-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

-

Epstein files opened: famous faces, many blacked-out pages

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

-

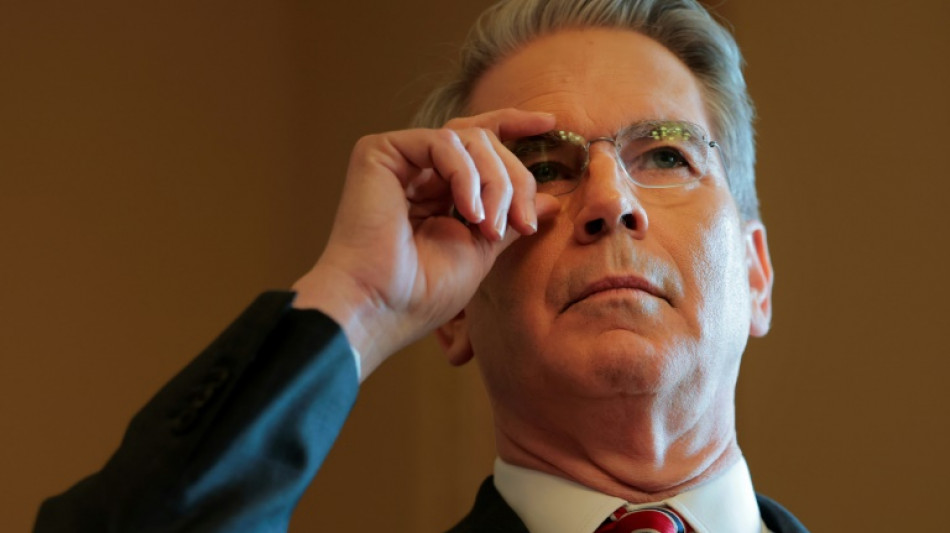

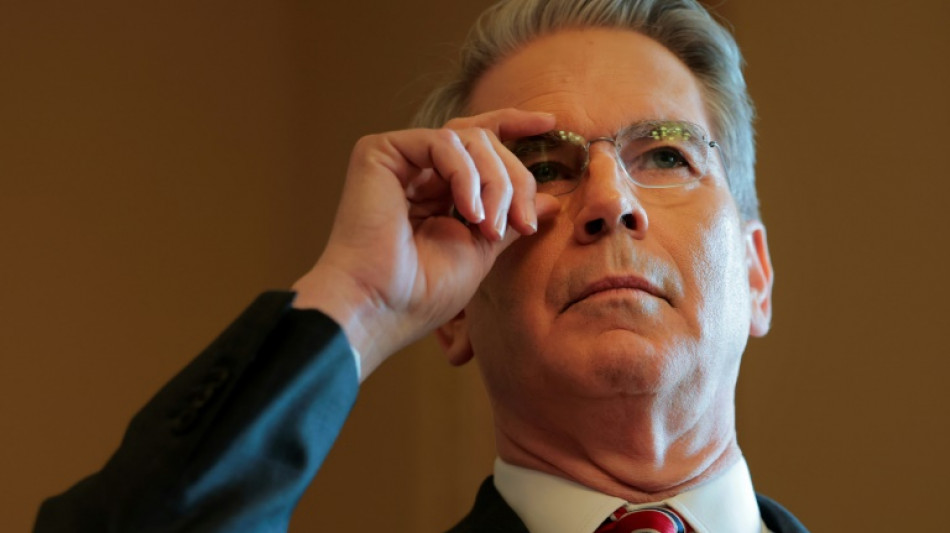

Rubio says won't force deal on Ukraine as Europeans join Miami talks

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

-

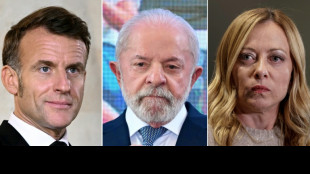

Mercosur meets in Brazil, EU eyes January 12 trade deal

Mercosur meets in Brazil, EU eyes January 12 trade deal

-

US Fed official says no urgency to cut rates, flags distorted data

-

Rome to charge visitors for access to Trevi Fountain

Rome to charge visitors for access to Trevi Fountain

-

Spurs 'not a quick fix' for under-fire Frank

-

Poland president accuses Ukraine of not appreciating war support

Poland president accuses Ukraine of not appreciating war support

-

Stocks advance with focus on central banks, tech

-

Amorim unfazed by 'Free Mainoo' T-shirt ahead of Villa clash

Amorim unfazed by 'Free Mainoo' T-shirt ahead of Villa clash

-

PSG penalty hero Safonov ended Intercontinental win with broken hand

Markets boosted as Trump softens tariff pain for auto firms

Markets rose Tuesday following news that Donald Trump is set to let auto makers off some of his wide-ranging tariffs, boosting hopes of a less combative approach to his trade war.

