-

Indigenous Brazilians protest Amazon river dredging for grain exports

Indigenous Brazilians protest Amazon river dredging for grain exports

-

Google's annual revenue tops $400 bn for first time, AI investments rise

-

Last US-Russia nuclear treaty ends in 'grave moment' for world

Last US-Russia nuclear treaty ends in 'grave moment' for world

-

Man City brush aside Newcastle to reach League Cup final

-

Guardiola wants permission for Guehi to play in League Cup final

Guardiola wants permission for Guehi to play in League Cup final

-

Boxer Khelif reveals 'hormone treatments' before Paris Olympics

-

'Bad Boy,' 'Little Pablo' and Mordisco: the men on a US-Colombia hitlist

'Bad Boy,' 'Little Pablo' and Mordisco: the men on a US-Colombia hitlist

-

BHP damages trial over Brazil mine disaster to open in 2027

-

Dallas deals Davis to Wizards in blockbuster NBA trade: report

Dallas deals Davis to Wizards in blockbuster NBA trade: report

-

Iran-US talks back on, as Trump warns supreme leader

-

Lens cruise into French Cup quarters, Endrick sends Lyon through

Lens cruise into French Cup quarters, Endrick sends Lyon through

-

No.1 Scheffler excited for Koepka return from LIV Golf

-

Curling quietly kicks off sports programme at 2026 Winter Olympics

Curling quietly kicks off sports programme at 2026 Winter Olympics

-

Undav pokes Stuttgart past Kiel into German Cup semis

-

Germany goalkeeper Ter Stegen to undergo surgery

Germany goalkeeper Ter Stegen to undergo surgery

-

Bezos-led Washington Post announces 'painful' job cuts

-

Iran says US talks are on, as Trump warns supreme leader

Iran says US talks are on, as Trump warns supreme leader

-

Gaza health officials say strikes kill 24 after Israel says officer wounded

-

Empress's crown dropped in Louvre heist to be fully restored: museum

Empress's crown dropped in Louvre heist to be fully restored: museum

-

UK PM says Mandelson 'lied' about Epstein relations

-

Shai to miss NBA All-Star Game with abdominal strain

Shai to miss NBA All-Star Game with abdominal strain

-

Trump suggests 'softer touch' needed on immigration

-

From 'flop' to Super Bowl favorite: Sam Darnold's second act

From 'flop' to Super Bowl favorite: Sam Darnold's second act

-

Man sentenced to life in prison for plotting to kill Trump in 2024

-

Native Americans on high alert over Minneapolis crackdown

Native Americans on high alert over Minneapolis crackdown

-

Dallas deals Davis to Wizards in blockbuster NBA deal: report

-

Russia 'no longer bound' by nuclear arms limits as treaty with US ends

Russia 'no longer bound' by nuclear arms limits as treaty with US ends

-

Panama hits back after China warns of 'heavy price' in ports row

-

Strike kills guerrillas as US, Colombia agree to target narco bosses

Strike kills guerrillas as US, Colombia agree to target narco bosses

-

Wildfire smoke kills more than 24,000 Americans a year: study

-

Telegram founder slams Spain PM over under-16s social media ban

Telegram founder slams Spain PM over under-16s social media ban

-

Curling kicks off sports programme at 2026 Winter Olympics

-

Preventative cholera vaccination resumes as global supply swells: WHO

Preventative cholera vaccination resumes as global supply swells: WHO

-

Wales' Macleod ready for 'physical battle' against England in Six Nations

-

Xi calls for 'mutual respect' with Trump, hails ties with Putin

Xi calls for 'mutual respect' with Trump, hails ties with Putin

-

'All-time great': Maye's ambitions go beyond record Super Bowl bid

-

Shadow over Vonn as Shiffrin, Odermatt headline Olympic skiing

Shadow over Vonn as Shiffrin, Odermatt headline Olympic skiing

-

US seeks minerals trade zone in rare Trump move with allies

-

Ukraine says Abu Dhabi talks with Russia 'substantive and productive'

