-

Netflix to buy Warner Bros. Discovery in deal of the decade

Netflix to buy Warner Bros. Discovery in deal of the decade

-

French stars Moefana and Atonio return for Champions Cup

-

Penguins queue in Paris zoo for their bird flu jabs

Penguins queue in Paris zoo for their bird flu jabs

-

Netflix to buy Warner Bros. Discovery for nearly $83 billion

-

Sri Lanka issues fresh landslide warnings as toll nears 500

Sri Lanka issues fresh landslide warnings as toll nears 500

-

Root says England still 'well and truly' in second Ashes Test

-

Chelsea's Maresca says rotation unavoidable

Chelsea's Maresca says rotation unavoidable

-

Italian president urges Olympic truce at Milan-Cortina torch ceremony

-

Norris edges Verstappen in opening practice for season-ending Abu Dhabi GP

Norris edges Verstappen in opening practice for season-ending Abu Dhabi GP

-

Australia race clear of England to seize control of second Ashes Test

-

Stocks, dollar rise before key US inflation data

Stocks, dollar rise before key US inflation data

-

Trump strategy shifts from global role and vows 'resistance' in Europe

-

Turkey orders arrest of 29 footballers in betting scandal

Turkey orders arrest of 29 footballers in betting scandal

-

EU hits X with 120-mn-euro fine, risking Trump ire

-

Arsenal's Merino has earned striking role: Arteta

Arsenal's Merino has earned striking role: Arteta

-

Putin offers India 'uninterrupted' oil in summit talks with Modi

-

New Trump strategy vows shift from global role to regional

New Trump strategy vows shift from global role to regional

-

World Athletics ditches long jump take-off zone reform

-

French town offers 1,000-euro birth bonuses to save local clinic

French town offers 1,000-euro birth bonuses to save local clinic

-

After wins abroad, Syria leader must gain trust at home

-

Slot spots 'positive' signs at struggling Liverpool

Slot spots 'positive' signs at struggling Liverpool

-

Eyes of football world on 2026 World Cup draw with Trump centre stage

-

South Africa rugby coach Erasmus extends contract until 2031

South Africa rugby coach Erasmus extends contract until 2031

-

Ex-Manchester Utd star Lingard announces South Korea exit

-

Australia edge ominously within 106 runs of England in second Ashes Test

Australia edge ominously within 106 runs of England in second Ashes Test

-

Markets rise ahead of US data, expected Fed rate cut

-

McIlroy survives as Min Woo Lee surges into Australian Open hunt

McIlroy survives as Min Woo Lee surges into Australian Open hunt

-

German factory orders rise more than expected

-

India's Modi and Russia's Putin talk defence, trade and Ukraine

India's Modi and Russia's Putin talk defence, trade and Ukraine

-

Flooding kills two as Vietnam hit by dozens of landslides

-

Italy to open Europe's first marine sanctuary for dolphins

Italy to open Europe's first marine sanctuary for dolphins

-

Hong Kong university suspends student union after calls for fire justice

-

Asian markets rise ahead of US data, expected Fed rate cut

Asian markets rise ahead of US data, expected Fed rate cut

-

Nigerian nightlife finds a new extravagance: cabaret

-

Tanzania tourism suffers after election killings

Tanzania tourism suffers after election killings

-

Yo-de-lay-UNESCO? Swiss hope for yodel heritage listing

-

Weatherald fires up as Australia race to 130-1 in second Ashes Test

Weatherald fires up as Australia race to 130-1 in second Ashes Test

-

Georgia's street dogs stir affection, fear, national debate

-

Survivors pick up pieces in flood-hit Indonesia as more rain predicted

Survivors pick up pieces in flood-hit Indonesia as more rain predicted

-

Gibbs runs for three TDs as Lions down Cowboys to boost NFL playoff bid

-

Pandas and ping-pong: Macron ending China visit on lighter note

Pandas and ping-pong: Macron ending China visit on lighter note

-

TikTok to comply with 'upsetting' Australian under-16 ban

-

Hope's resistance keeps West Indies alive in New Zealand Test

Hope's resistance keeps West Indies alive in New Zealand Test

-

Pentagon endorses Australia submarine pact

-

India rolls out red carpet for Russia's Putin

India rolls out red carpet for Russia's Putin

-

Softbank's Son says super AI could make humans like fish, win Nobel Prize

-

LeBron scoring streak ends as Hachimura, Reaves lift Lakers

LeBron scoring streak ends as Hachimura, Reaves lift Lakers

-

England all out for 334 in second Ashes Test

-

Hong Kong university axes student union after calls for fire justice

Hong Kong university axes student union after calls for fire justice

-

'Annoying' Raphinha pulling Barca towards their best

European stocks steady as US shuts for Thanksgiving

European stock markets steadied Thursday after solid gains in Asia, as markets increasingly expect the US Federal Reserve to cut interest rates next month.

Wall Street was closed for the Thanksgiving holiday.

London dipped as markets digested the UK government's tax-raising budget unveiled Wednesday.

The measures reassured markets, with UK government bond yields and the pound steady.

Paris equities flattened and Frankfurt edged higher in midday deals.

"European markets are showing a distinct lack of direction... and traders shouldn't expect too much given a threadbare economic calendar and US Thanksgiving market closure," noted Joshua Mahony, chief market analyst at Scope Markets.

With recent worries over stretched valuations appearing to be on the back burner, sentiment has been lifted on trading floors this week, boosting riskier assets, including bitcoin.

The cryptocurrency, which recently plunged to a seven-month low just above $80,000 amid the recent market swoon, rose back above $90,000 on Thursday.

However, it is still off its record high above $126,200 touched in early October.

