-

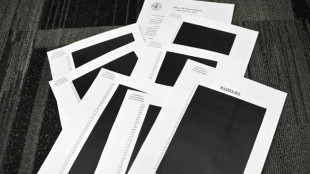

Epstein files opened: famous faces, many blacked-out pages

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

-

Mercosur meets in Brazil, EU eyes January 12 trade deal

Mercosur meets in Brazil, EU eyes January 12 trade deal

-

US Fed official says no urgency to cut rates, flags distorted data

-

Rome to charge visitors for access to Trevi Fountain

Rome to charge visitors for access to Trevi Fountain

-

Spurs 'not a quick fix' for under-fire Frank

-

Poland president accuses Ukraine of not appreciating war support

Poland president accuses Ukraine of not appreciating war support

-

Stocks advance with focus on central banks, tech

-

Amorim unfazed by 'Free Mainoo' T-shirt ahead of Villa clash

Amorim unfazed by 'Free Mainoo' T-shirt ahead of Villa clash

-

PSG penalty hero Safonov ended Intercontinental win with broken hand

-

French court rejects Shein suspension

French court rejects Shein suspension

-

'It's so much fun,' says Vonn as she milks her comeback

-

Moscow intent on pressing on in Ukraine: Putin

Moscow intent on pressing on in Ukraine: Putin

-

UN declares famine over in Gaza, says 'situation remains critical'

-

Guardiola 'excited' by Man City future, not pondering exit

Guardiola 'excited' by Man City future, not pondering exit

-

Zabystran upsets Odermatt to claim first World Cup win in Val Gardena super-G

-

Czechs name veteran coach Koubek for World Cup play-offs

Czechs name veteran coach Koubek for World Cup play-offs

-

PSG penalty hero Safonov out until next year with broken hand

-

Putin says ball in court of Russia's opponents in Ukraine talks

Putin says ball in court of Russia's opponents in Ukraine talks

-

Czech Zabystran upsets Odermatt to claim Val Gardena super-G

-

NGOs fear 'catastrophic impact' of new Israel registration rules

NGOs fear 'catastrophic impact' of new Israel registration rules

-

US suspends green card lottery after MIT professor, Brown University killings

-

Stocks mixed with focus on central banks, tech

Stocks mixed with focus on central banks, tech

-

Arsenal in the 'right place' as Arteta marks six years at club

Stocks edge out gains as fears ease over next Trump tariffs

Global equities eked out some gains Tuesday with Wall Street largely advancing while European stocks made modest progress as concerns eased over upcoming tariffs from US President Donald Trump.

The Dow closed little-changed while the broad-based S&P 500 and tech-heavy Nasdaq ended the day slightly higher following a rally fueled by technology stocks the previous day.

Europe enjoyed greater momentum with Paris, Frankfurt and Milan adding just north of one percent at the close while London sputtered to end with a 0.3 percent advance.

"Sentiment continues to wane among investors, consumers and businesses as economic concerns and economic policy uncertainty takes its toll," said eToro US investment analyst Bret Kenwell.

Kenwell added that "until there's more certainty on the tariff and macro front, sentiment and confidence remain vulnerable."

The market was initially buoyed by indications from the White House that a glut of levies due next week would be less severe than feared.

Trump has dubbed April 2 "Liberation Day" as he pledges to impose reciprocal tariffs on trading partners in an effort to remedy practices that Washington deems unfair.

"Tariff fears subsided a touch after President Trump suggested that the reciprocal tariffs promised next week may be smaller in scope than many had feared," said David Morrison, senior market analyst at Trade Nation.

"But without specific guidance over what will, and what won't, be included, investors remain on edge," Morrison added.

Tony Sycamore, market analyst at IG trading group, said markets expect that the next phase of tariffs "will be more organized and structured than previous actions."

Whatever numbers are announced "are likely to be negotiated down from there," Sycamore said.

For now, in the United States, consumer confidence slipped for a fourth straight month in March, reaching the lowest level since the midst of the pandemic in 2021.

The US consumer confidence index dropped 7.2 points to 92.9, The Conference Board said, noting that survey respondents flagged growing concerns about the economic impact of Trump's trade and tariff plans.

Positivity on European markets came on the back of data revealing that German business confidence rose in March, as a massive government spending plan promised to get Europe's largest economy rolling once again.

Asian markets closed mixed as traders focused on more domestic matters, while the dollar dropped awaiting US inflation data this week that could firm expectations of fresh cuts to interest rates this year in the world's biggest economy.

Hong Kong sank 2.4 percent, weighed by a drop of around six percent in Chinese tech giant Xiaomi, which raised $5.5 billion in a mega share sale as it looked to expand its electric vehicle business.

The deal, which comes after a similar move this month by EV firm BYD, stoked worries about market liquidity.

Among individual stocks, shares in British energy giant Shell added just over one percent after announcing plans to slash costs by billions of dollars and increase shareholder returns.

Tesla shares dipped more than two percent but pulled back into the green as industry data showed its sales in Europe sank almost by half in the first two months of the year amid anger over Elon Musk's political positions.

- Key figures around 2030 GMT -

New York - Dow: FLAT at 42,587.50 points (close)

New York - S&P 500: UP 0.2 percent at 5,776.65 (close)

New York - Nasdaq: UP 0.5 percent at 18,271.86 (close)

London - FTSE 100: UP 0.3 percent at 8,663.80 (close)

Paris - CAC 40: UP 1.1 percent at 8,108.59 (close)

Frankfurt - DAX: UP 1.1 at 23,109.79 (close)

Tokyo - Nikkei 225: UP 0.5 percent at 37,780.54 (close)

Hong Kong - Hang Seng Index: DOWN 2.4 percent at 23,344.25 (close)

Shanghai - Composite: FLAT at 3,369.98 (close)

Euro/dollar: DOWN at $1.0791 from $1.0805 on Monday

Pound/dollar: UP at $1.2943 from $1.2924

Dollar/yen: DOWN at 149.90 yen from 150.58 yen

Euro/pound: DOWN at 83.37 pence from 83.58 pence

Brent North Sea Crude: FLAT at $73.02 per barrel

West Texas Intermediate: DOWN 0.2 percent at $69.00 per barrel

dan-bcp-cw-bys/sst

O.Krause--BTB