

-

Sri Lanka drop Test captain De Silva from T20 World Cup squad

-

France demands 1.7 bn euros in payroll taxes from Uber: media report

France demands 1.7 bn euros in payroll taxes from Uber: media report

-

EU will struggle to secure key raw materials supply, warns report

-

France poised to adopt 2026 budget after months of tense talks

France poised to adopt 2026 budget after months of tense talks

-

Latest Epstein file dump rocks UK royals, politics

-

Arteta seeks Arsenal reinforcement for injured Merino

Arteta seeks Arsenal reinforcement for injured Merino

-

Russia uses sport to 'whitewash' its aggression, says Ukraine minister

-

Chile officially backs Bachelet candidacy for UN top job

Chile officially backs Bachelet candidacy for UN top job

-

European stocks rise as oil tumbles, while tech worries weigh on New York

-

England captain Itoje on bench for Six Nations opener against Wales

England captain Itoje on bench for Six Nations opener against Wales

-

Rahm says golfers should be 'free' to play where they want after LIV defections

-

More baby milk recalls in France after new toxin rules

More baby milk recalls in France after new toxin rules

-

Rosenior will not rush Estevao return from Brazil

-

Mercedes ready to win F1 world title, says Russell

Mercedes ready to win F1 world title, says Russell

-

Germany hit by nationwide public transport strike

-

Barca coach Flick 'not happy' with Raphinha thigh strain

Barca coach Flick 'not happy' with Raphinha thigh strain

-

WHO chief says turmoil creates chance for reset

-

European stocks rise as gold, oil prices tumble

European stocks rise as gold, oil prices tumble

-

Rink issues resolved, NHL stars chase Olympic gold at Milan

-

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

-

Rodri rages that officials 'don't want' Man City to win

-

Gaza's Rafah crossing makes limited reopening after two-year war

Gaza's Rafah crossing makes limited reopening after two-year war

-

African players in Europe: Ouattara dents Villa title hopes

-

Liverpool beat Chelsea to Rennes defender Jacquet - reports

Liverpool beat Chelsea to Rennes defender Jacquet - reports

-

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

-

Trump says US talking deal with 'highest people' in Cuba

Trump says US talking deal with 'highest people' in Cuba

-

Trump threatens legal action against Grammy host over Epstein comment

-

Olympic Games in northern Italy have German twist

Olympic Games in northern Italy have German twist

-

Bad Bunny: the Puerto Rican phenom on top of the music world

-

Snapchat blocks 415,000 underage accounts in Australia

Snapchat blocks 415,000 underage accounts in Australia

-

At Grammys, 'ICE out' message loud and clear

-

Dalai Lama's 'gratitude' at first Grammy win

Dalai Lama's 'gratitude' at first Grammy win

-

Bad Bunny makes Grammys history with Album of the Year win

-

Stocks, oil, precious metals plunge on volatile start to the week

Stocks, oil, precious metals plunge on volatile start to the week

-

Steven Spielberg earns coveted EGOT status with Grammy win

-

Knicks boost win streak to six by beating LeBron's Lakers

Knicks boost win streak to six by beating LeBron's Lakers

-

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

-

Japan says rare earth found in sediment retrieved on deep-sea mission

Japan says rare earth found in sediment retrieved on deep-sea mission

-

San Siro prepares for last dance with Winter Olympics' opening ceremony

-

France great Benazzi relishing 'genius' Dupont's Six Nations return

France great Benazzi relishing 'genius' Dupont's Six Nations return

-

Grammy red carpet: black and white, barely there and no ICE

-

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

-

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

-

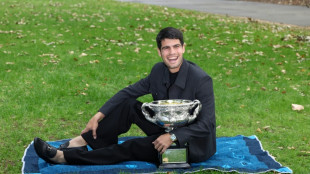

Hatred of losing drives relentless Alcaraz to tennis history

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

| RBGPF | 0.12% | 82.5 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| RYCEF | 4.19% | 16.7 | $ | |

| AZN | 0.84% | 192.06 | $ | |

| CMSC | -0.17% | 23.71 | $ | |

| BTI | 0.25% | 60.845 | $ | |

| GSK | 1.84% | 52.58 | $ | |

| RELX | -0.52% | 35.62 | $ | |

| RIO | 1.75% | 92.705 | $ | |

| BCC | 1.94% | 82.425 | $ | |

| NGG | -0.12% | 85.16 | $ | |

| BCE | 0.1% | 25.871 | $ | |

| CMSD | -0.03% | 24.092 | $ | |

| VOD | 1.51% | 14.875 | $ | |

| JRI | 0.48% | 13.14 | $ | |

| BP | -0.22% | 37.795 | $ |

Millionaires make unusual plea: 'Tax us now'

More than 100 millionaires made an unusual plea on Wednesday: "Tax us now".

Their appeal came as a study backed by wealthy individuals and nonprofits found that a wealth tax on the world's richest people could raise $2.52 trillion per year -- enough to pay for Covid vaccines for everyone and pull 2.3 billion people out of poverty.

In an open letter to the World Economic Forum's online Davos meeting, 102 millionaires, including Disney heiress Abigail Disney, said the current tax system is unfair and "deliberately designed to make the rich richer".

"The world -- every country in it -- must demand the rich pay their fair share," the letter says. "Tax us, the rich, and tax us now."

Their plea follows a report by global charity Oxfam this week which said that the world's 10 wealthiest men doubled their fortunes to $1.5 trillion during the first two years of the pandemic while inequality and poverty soared.

"As millionaires, we know that the current tax system is not fair," says the letter circulated by groups including Patriotic Millionaires, Millionaires for Humanity, Tax me Now, and Oxfam.

"Most of us can say that, while the world has gone through an immense amount of suffering in the last two years, we have actually seen our wealth rise during the pandemic -- yet few if any of us can honestly say that we pay our fair share in taxes."

The signatories include wealthy men and women from the United States, Canada, Germany, Britain, Denmark, Norway, Austria, the Netherlands and Iran.

The Patriotic Millionaires took part in a the wealth tax study with a network of non-profits and social movements, including Fight for Inequality Alliance, Oxfam and the US-based Institute for Policy Studies think tank.

In addition to funding vaccines worldwide and alleviating poverty, the tax would be enough to provide universal health care and social protection to 3.6 billion people in low- and middle-income countries, the group said.

The tax would be set at two percent for those worth over $5 million, three percent for over $50 million and five percent for over $1 billion.

- 'Realistic' tax -

The group said a steeper progressive tax, which includes a 10 percent levy on billionaires, would raise $3.62 trillion a year. The actual levels of taxation would be country specific.

Jenny Ricks, global convenor of the Fight Inequality Alliance, told AFP the group chose a lower progressive tax that was on the "realistic side".

A plan to tax the wealth of some 700 American billionaires was floated by Democrats in the US Congress last year, but it was cut from President Joe Biden's $1.75 trillion social spending and climate change programme.

Wednesday's tax proposal was made as global government and business leaders take part in the virtual Davos meeting this week. The in-person gathering was postponed due to the spread of the Omicron variant.

"There is no defending a system that endlessly inflates the wealth of the world's richest people while condemning billions to easily preventable poverty," Patriotic Millionaires chairman Morris Pearl, a former BlackRock investment firm managing director, said in a statement.

"We need deep, systemic change, and that starts with taxing rich people like me," Morris said.

D.Schneider--BTB