-

England lose Duckett in chase of record 435 to keep Ashes alive

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

US strikes Islamic State group in Syria after deadly attack on troops

-

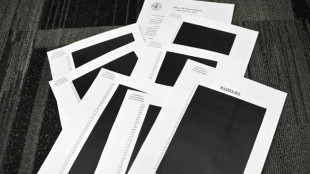

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

Amorim takes aim at Man Utd youth stars over 'entitlement'

-

Mercosur meets in Brazil, EU eyes January 12 trade deal

-

US Fed official says no urgency to cut rates, flags distorted data

US Fed official says no urgency to cut rates, flags distorted data

-

Rome to charge visitors for access to Trevi Fountain

-

Spurs 'not a quick fix' for under-fire Frank

Spurs 'not a quick fix' for under-fire Frank

-

Poland president accuses Ukraine of not appreciating war support

-

Stocks advance with focus on central banks, tech

Stocks advance with focus on central banks, tech

-

Amorim unfazed by 'Free Mainoo' T-shirt ahead of Villa clash

-

PSG penalty hero Safonov ended Intercontinental win with broken hand

PSG penalty hero Safonov ended Intercontinental win with broken hand

-

French court rejects Shein suspension

-

'It's so much fun,' says Vonn as she milks her comeback

'It's so much fun,' says Vonn as she milks her comeback

-

Moscow intent on pressing on in Ukraine: Putin

-

UN declares famine over in Gaza, says 'situation remains critical'

UN declares famine over in Gaza, says 'situation remains critical'

-

Guardiola 'excited' by Man City future, not pondering exit

-

Zabystran upsets Odermatt to claim first World Cup win in Val Gardena super-G

Zabystran upsets Odermatt to claim first World Cup win in Val Gardena super-G

-

Czechs name veteran coach Koubek for World Cup play-offs

Glencore looks to leave London Stock Exchange as falls into loss

Swiss mining and commodity trading giant Glencore said Wednesday it was considering shifting its stock listing from London after it stumbled into a net loss last year on falling coal prices and writing down the value of assets.

"We are actively considering the right exchange for our shares," Glencore chief executive Gary Nagle said in a call with analysts.

The company chose in 2011 to list on the London Stock Exchange, which was then considered the leading exchange for international mining groups.

"We're not saying that the London Stock Exchange is bad," said Nagle.

"What we're saying is: is there a better stock exchange to trade our securities?" he added, acknowledging that "the US is the leading stock market".

The company's shares were down around seven percent in London.

- Coal business take a lump -

The company earlier Wednesday reported $1.6 billion net loss for 2024 compared to a net profit of nearly $4.3 billion the previous year.

The group took charges to write down the value in its accounts of its coal operations in South Africa, and the Koniambo nickel mine in New Caledonia.

Accounting rules force companies to take such charges to reflect changes in the market value of their operations.

Excluding such exceptional charges, the company said it would have posted a net profit of $3.7 billion.

Nagle said in the statement that "operationally, 2024 was a strong year for Glencore" with its industrial mining operations meeting their performance targets.

Adjusted operational earnings from these operations came in at $10.6 billion, a drop of 20 percent from 2023, which the company said was "primarily driven by lower energy coal prices".

While mining rivals Rio Tinto or Anglo American have pulled out of coal mining, Glencore boosted its involvement in this market by buying Elk Valley Resources (EVR) from Canada's Teck Resources for $7 billion last year.

Glencore's commodities trading business generated adjusted operational earnings of $3.2 billion, an eight percent drop from 2023 due to the "progressive normalisation of energy markets from the severe disruption and extreme volatilities seen in 2022/23".

That disruption and extreme volatility in energy markets driven by Russia's invasion of Ukraine helped Glencore post a record profit of $34.1 billion, allowing it to return $7.1 to shareholders in dividends.

Despite the net loss Glencore plans to distribute $2.2 billion to its shareholders via dividends and share buybacks.

The group said it expects to receive in the coming months $1 billion in cash from the sale of its stake in Canadian grain handling company Viterra to Bunge, plus shares in the US-Swiss agribusiness.

R.Adler--BTB