Ukraine says Abu Dhabi talks with Russia 'substantive and productive'

-

Brazil mine disaster victims in London to 'demand what is owed'

-

AI-fuelled tech stock selloff rolls on

AI-fuelled tech stock selloff rolls on

-

Russia vows to act 'responsibly' as nuclear pact ends with US

-

White says time at Toulon has made him a better Scotland player

White says time at Toulon has made him a better Scotland player

-

Washington Post announces 'painful' job cuts

-

All lights are go for Jalibert, says France's Dupont

All lights are go for Jalibert, says France's Dupont

-

Artist rubs out Meloni church fresco after controversy

-

Palestinians in Egypt torn on return to a Gaza with 'no future'

Palestinians in Egypt torn on return to a Gaza with 'no future'

-

US removing 700 immigration officers from Minnesota

-

Who is behind the killing of late ruler Gaddafi's son, and why now?

Who is behind the killing of late ruler Gaddafi's son, and why now?

-

Coach Thioune tasked with saving battling Bremen

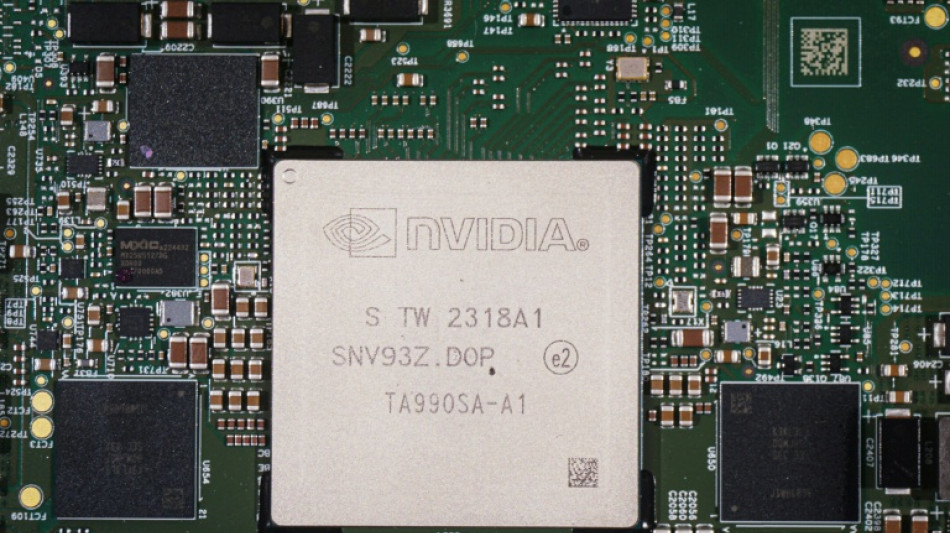

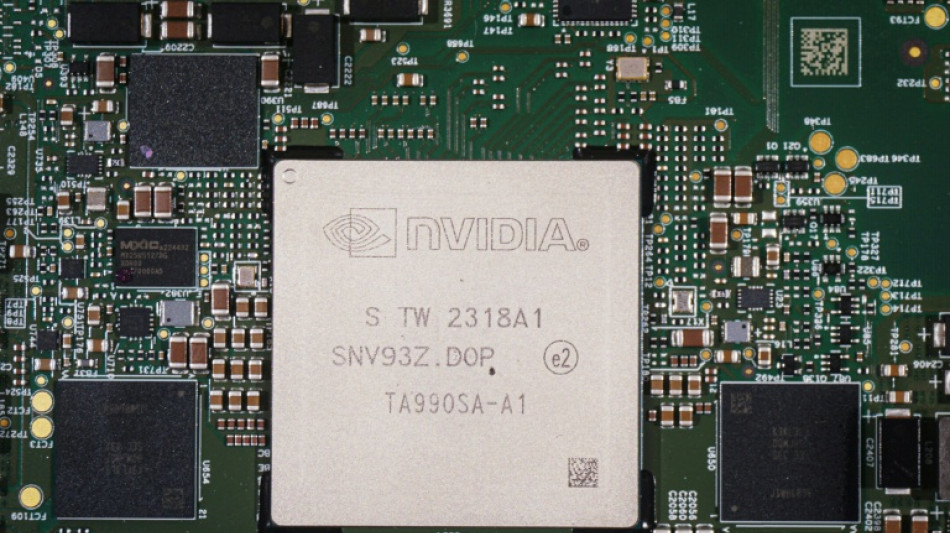

US stocks end mostly higher despite drop in Nvidia

Wall Street stocks mostly rose Tuesday as optimism over a likely end to the US government shutdown offset weakness in some leading technology equities.

After Monday's rally, US stocks opened mostly lower on lingering unease about the stratospheric valuation growth of major players in artificial intelligence.

Those worries ebbed a bit as the session progressed, with some large tech equities finishing in positive territory. But the tech-heavy Nasdaq Composite was down 0.3 percent, the only one of the three main US indices to retreat.

"There's definitely concern over valuations but that valuations don't mean the market's going to sell off," said Tim Urbanowicz of Innovator Capital Management, adding "it just leaves a lot less room for bad news."

Japan's SoftBank announced it sold $5.8 billion worth of shares in US chip giant Nvidia last month. SoftBank did not give a reason for the Nvidia stock sale in its earnings statement.

Shares in Nvidia, whose processors are prized by companies training and operating AI models, fell 3.0 percent.

