-

England 'flat' as Crawley admits Australia a better side

England 'flat' as Crawley admits Australia a better side

-

Australia four wickets from Ashes glory as England cling on

-

Beetles block mining of Europe's biggest rare earths deposit

Beetles block mining of Europe's biggest rare earths deposit

-

French culture boss accused of mass drinks spiking to humiliate women

-

NBA champions Thunder suffer rare loss to Timberwolves

NBA champions Thunder suffer rare loss to Timberwolves

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

US strikes Islamic State group in Syria after deadly attack on troops

-

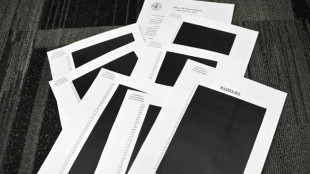

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

Amorim takes aim at Man Utd youth stars over 'entitlement'

-

Mercosur meets in Brazil, EU eyes January 12 trade deal

-

US Fed official says no urgency to cut rates, flags distorted data

US Fed official says no urgency to cut rates, flags distorted data

-

Rome to charge visitors for access to Trevi Fountain

Financial markets may be the last guardrail on Trump

Since returning to the White House, Donald Trump has ushered in sweeping changes to international geopolitics and US government administration with little regard for norms that have constrained predecessors.

But there has been one source of restraint on a president determined to push the limits of US governance: financial markets.

The stock market's response to Trump's "Liberation Day" tariff announcement was "probably the most influential force to date" in tempering Trump's policies, said Terrence Guay, professor of international business at Pennsylvania State University.

In just two days, Wall Street equities shredded some $6 trillion in value as the S&P 500 suffered its worst session since the darkest days of Covid-19 in 2020.

"The market does tend to be ... kind of like a seismograph. It reacts to the slightest little tremor," said Steven Kyle, professor of applied economics at Cornell University.

A week after Trump's announcement of reciprocal tariffs threw markets into turmoil, the Republican suddenly scaled back his plan's most draconian elements for every country except China. The pivot sent stocks skyrocketing.

Last week, market watchers perceived another significant Trump retreat after another round of scary market action. The gyrations came after the president combined an ever-worsening tit-for-tat trade war with China with threats to oust Federal Reserve Chair Jerome Powell.

The White House quickly shifted its tone on China and Trump reassured the public that he won't fire Powell.

"Markets 'punished' his policies and he must have realized," along with his advisors, "that trade wars are not that easy to win," said Petros Mavroidis, a professor at Columbia Law School and a former member of the World Trade Organization.

"I am sure he doesn't want to be known as the president who led to a stock market crash," Guay added.

- Bond market angst -

But if "Wall Street sent the loudest signal, it wasn't the only signal," said University of Richmond finance professor Art Durnev.

Even more than the stock market, "the bond market is a stronger force and this is the primary driver" of Trump's shift, Durnev said.

Like gold or the Swiss franc, US Treasury bonds have traditionally been seen as a refuge for investors during times of duress in financial markets, or in the real economy.

But demand for US Treasury bonds -- a bedrock during the 2008 financial crisis and other perilous moments -- has been shaken in recent weeks as Trump's aggressive policies have pushed yields higher in a sign of flagging demand for American issues.

Trump himself acknowledged the import of the bond market gyrations, saying investors were getting "a little bit yippy." That word means nervous.

The bond market "also had a big impact," Guay said. "Many investors have pulled their money out of the US."

Besides Trump's ambitious attempts to overhaul international trade, analysts have tied bond market volatility to worries that planned tax cuts could worsen the US deficit.

Then there is Powell, whom Trump also criticized in his first presidential term. The most recent round of Treasury market panic followed Trump's social media post on April 21 branding Powell a "major loser" for not cutting interest rates.

But by the following day, Trump had pulled back, saying he had "no intention of firing" Powell.

The combination of these factors means investors are beginning to realize that "the US may not be, under this administration, the stable environment we've seen for decades," Guay said.

J.Fankhauser--BTB