-

Number's up: Calculators hold out against AI

Number's up: Calculators hold out against AI

-

McIntosh, Marchand close US Open with 200m fly victories

-

Divided US Fed set for contentious interest rate meeting

Divided US Fed set for contentious interest rate meeting

-

India nightclub fire kills 23 in Goa

-

France's Ugo Bienvenu ready to take animated 'Arco' to Oscars

France's Ugo Bienvenu ready to take animated 'Arco' to Oscars

-

Trump's Pentagon chief under fire as scandals mount

-

England's Archer takes pillow to second Ashes Test in 'shocking look'

England's Archer takes pillow to second Ashes Test in 'shocking look'

-

Australia skipper Cummins 'good to go' for Adelaide Test

-

Mexico's Sheinbaum holds huge rally following major protests

Mexico's Sheinbaum holds huge rally following major protests

-

Salah tirade adds to Slot's troubles during Liverpool slump

-

Torres treble helps Barca extend Liga lead, Atletico slip

Torres treble helps Barca extend Liga lead, Atletico slip

-

PSG thump Rennes but Lens remain top in France

-

Salah opens door to Liverpool exit with 'thrown under the bus' rant

Salah opens door to Liverpool exit with 'thrown under the bus' rant

-

Two eagles lift Straka to World Challenge lead over Scheffler

-

Messi dazzles as Miami beat Vancouver to win MLS title

Messi dazzles as Miami beat Vancouver to win MLS title

-

Bielle-Biarrey strikes twice as Bordeaux-Begles win Champions Cup opener in S.Africa

-

Bilbao's Berenguer deals Atletico another Liga defeat

Bilbao's Berenguer deals Atletico another Liga defeat

-

Salah opens door to Liverpool exit after being 'thrown under the bus'

-

Bethlehem Christmas tree lit up for first time since Gaza war

Bethlehem Christmas tree lit up for first time since Gaza war

-

Slot shows no sign of finding answers to Liverpool slump

-

New Zealand's Robinson wins giant slalom at Mont Tremblant

New Zealand's Robinson wins giant slalom at Mont Tremblant

-

Liverpool slump self-inflicted, says Slot

-

Hundreds in Tunisia protest against government

Hundreds in Tunisia protest against government

-

Mofokeng's first goal wins cup final for Orlando Pirates

-

Torres hat-trick helps Barca down Betis to extend Liga lead

Torres hat-trick helps Barca down Betis to extend Liga lead

-

Bielle-Biarrey strikes twice as Bordeaux win Champions Cup opener in S.Africa

-

Liverpool humbled again by Leeds fightback for 3-3 draw

Liverpool humbled again by Leeds fightback for 3-3 draw

-

'Democracy has crumbled!': Four arrested in UK Crown Jewels protest

-

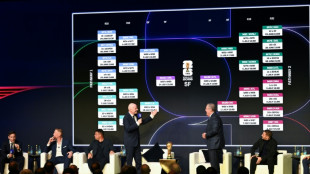

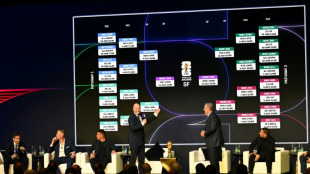

Contenders plot path to 2026 World Cup glory as FIFA reveals tournament schedule

Contenders plot path to 2026 World Cup glory as FIFA reveals tournament schedule

-

Inter thump Como to top Serie A ahead of Liverpool visit

-

Maresca fears Chelsea striker Delap faces fresh injury setback

Maresca fears Chelsea striker Delap faces fresh injury setback

-

Consistency the key to Man City title charge – Guardiola

-

Thauvin on target again as Lens remain top in France

Thauvin on target again as Lens remain top in France

-

Greyness and solitude: French ex-president describes prison stay

-

Frank relieved after Spurs ease pressure on under-fire boss

Frank relieved after Spurs ease pressure on under-fire boss

-

England kick off World Cup bid in Dallas as 2026 schedule confirmed

-

Milei welcomes Argentina's first F-16 fighter jets

Milei welcomes Argentina's first F-16 fighter jets

-

No breakthrough at 'constructive' Ukraine-US talks

-

Bielle-Biarrey double helps Bordeaux-Begles open Champions Cup defence with Bulls win

Bielle-Biarrey double helps Bordeaux-Begles open Champions Cup defence with Bulls win

