-

Stormers see off La Rochelle, Sale stun Clermont in Champions Cup

Stormers see off La Rochelle, Sale stun Clermont in Champions Cup

-

Maresca hails Palmer as Chelsea return to winning ways against Everton

-

Hungarian protesters demand Orban quits over abuse cases

Hungarian protesters demand Orban quits over abuse cases

-

Belarus frees protest leader Kolesnikova, Nobel winner Bialiatski

-

Salah sets up goal on return to Liverpool action

Salah sets up goal on return to Liverpool action

-

Palmer strikes as Chelsea return to winning ways against Everton

-

Pogacar targets Tour de France Paris-Roubaix and Milan-San Remo in 2026

Pogacar targets Tour de France Paris-Roubaix and Milan-San Remo in 2026

-

Salah back in action for Liverpool after outburst

-

Atletico recover Liga momentum with battling win over Valencia

Atletico recover Liga momentum with battling win over Valencia

-

Meillard leads 'perfect' Swiss sweep in Val d'Isere giant slalom

-

Salah on Liverpool bench for Brighton match

Salah on Liverpool bench for Brighton match

-

Meillard leads Swiss sweep in Val d'Isere giant slalom

-

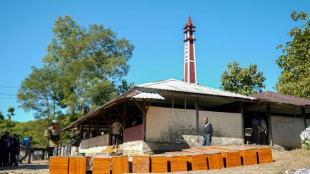

Indonesia flood death toll passes 1,000 as authorities ramp up aid

Indonesia flood death toll passes 1,000 as authorities ramp up aid

-

Cambodia shuts Thailand border crossings over deadly fighting

-

First urban cable car unveiled outside Paris

First urban cable car unveiled outside Paris

-

Vonn second behind Aicher in World Cup downhill at St Moritz

-

Aicher pips Vonn to downhill win at St Moritz

Aicher pips Vonn to downhill win at St Moritz

-

Thailand says 4 soldiers killed in Cambodia conflict, denies Trump truce claim

-

Fans vandalise India stadium after Messi's abrupt exit

Fans vandalise India stadium after Messi's abrupt exit

-

Women sommeliers are cracking male-dominated wine world open

-

Exhibition of Franco-Chinese print master Zao Wou-Ki opens in Hong Kong

Exhibition of Franco-Chinese print master Zao Wou-Ki opens in Hong Kong

-

Myanmar junta denies killing civilians in hospital strike

-

Why SpaceX IPO plan is generating so much buzz

Why SpaceX IPO plan is generating so much buzz

-

Thailand continues Cambodia strikes despite Trump truce calls

-

US envoy to meet Zelensky, Europe leaders in Berlin this weekend

US envoy to meet Zelensky, Europe leaders in Berlin this weekend

-

North Korea acknowledges its troops cleared mines for Russia

-

US unseals warrant for tanker seized off Venezuelan coast

US unseals warrant for tanker seized off Venezuelan coast

-

Cambodia says Thailand still bombing hours after Trump truce call

-

Machado urges pressure so Maduro understands 'he has to go'

Machado urges pressure so Maduro understands 'he has to go'

-

Leinster stutter before beating Leicester in Champions Cup

-

World stocks mostly slide, consolidating Fed-fuelled gains

World stocks mostly slide, consolidating Fed-fuelled gains

-

Crypto firm Tether bids for Juventus, is quickly rebuffed

-

Union sink second-placed Leipzig to climb in Bundesliga

Union sink second-placed Leipzig to climb in Bundesliga

-

US Treasury lifts sanctions on Brazil Supreme Court justice

-

UK king shares 'good news' that cancer treatment will be reduced in 2026

UK king shares 'good news' that cancer treatment will be reduced in 2026

-

Wembanyama expected to return for Spurs in NBA Cup clash with Thunder

-

Five takeaways from Luigi Mangione evidence hearings

Five takeaways from Luigi Mangione evidence hearings

-

UK's king shares 'good news' that cancer treatment will be reduced in 2026

-

Steelers' Watt undergoes surgery to repair collapsed lung

Steelers' Watt undergoes surgery to repair collapsed lung

-

Iran detains Nobel-prize winner in 'brutal' arrest

-

NBA Cup goes from 'outside the box' idea to smash hit

NBA Cup goes from 'outside the box' idea to smash hit

-

UK health service battles 'super flu' outbreak

-

Can Venezuela survive US targeting its oil tankers?

