-

Schauffele ties record-low major round with 62 for PGA lead

Schauffele ties record-low major round with 62 for PGA lead

-

Slovak PM speaking but serious after shooting, suspected gunman charged

-

Ten Hag warns England's Shaw doubtful for Euro 2024

Ten Hag warns England's Shaw doubtful for Euro 2024

-

Swiatek into Rome Open final as trophy record beckons, Paul battles through

-

US bank regulator grilled over 'toxic culture' at agency

US bank regulator grilled over 'toxic culture' at agency

-

Nigeria lawmaker's plan for mass wedding of orphans sparks uproar

-

Ukraine trying to 'stabilise' front as Russia pushes northeast

Ukraine trying to 'stabilise' front as Russia pushes northeast

-

'Fighter' Alaphilippe back winning in Giro 12th stage, Pogacar holds lead

-

Demirtas: Erdogan's Kurdish nemesis condemned to prison

Demirtas: Erdogan's Kurdish nemesis condemned to prison

-

Juve's Allegri suspended two matches after cup final red

-

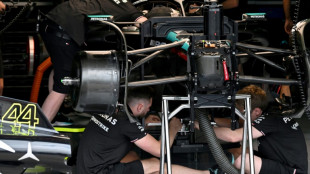

Hamilton says struggling Mercedes have found 'North Star'

Hamilton says struggling Mercedes have found 'North Star'

-

Trump lawyers vie to discredit key witness Cohen at trial

-

England centre Slade signs new Exeter deal to end talk of France move

England centre Slade signs new Exeter deal to end talk of France move

-

Brazil's Porto Alegre: a flood disaster waiting to happen

-

Resilient Schauffele grabs PGA lead as McIlroy's emotions tested

Resilient Schauffele grabs PGA lead as McIlroy's emotions tested

-

'I was trying to take a picture' with Slovak PM when he was shot: witness

-

F1 design guru Newey will 'probably' join new team after Red Bull exit

F1 design guru Newey will 'probably' join new team after Red Bull exit

-

Walmart profits rise on strong sales from wealthier shoppers

-

100 years of British royal photography goes on display in London

100 years of British royal photography goes on display in London

-

Alaphilippe wins Giro 12th stage, Pogacar holds race lead

-

Nigerian women's rights pioneer celebrated in new biopic

Nigerian women's rights pioneer celebrated in new biopic

-

Israel vows to 'intensify' operations in Rafah

-

Slovak PM 'able to speak' after shooting, suspected gunman charged

Slovak PM 'able to speak' after shooting, suspected gunman charged

-

Pyramids built along long-lost river, scientists discover

-

London's Queen's Club to host WTA Tour event for first time in 52 years

London's Queen's Club to host WTA Tour event for first time in 52 years

-

Paul survives chaotic ending to reach Rome Open semis

-

French LGBTQ groups 'extremely concerned' over increase in attacks

French LGBTQ groups 'extremely concerned' over increase in attacks

-

Anya Taylor-Joy praises 'unbelievable' 'Mad Max' stunt team

-

Stocks waver after hitting record highs

Stocks waver after hitting record highs

-

Green policies can be vote winners, London mayor says

-

McIlroy shares early lead at emotionally testing PGA Championship

McIlroy shares early lead at emotionally testing PGA Championship

-

S.Africa tells UN court Israel 'genocide' hit 'new and horrific stage'