"For the wider investment community, when big investors cash out of their AI positions, they will take notice, and this is why the stock is declining today," said Kathleen Brooks, research director at XTB trading group.

More broadly, Brooks said tech stocks were no longer providing market momentum.

"Without momentum helping US indices move higher, volatility could take hold, so we are not expecting stocks to move in a straight line for now, and the market correction may not be over," she said in a note to clients.

Some market watchers viewed Tuesday's strong rise in the Dow as evidence of a rotation to industrial names from tech.

Investors have been cheered by the progress on legislation on Capitol Hill to reopen the government.

On Monday night several Democratic senators broke ranks to join Republicans in a 60-40 vote passing legislation to reopen the government, which would trigger a release of US economic reports on labor, consumer prices and other key benchmarks in the coming weeks.

Tuesday's session was held on Veteran's Day, a US holiday, resulting in lower volumes than normal.

Europe's main stock markets climbed Tuesday.

London's top-tier FTSE 100 index reached a fresh record high as a weakening pound boosted multi-nationals earning in dollars, while Paris won solid gains in a day that is also a public holiday in France.

- Key figures at 2110 GMT -

New York - Dow: UP 1.2 percent at 47,927.96 (close)

New York - S&P 500: UP 0.2 percent at 6,846.61 (close)

New York - Nasdaq Composite: DOWN 0.3 percent at 23,468.30 (close)

London - FTSE 100: UP 1.2 percent at 9,899.60 (close)

Paris - CAC 40: UP 1.3 percent at 8,156.23 (close)

Frankfurt - DAX: UP 0.5 percent at 24,088.06 (close)

Tokyo - Nikkei 225: DOWN 0.1 percent at 50,842.93 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 26,696.41 (close)

Shanghai - Composite: DOWN 0.4 percent at 4,002.76 (close)

Euro/dollar: UP at $1.1588 from $1.1557 on Monday

Pound/dollar: DOWN at $1.3168 from $1.3175

Dollar/yen: DOWN at 154.10 yen from 154.15 yen

Euro/pound: UP at 87.99 pence from 87.72 pence

Brent North Sea Crude: UP 1.7 percent at $65.16 per barrel

West Texas Intermediate: UP 1.5 percent at $61.04 per barrel

burs-jmb/jgc

S.Keller--BTB