Can Venezuela survive US targeting its oil tankers?

-

Democrats release new cache of Epstein photos

-

Colombia's ELN guerrillas place communities in lockdown citing Trump 'intervention' threats

Colombia's ELN guerrillas place communities in lockdown citing Trump 'intervention' threats

-

'Don't use them': Tanning beds triple skin cancer risk, study finds

-

Nancy aims to restore Celtic faith with Scottish League Cup final win

Nancy aims to restore Celtic faith with Scottish League Cup final win

-

Argentina fly-half Albornoz signs for Toulon until 2030

-

Trump says Thailand, Cambodia have agreed to stop border clashes

Trump says Thailand, Cambodia have agreed to stop border clashes

-

Salah in Liverpool squad for Brighton after Slot talks - reports

Stocks extend gains on US rate-cut bets

Stock markets rose Wednesday, with Wall Street building on the previous day's record highs after steady US inflation data fuelled hopes that the US Federal Reserve will cut interest rates.

The broad-based S&P 500 index and the tech-heavy Nasdaq extended gains after reaching new summits on Tuesday.

Tokyo's Nikkei index followed suit on Wednesday, hitting a record as it closed 1.3 percent higher.

European stock markets also finished in the green.

Investors have worried about the impact that US President Donald Trump's tariffs will have on US inflation and growth in the world's biggest economy.

But official figures showed Tuesday that the US consumer price index (CPI) remained steady at 2.7 percent in July, unchanged from June.

Investors shrugged off data showing that core CPI -- a measure of inflation that strips out volatile food and energy prices -- accelerated in July to the fastest pace in six months to 3.1 percent.

"Even as core CPI was accelerating, markets were reassured because the tariff impact on inflation didn't look so obvious this time," Deutsche Bank analysts said in a note.

Markets could have reacted negatively as core inflation is usually the data point favoured by the Fed to make decisions on interest rates, said Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

"Investors instead increased September cut expectations, thinking that imported goods inflation remained lower than feared as companies continued to absorb tariff costs," she said.

Trump has repeatedly demanded that the independent Fed cut rates and lambasted its chief, Jerome Powell, over the issue.

The central bank, which will make its next interest-rate decision in September, has kept borrowing costs unchanged for now.

The dollar slumped against other major currencies as the prospect of lower interest rates reduced its appeal to foreign investors.

Investor focus was also on a summit in Alaska on Friday between Trump and Russian leader Vladimir Putin on the three-year-old Ukraine war.

And oil prices fell more than one percent as the International Energy Agency raised its forecast for supply growth in 2025 and 2026 -- leaving the world with a surplus -- after OPEC+ decided to raise production.

- Key figures at around 1540 GMT -

New York - Dow: UP 0.8 percent at 44,790.31 points

New York - S&P 500: UP 0.2 percent at 6,456.15

New York - Nasdaq: UP 0.1 percent at 21,700.95

London - FTSE 100: UP 0.2 percent at 9,165.23 (close)

Paris - CAC 40: UP 0.7 percent at 7,804.97 (close)

Frankfurt - DAX: UP 0.7 percent at 24,185.59 (close)

Tokyo - Nikkei 225: UP 1.3 percent at 43,274.67 (close)

Hong Kong - Hang Seng Index: UP 2.6 percent at 25,613.67 (close)

Shanghai - Composite: UP 0.5 percent at 3,683.46 (close)

Euro/dollar: UP at $1.1713 from $1.1677 on Tuesday

Pound/dollar: UP at $1.3571 from $1.3501

Dollar/yen: DOWN at 147.24 yen from 147.77 yen

Euro/pound: DOWN at 86.31 pence from 86.45 pence

West Texas Intermediate: DOWN 1.4 percent at $62.28 per barrel

Brent North Sea Crude: DOWN 1.2 percent at $65.32 per barrel

F.Pavlenko--BTB