-

Man City's Ederson out of Premier League climax and FA Cup final

Man City's Ederson out of Premier League climax and FA Cup final

-

'Rappers and yodellers': Nagelsmann strikes balance in Euro 2024 squad

-

England set to ban gender identity teaching in schools

England set to ban gender identity teaching in schools

-

Serbia leases army HQ bombed by NATO to Trump son-in-law

-

France deploys additional forces to quell New Caledonia unrest

France deploys additional forces to quell New Caledonia unrest

-

McIlroy faces emotional early test as PGA Championship begins

-

Chelsea players 'love' Pochettino and must fight for him, says Palmer

Chelsea players 'love' Pochettino and must fight for him, says Palmer

-

Germany boss Nagelsmann ignores Hummels to stick with regulars for Euros

-

Sevilla great Navas to leave club in summer

Sevilla great Navas to leave club in summer

-

France accuses Azerbaijan of interference in New Caledonia riots

-

European stocks dip from records, shrugging off gains elsewhere

European stocks dip from records, shrugging off gains elsewhere

-

Toulouse's Chocobares eligible for Champions Cup final in spite of suspension

-

Dutch EU opt-out on asylum could take 'years': Wilders to AFP

Dutch EU opt-out on asylum could take 'years': Wilders to AFP

-

Murray makes victorious comeback in Bordeaux

-

China's Baidu posts weakest quarterly revenue growth in over a year

China's Baidu posts weakest quarterly revenue growth in over a year

-

EU probes Facebook, Instagram over child protection

-

Inter's title party continues as off-field problems lurk

Inter's title party continues as off-field problems lurk

-

A pariah in the West, Putin finds fans in Beijing

| RBGPF | -1.42% | 59.7 | $ | |

| CMSC | -0.25% | 24.43 | $ | |

| NGG | 0.65% | 73.277 | $ | |

| RYCEF | -2.13% | 5.326 | $ | |

| SCS | 0.69% | 13.705 | $ | |

| BCC | -2.99% | 136.77 | $ | |

| RIO | 1.64% | 71.5 | $ | |

| CMSD | -0.3% | 24.3 | $ | |

| RELX | -0.07% | 43.88 | $ | |

| BCE | -0.71% | 34.326 | $ | |

| JRI | -0.34% | 11.61 | $ | |

| VOD | 1.48% | 9.785 | $ | |

| AZN | 0.11% | 77.055 | $ | |

| GSK | -1.01% | 44.8701 | $ | |

| BP | -0.71% | 37.06 | $ | |

| BTI | 0.81% | 31.575 | $ |

US stocks rise on tech outlook as yen rebounds

The yen rebounded Monday from a 34-year low against the dollar after what some traders speculate could have been the first intervention by Japanese authorities to support the weakening currency since late 2022.

Meanwhile, US shares opened higher as last week's tech rally continued, led by Tesla after its founder Elon Musk won key security clearances during a trip to China.

In Asia, the yen sank to 160.17 to the dollar in choppy but thin holiday trading, before suddenly bouncing back as high as 154.54.

The yen's initial drop "was met by a wave of dollar sellers," said David Morrison, senior market analyst at Trade Nation.

"It's unclear whether the BoJ (Bank of Japan) has intervened directly or not, but the dollar is down this morning, while there has been little movement in crosses outside of those including either US dollars or Japanese yen."

Masato Kanda, Japan's vice minister of finance for international affairs, made no comment to reporters on Monday.

The Japanese currency had come under pressure again after the Bank of Japan refused to tighten monetary policy further at its meeting last week.

At the same time, forecast-topping US inflation reports have dented hopes for the US Federal Reserve to cut its interest rates this year.

Japanese officials have repeatedly said they are ready to step in if there were wild speculative movements.

On Wall Street, all the main equity indexes rose as the prospect of continued strong earnings from tech companies outweighed repeated delays in when the Fed could start cutting interest rate cuts.

Tesla jumped 11 percent after its locally produced models were listed among electric vehicles that meet China's data security requirements for smart cars during Musk's whistlestop visit to the world's biggest car market.

Late last week, Microsoft and Google owner Alphabet released forecast-beating earnings, soothing worries that this year's tech-fuelled global markets rally might have been overdone.

The US Federal Reserve's policymaking committee begins a two-day meeting on Tuesday, and will announce its decision Wednesday, with hardly anyone expecting a rate cut given a succession of stubbornly high inflation reports.

"The signals of the Fed speakers into this meeting were uniform –- high for longer until they have confidence from inflation data dropping," said Bob Savage, head of market strategy at BNY Mellon.

Most Asian equity markets closed higher Monday, following through from last week's rally on Wall Street.

Eurozone stocks diverged, but London struck another record peak with mining giant Anglo-American up 1.5 percent after rejecting a bid from Australia's BHP, which is expected to come back with a higher offer.

In Amsterdam, Philips was up 38 percent after it reached a settlement to put an end to litigation in the United States over recalled sleep machines.

- Key figures around 1040 GMT -

Dollar/yen: DOWN at 156.49 yen from 158.33 yen on Friday

New York - Dow: UP 0.3 percent at 38,346.87 points

New York - S&P 500: UP 0.4 percent at 5,119.74

New York - Nasdaq Composite: UP 0.5 percent at 16,012.61

London - FTSE 100: UP 0.3 percent at 8,161.81

Paris - CAC 40: FLAT at 8,089.43

Frankfurt - DAX: DOWN 0.2 percent at 18,124.64

EURO STOXX 50: DOWN 0.3 percent at 4,992.21

Hong Kong - Hang Seng Index: UP 0.5 percent at 17,746.91 (close)

Shanghai - Composite: UP 0.8 percent at 3,113.04 (close)

Tokyo - Nikkei 225: Closed for a holiday

Euro/dollar: UP at $1.0700 from $1.0693

Pound/dollar: UP at $1.2521 from $1.2493

Euro/pound: DOWN at 85.46 pence from 85.59 pence

Brent North Sea Crude: DOWN 0.7 percent at $88.84 per barrel

West Texas Intermediate: DOWN 0.8 percent at $83.33 per barrel

K.Thomson--BTB