A month that started with the explosion of Washington's "Liberation Day" tariffs on April 2 was on course for a more positive close as governments line up to cut deals to avert the full force of the measures.

The White House said foreign auto firms paying tariffs of 25 percent for their US car and parts shipments would not face other levies such as those on steel and aluminium, the Wall Street Journal said. Companies will also be reimbursed for fees already paid.

The move is aimed at making sure the various tariffs Trump has unveiled do not stack up on top of each other.

Commerce Secretary Howard Lutnick said the deal was "a major victory for the president's trade policy".

He said it rewarded firms "who manufacture domestically while providing runway to manufacturers who have expressed their commitment to invest in America and expand their domestic manufacturing".

Stephen Innes at SPI Asset Management said the move was able to "reinforce the market's hope that, even if the US-China heavyweights are still circling each other, there's still room for incremental detente elsewhere".

While there is a hope that the president's other sweeping measures on trade partners can be tempered before a 90-day stay of execution comes to an end in July, there appears to be little movement with China.

The White House has imposed 10 percent tariffs on most US trading partners and a separate 145 percent levy on many products from China. Beijing has responded with 125 percent tariffs of its own.

Reports last week said China was considering exempting some US goods from its retaliatory tariffs but officials have said there are no active negotiations between the economic superpowers.

On Monday a Chinese official denied Trump's claims he had spoken recently with President Xi Jinping.

The chance of a deal between the two for now seems remote, with US Treasury Secretary Scott Bessent telling CNBC that negotiations were ongoing but the ball was in China's court.

"As I've repeatedly said, I believe it's up to China to de-escalate, because they sell five times more to us than we sell to them. So these 125 percent tariffs are unsustainable," he said in an interview aired Monday.

While uncertainty rules on trading floors, most Asian markets pushed higher on Tuesday, with Hong Kong, Sydney, Singapore, Taipei, Mumbai and Manila in positive territory.

Seoul also rose as auto makers Hyundai and Kia were boosted by the auto tariff news.

London, Paris and Frankfurt opened with gains.

Shanghai dipped and Tokyo was closed for a holiday.

Data this week could give an idea about the impact of Trump's measures on companies, with tech titans Amazon, Apple, Meta and Microsoft all reporting their earnings.

Also on the agenda are key economic data, including jobs creation and the Federal Reserve's preferred gauge of inflation amid warnings the tariffs could reignite prices.

"While consumer and business survey data continue to plunge, the hard data has shown resilience, a trend likely to persist for a month or two until the effects of the Liberation tariffs become evident mid-year," said Tony Sycamore, a market analyst at IG.

"If President Trump's tariffs are reduced, weaker hard data will be looked through, allowing the US economy and stock markets to muddle through the end of the year."

However, he added that if tariffs stayed elevated, stock markets could resume their losses and the chances of a recession rose.

On currency markets Canada's dollar weakened against its US counterpart as speculation swirled over whether Prime Minister Mark Carney's Liberal Party would win an outright majority in national elections.

- Key figures at 0715 GMT -

Hong Kong - Hang Seng Index: UP 0.1 percent at 21,992.79

Shanghai - Composite: DOWN 0.1 percent at 3,286.65 (close)

London - FTSE 100: UP 0.1 percent at 8,423.41

Tokyo - Nikkei 225: Closed for a holiday

Euro/dollar: DOWN at $1.1389 from $1.1424 on Monday

Pound/dollar: DOWN at $1.3408 from $1.3441

Dollar/yen: UP at 142.50 yen from 142.04 yen

Euro/pound: DOWN at 84.90 pence from 84.99 pence

West Texas Intermediate: DOWN 0.9 percent at $61.51 per barrel

Brent North Sea Crude: DOWN 0.8 percent at $64.28 per barrel

New York - Dow: UP 0.3 percent at 40,227.59 (close)

R.Adler--BTB