-

Ukrainian chasing sumo greatness after meteoric rise

Ukrainian chasing sumo greatness after meteoric rise

-

Draper to make long-awaited return in Davis Cup qualifier

-

Can Ilia Malinin fulfil his promise at the Winter Olympics?

Can Ilia Malinin fulfil his promise at the Winter Olympics?

-

CK Hutchison begins arbitration against Panama over annulled canal contract

-

UNESCO recognition inspires hope in Afghan artist's city

UNESCO recognition inspires hope in Afghan artist's city

-

Ukraine, Russia, US negotiators gather in Abu Dhabi for war talks

-

WTO must 'reform or die': talks facilitator

WTO must 'reform or die': talks facilitator

-

Doctors hope UK archive can solve under-50s bowel cancer mystery

-

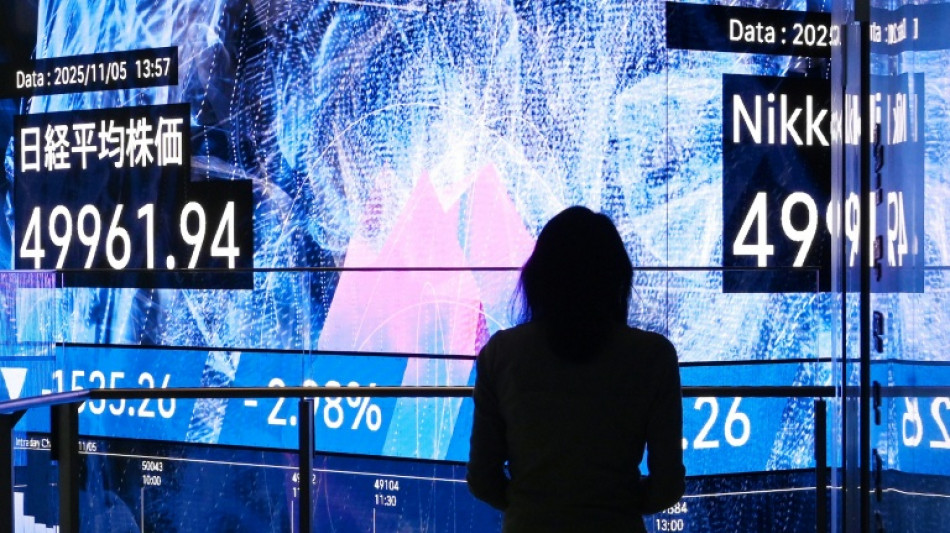

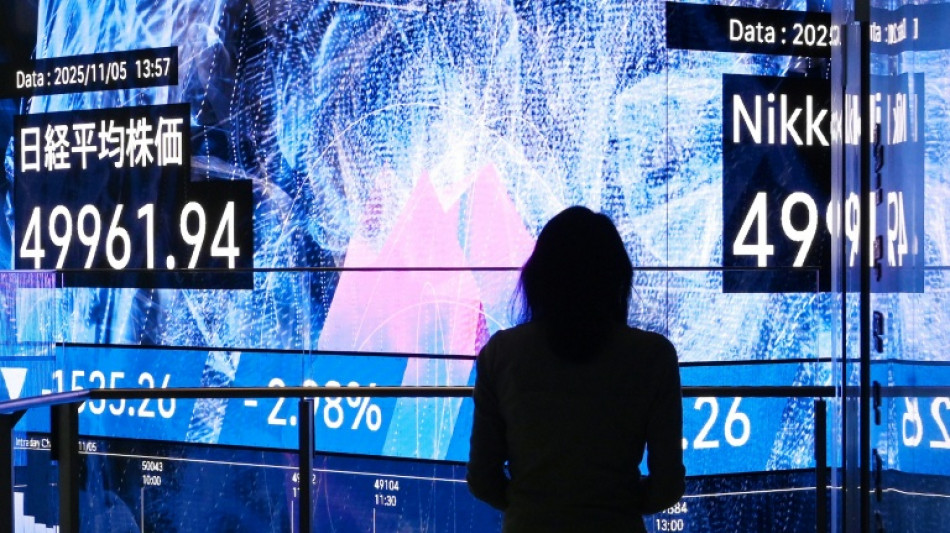

Stocks swing following latest AI-fuelled sell-off on Wall St

Stocks swing following latest AI-fuelled sell-off on Wall St

-

Demanding Dupont set to fire France in Ireland opener

-

Britain's ex-prince Andrew leaves Windsor home: BBC

Britain's ex-prince Andrew leaves Windsor home: BBC

-

Coach plots first South Africa World Cup win after Test triumph

-

Spin-heavy Pakistan hit form, but India boycott risks early T20 exit

Spin-heavy Pakistan hit form, but India boycott risks early T20 exit

-

Japan eyes Premier League parity by aligning calendar with Europe

-

Whack-a-mole: US academic fights to purge his AI deepfakes

Whack-a-mole: US academic fights to purge his AI deepfakes

-

Love in a time of war for journalist and activist in new documentary

-

'Unprecedented mass killing': NGOs battle to quantify Iran crackdown scale

'Unprecedented mass killing': NGOs battle to quantify Iran crackdown scale

-

Seahawks kid Cooper Kupp seeks new Super Bowl memories

-

Thousands of Venezuelans march to demand Maduro's release

Thousands of Venezuelans march to demand Maduro's release

-

AI, manipulated images falsely link some US politicians with Epstein

-

Move on, says Trump as Epstein files trigger probe into British politician

Move on, says Trump as Epstein files trigger probe into British politician

-

Arteta backs Arsenal to build on 'magical' place in League Cup final

-

Evil Empire to underdogs: Patriots eye 7th Super Bowl

Evil Empire to underdogs: Patriots eye 7th Super Bowl

-

UBS grilled on Capitol Hill over Nazi-era probe

-

Guardiola 'hurt' by suffering caused in global conflicts

Guardiola 'hurt' by suffering caused in global conflicts

-

Marseille do their work early to beat Rennes in French Cup

-

Colombia's Petro, Trump hail talks after bitter rift

Colombia's Petro, Trump hail talks after bitter rift

-

Trump signs spending bill ending US government shutdown

-

Arsenal sink Chelsea to reach League Cup final

Arsenal sink Chelsea to reach League Cup final

-

Leverkusen sink St Pauli to book spot in German Cup semis

-

'We just need something positive' - Monks' peace walk across US draws large crowds

'We just need something positive' - Monks' peace walk across US draws large crowds

-

Milan close gap on Inter with 3-0 win over Bologna

-

No US immigration agents at Super Bowl: security chief

No US immigration agents at Super Bowl: security chief

-

NASA Moon mission launch delayed to March after test

-

'You are great': Trump makes up with Colombia's Petro in fireworks-free meeting

