-

Stormers see off La Rochelle, Sale stun Clermont in Champions Cup

Stormers see off La Rochelle, Sale stun Clermont in Champions Cup

-

Maresca hails Palmer as Chelsea return to winning ways against Everton

-

Hungarian protesters demand Orban quits over abuse cases

Hungarian protesters demand Orban quits over abuse cases

-

Belarus frees protest leader Kolesnikova, Nobel winner Bialiatski

-

Salah sets up goal on return to Liverpool action

Salah sets up goal on return to Liverpool action

-

Palmer strikes as Chelsea return to winning ways against Everton

-

Pogacar targets Tour de France Paris-Roubaix and Milan-San Remo in 2026

Pogacar targets Tour de France Paris-Roubaix and Milan-San Remo in 2026

-

Salah back in action for Liverpool after outburst

-

Atletico recover Liga momentum with battling win over Valencia

Atletico recover Liga momentum with battling win over Valencia

-

Meillard leads 'perfect' Swiss sweep in Val d'Isere giant slalom

-

Salah on Liverpool bench for Brighton match

Salah on Liverpool bench for Brighton match

-

Meillard leads Swiss sweep in Val d'Isere giant slalom

-

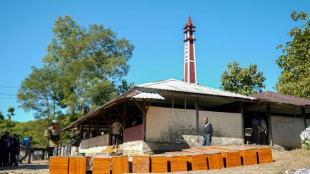

Indonesia flood death toll passes 1,000 as authorities ramp up aid

Indonesia flood death toll passes 1,000 as authorities ramp up aid

-

Cambodia shuts Thailand border crossings over deadly fighting

-

First urban cable car unveiled outside Paris

First urban cable car unveiled outside Paris

-

Vonn second behind Aicher in World Cup downhill at St Moritz

-

Aicher pips Vonn to downhill win at St Moritz

Aicher pips Vonn to downhill win at St Moritz

-

Thailand says 4 soldiers killed in Cambodia conflict, denies Trump truce claim

-

Fans vandalise India stadium after Messi's abrupt exit

Fans vandalise India stadium after Messi's abrupt exit

-

Women sommeliers are cracking male-dominated wine world open

-

Exhibition of Franco-Chinese print master Zao Wou-Ki opens in Hong Kong

Exhibition of Franco-Chinese print master Zao Wou-Ki opens in Hong Kong

-

Myanmar junta denies killing civilians in hospital strike

-

Why SpaceX IPO plan is generating so much buzz

Why SpaceX IPO plan is generating so much buzz

-

Thailand continues Cambodia strikes despite Trump truce calls

-

US envoy to meet Zelensky, Europe leaders in Berlin this weekend

US envoy to meet Zelensky, Europe leaders in Berlin this weekend

-

North Korea acknowledges its troops cleared mines for Russia

-

US unseals warrant for tanker seized off Venezuelan coast

US unseals warrant for tanker seized off Venezuelan coast

-

Cambodia says Thailand still bombing hours after Trump truce call

-

Machado urges pressure so Maduro understands 'he has to go'

Machado urges pressure so Maduro understands 'he has to go'

-

Leinster stutter before beating Leicester in Champions Cup

-

World stocks mostly slide, consolidating Fed-fuelled gains

World stocks mostly slide, consolidating Fed-fuelled gains

-

Crypto firm Tether bids for Juventus, is quickly rebuffed

-

Union sink second-placed Leipzig to climb in Bundesliga

Union sink second-placed Leipzig to climb in Bundesliga

-

US Treasury lifts sanctions on Brazil Supreme Court justice

-

UK king shares 'good news' that cancer treatment will be reduced in 2026

UK king shares 'good news' that cancer treatment will be reduced in 2026

-

Wembanyama expected to return for Spurs in NBA Cup clash with Thunder

-

Five takeaways from Luigi Mangione evidence hearings

Five takeaways from Luigi Mangione evidence hearings

-

UK's king shares 'good news' that cancer treatment will be reduced in 2026

-

Steelers' Watt undergoes surgery to repair collapsed lung

Steelers' Watt undergoes surgery to repair collapsed lung

-

Iran detains Nobel-prize winner in 'brutal' arrest

-

NBA Cup goes from 'outside the box' idea to smash hit

NBA Cup goes from 'outside the box' idea to smash hit

-

UK health service battles 'super flu' outbreak

-

Can Venezuela survive US targeting its oil tankers?

Can Venezuela survive US targeting its oil tankers?

-

Democrats release new cache of Epstein photos

-

Colombia's ELN guerrillas place communities in lockdown citing Trump 'intervention' threats

Colombia's ELN guerrillas place communities in lockdown citing Trump 'intervention' threats

-

'Don't use them': Tanning beds triple skin cancer risk, study finds

-

Nancy aims to restore Celtic faith with Scottish League Cup final win

Nancy aims to restore Celtic faith with Scottish League Cup final win

-

Argentina fly-half Albornoz signs for Toulon until 2030

-

Trump says Thailand, Cambodia have agreed to stop border clashes

Trump says Thailand, Cambodia have agreed to stop border clashes

-

Salah in Liverpool squad for Brighton after Slot talks - reports

UK lenders face $12 bn plus compensation bill despite court ruling: watchdog

British finance firms behind high interest car loans could have to pay out more than nine billion pounds ($12 billion) in compensation despite the country's highest court ruling that most of the controversial deals were lawful, a financial watchdog said Sunday.

The Supreme Court on Friday partially overturned judgments that the loans were unlawful, giving relief to banks which had been bracing for compensation claims from millions of car-buyers.

It did, however, uphold one of the three cases, which allows the claimant to seek compensation.

And in a similar but separate probe, the Financial Conduct Authority (FCA) said that the cost of any redress scheme relating to discretionary commission arrangements for car loans would likely be higher than £9 billion.

"While there are plausible scenarios which underpin estimates of a total cost as high as £18 billion, we do not consider those scenarios to be the most likely and analyst estimates in the midpoint of this range are more plausible," the FCA said in a statement.

The FCA estimates that most individuals will probably receive less than £950 in compensation.

The court ruling had given the FCA "clarity... because we have been looking at what is unfair and, prior to this judgment, there were different interpretations of the law coming from different courts," it said.

"It is clear that some firms have broken the law and our rules. It's fair for their customers to be compensated," said Nikhil Rathi, chief executive of the FCA.

The Supreme Court decision mostly overturned Court of Appeal rulings last year that it was unlawful for car dealers to receive a commission on loans without sufficiently informing borrowers.

In some cases, the loans -- available from 2007 -- allowed car dealers to offer higher interest rates in return for a bigger commission from banks.

The ruling means that dealers have some leeway when arranging loans, without requiring explicit consent from borrowers for terms that may benefit lenders.

The case that was upheld involved Marcus Johnson, who in 2017 bought a Suzuki Swift from a car dealer in Cardiff for £6,500 including loan costs -- unaware that interest on the loan amount would fund a commission of more than £1,600.

When the Court of Appeal ruled in favour of Johnson, ordering FirstRand Bank, a South African based lender, to refund the commission plus interest, it sparked panic across the finance sector.

That ruling was upheld by the top court due to the high level of commission Johnson was charged and the complexity of the contract setting out the fee, which limits the scope of other compensation claims.

HSBC bank analysts had suggested before the trial that the total cost to the banking sector could have reached £44 billion.

C.Kovalenko--BTB