Comments from Fed officials and a string of weak US jobs reports have reinforced expectations that the central bank's next policy meeting in December will end with a third successive reduction in borrowing costs.

Markets are now pricing in around an 80-percent chance of a cut on December 10 and a further three next year. That compares with just three reductions in total that Bloomberg said had been previously expected.

All three main indices on Wall Street pushed higher for a fourth-straight day Wednesday ahead of the holiday.

Tokyo led the way in Asia on Thursday, climbing more than one percent, while Hong Kong and Shanghai closed higher.

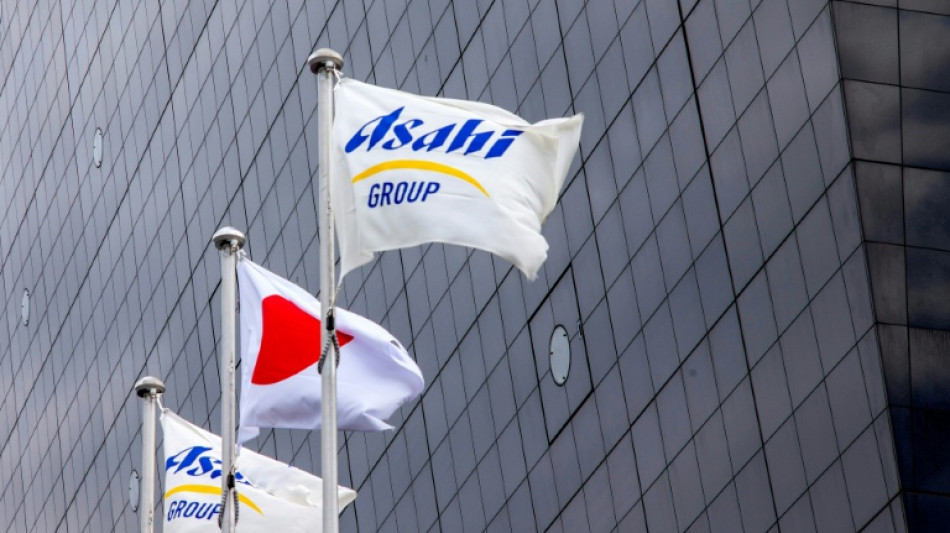

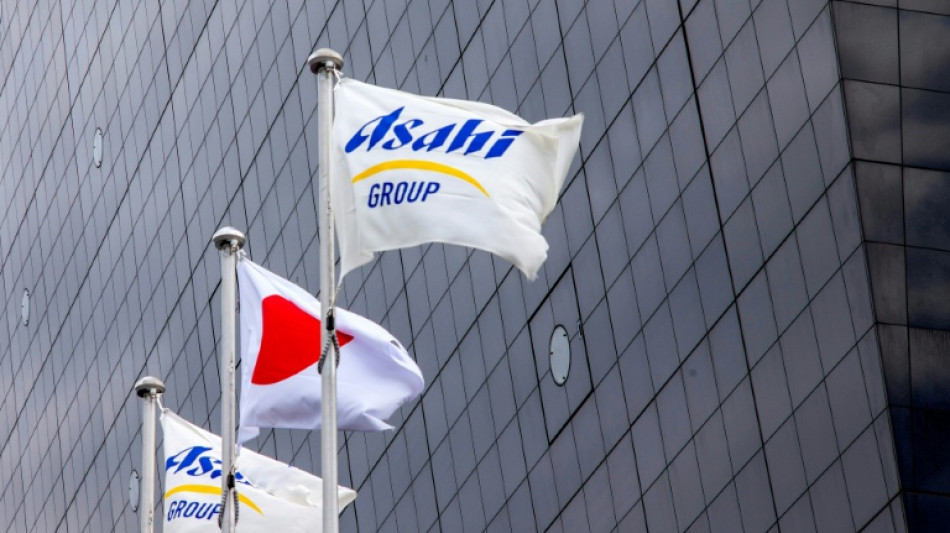

On the downside, Tokyo-listed beer titan Asahi fell as it said it would delay its financial results owing to a cyberattack that began in September.

The maker of Asahi Super Dry, one of Japan's most popular beers, announced it was experiencing system troubles on September 29, stopping its ability to receive orders and to ship products. It blamed a ransomware attack.

Meanwhile, South Korea's biggest crypto exchange Upbit said it had suspended deposits and withdrawals following an unauthorised transfer of about $37 million of digital assets.

The announcement came as it emerged that its parent Dunamu would be bought by Naver Financial, one of the country's top tech giants, in a deal valued at more than $13 billion.

Upbit is the world's fourth-largest crypto exchange in terms of trading volume.

- Key figures at around 1100 GMT -

London - FTSE 100: DOWN 0.2 percent at 9,673.21 points

Paris - CAC 40: FLAT at 8,096.43

Frankfurt - DAX: UP 0.2 percent at 23,781.52

Tokyo - Nikkei 225: UP 1.2 percent at 50,167.10 (close)

Hong Kong - Hang Seng Index: UP 0.1 percent at 25,945.93 (close)

Shanghai - Composite: UP 0.3 percent at 3,875.26 (close)

New York - Dow: UP 0.7 percent at 47,427.12 (close)

Euro/dollar: DOWN at $1.1588 from $1.1598 on Wednesday

Pound/dollar: DOWN at $1.3228 from $1.3239

Dollar/yen: DOWN at 156.27 yen from 156.42 yen

Euro/pound: UP at 87.61 pence from 87.60 pence

Brent North Sea Crude: DOWN 0.2 percent at $62.68 per barrel

West Texas Intermediate: DOWN 0.3 percent at $58.85 per barrel

H.Seidel--BTB