-

Verstappen looking for a slice of luck to claim fifth title

-

Kane cameo hat-trick as Bayern blast past Stuttgart

Kane cameo hat-trick as Bayern blast past Stuttgart

-

King Kohli says 'free in mind' after stellar ODI show

-

Arsenal rocked by Aston Villa, Man City cut gap to two points

Arsenal rocked by Aston Villa, Man City cut gap to two points

-

Crestfallen Hamilton hits new low with Q1 exit

-

Sleepless in Abu Dhabi - nervy times for Norris says Rosberg

Sleepless in Abu Dhabi - nervy times for Norris says Rosberg

-

Arsenal will bounce back from Villa blow: Arteta

-

UN Security Council delegation urges all sides to stick to Lebanon truce

UN Security Council delegation urges all sides to stick to Lebanon truce

-

Verstappen outguns McLarens to take key pole in Abu Dhabi

-

Syria's Kurds hail 'positive impact' of Turkey peace talks

Syria's Kurds hail 'positive impact' of Turkey peace talks

-

Verstappen takes pole position for season-ending Abu Dhabi GP

| RBGPF | 0% | 78.35 | $ | |

| CMSD | -0.3% | 23.25 | $ | |

| BCE | 1.4% | 23.55 | $ | |

| RELX | -0.55% | 40.32 | $ | |

| JRI | 0.29% | 13.79 | $ | |

| NGG | -0.66% | 75.41 | $ | |

| BCC | -1.66% | 73.05 | $ | |

| GSK | -0.33% | 48.41 | $ | |

| SCS | -0.56% | 16.14 | $ | |

| RIO | -0.92% | 73.06 | $ | |

| CMSC | -0.21% | 23.43 | $ | |

| BTI | -1.81% | 57.01 | $ | |

| AZN | 0.17% | 90.18 | $ | |

| VOD | -1.31% | 12.47 | $ | |

| RYCEF | -0.34% | 14.62 | $ | |

| BP | -3.91% | 35.83 | $ |

Tokyo stocks soar on Takaichi win, Paris sinks as French PM resigns

Tokyo stocks surged almost five percent to a record high Monday and the yen sank on bets that the new leader of Japan's ruling party will embark on a new era of loose monetary policy to kickstart the country's economy.

The gains, however, came on a mixed day for the rest of Asia, while Paris tumbled more than two percent on news that France's newly appointed prime minister had stepped down, compounding a political crisis in the country.

News of the victory for Sanae Takaichi -- who is expected to become prime minister this month -- fanned a fresh wave of optimism on Japanese trading floors as she has previously backed aggressive monetary easing and expanded government spending.

Expectations the Federal Reserve will cut interest rates this month continue to support risk assets, with the S&P 500 and Dow both hitting peaks along with bitcoin and gold.

After her victory Saturday, Takaichi pledged first to implement measures to address inflation and boost Japan's economy, rural areas and primary industries.

Takaichi "looks more inclined than the others to juice the economy", said Taro Kimura at Bloomberg Economics.

"Still, with inflation rising and long-term (bond) yields climbing, she will have to balance her stance with reality, in order not to accelerate cost-of-living squeeze and jolt the rate market," Kimura added.

The Nikkei 225's surge came as the yen weakened more than one percent to top 150 per dollar, while it hit a record low against the euro, touching 176.25 to the single currency.

"An immediate market reaction is likely to be a return of a so-called 'Takaichi trade', which means higher equity prices (except banks), yen depreciation, and higher super-long bond yields," said Masamichi Adachi, UBS Securities chief economist for Japan.

Yields on 30-year Japanese bonds also rose sharply, reflecting fears the country's already colossal debt will balloon further.

Takaichi's win also raised questions about the chances of more Bank of Japan rate hikes, adding to downward pressure on the yen.

There were also gains in Singapore and Mumbai, but Hong Kong, Sydney, Wellington, Manila and Bangkok were all in the red.

Sentiment remains up, though, as bitcoin hit a new peak of $125,689 on Sunday.

Gold pushed past $3,945 and closer to $4,000 Monday, with the US shutdown and expected rate cuts boosting its attractiveness.

The plunge in Paris's CAC 40 index came after France's President Emmanuel Macron accepted Prime Minister Sebastien Lecornu's resignation, plunging the country further into political deadlock.

Macron appointed Lecornu last month but the largely unchanged cabinet lineup he unveiled late Sunday was met with fierce criticism across the political spectrum.

London's FTSE dipped in the morning, after ending last week at a record, while Frankfurt also sank.

US futures were all up.

The closure of parts of the US government dragged into a second week after senators voted for a fourth time to reject a funding fix proposed by Republicans.

Federal agencies have been out of money since Wednesday -- with several public services crippled -- as a result of deadlocked talks.

The row meant key jobs data used by the Fed to guide it on monetary policy was not released when due on Friday.

Still, observers say recent reports indicating the labour market is slowing would likely be enough to cut rates at the next meeting at the end of the month, with other readings on inflation due beforehand.

"It's still likely that the shutdown will end in relatively short order, allowing for the release of the September jobs report before the October (policy) meeting," said economists at Bank of America.

"But even if the first print of September payrolls is solid, doves on the committee will likely point to the recent trend of downward revisions to make the case to keep cutting.

"And given (Fed chief Jerome) Powell's recent dovish pivot, that argument is likely to carry the day."

Oil jumped more than one percent after OPEC+ agreed at the weekend to boost supplies by 137,000 barrels a day -- less than initially expected.

- Key figures at around 0810 GMT -

Tokyo - Nikkei 225: UP 4.8 percent at 47,944.76 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 26,957.77 (close)

London - FTSE 100: DOWN 0.1 percent at 9,477.95

Shanghai - Composite: Closed for a holiday

Dollar/yen: UP at 150.01 yen from 147.45 yen

Pound/dollar: DOWN at $1.3445 from $1.3482

Euro/pound: DOWN at 86.75 pence from 87.09 pence

Euro/dollar: DOWN at $1.1664 from $1.1742 on Friday

West Texas Intermediate: UP 1.3 percent at $61.66 per barrel

Brent North Sea Crude: UP 1.3 percent at $65.34 per barrel

New York - Dow: UP 0.5 percent at 46,758.28 points (close)

G.Schulte--BTB