'You are great': Trump makes up with Colombia's Petro in fireworks-free meeting

-

Spain to seek social media ban for under-16s

-

X hits back after France summons Musk, raids offices in deepfake probe

X hits back after France summons Musk, raids offices in deepfake probe

-

LIV Golf events to receive world ranking points: official

-

Russia resumes large-scale Ukraine strikes in glacial weather

Russia resumes large-scale Ukraine strikes in glacial weather

-

US House passes spending bill ending government shutdown

-

US jet downs Iran drone but talks still on course

US jet downs Iran drone but talks still on course

-

UK police launching criminal probe into ex-envoy Mandelson

-

US-Iran talks 'still scheduled' after drone shot down: White House

US-Iran talks 'still scheduled' after drone shot down: White House

-

Chomsky sympathized with Epstein over 'horrible' press treatment

-

French prosecutors stick to demand for five-year ban for Le Pen

French prosecutors stick to demand for five-year ban for Le Pen

-

Russia's economic growth slowed to 1% in 2025: Putin

-

Bethell spins England to 3-0 sweep over Sri Lanka in World Cup warm-up

Bethell spins England to 3-0 sweep over Sri Lanka in World Cup warm-up

-

Nagelsmann backs Ter Stegen for World Cup despite 'cruel' injury

-

Homage or propaganda? Carnival parade stars Brazil's Lula

Homage or propaganda? Carnival parade stars Brazil's Lula

-

EU must be 'less naive' in COP climate talks: French ministry

Asian markets mixed as traders struggle to hold Fed cut rally

Asian markets struggled to maintain their early momentum Thursday, even after the latest batch of US data reinforced expectations that the Federal Reserve will cut interest rates for a third successive time next week.

While Wall Street rose for a second day after a minor selloff on Monday, regional traders moved a little more tentatively as worries over extended valuations in the tech sector continued to linger.

Bets on a US reduction on Wednesday have surged to around 90 percent in the past two weeks, after several Fed officials backed such a move saying supporting jobs was more important than keeping a lid on elevated inflation.

The need for more action was further stoked by data from payrolls firm ADP showing 32,000 posts were lost in November, compared with an expected rise of 10,000, according to Bloomberg.

"Hiring has been choppy of late as employers weather cautious consumers and an uncertain macroeconomic environment," ADP chief economist Nela Richardson said.

The reading was also the most since early 2023 and is the latest example of a stuttering labour market.

"Right now, the data argues for additional Fed funds rate cuts. US labor demand is weak, consumer spending is showing early signs of cracking, and upside risks to inflation are fading," Elias Haddad, of Brown Brothers Harriman & Co, wrote.

Markets in Asia stumbled as they struggled to match New York's advance.

Tokyo advanced more than two percent, with Hong Kong, Sydney, Mumbai, Taipei and Manila also up, but Shanghai, Seoul, Singapore, Wellington, Bangkok and Jakarta slipped.

A healthy 30-year Japanese government bond sale provided some support as it slightly eased tensions about a posible rate hike by the central bank this month. The news compounded a strong response to a 10-year auction earlier in the week that settled some nerves.

On stocks, Pepperstone's Michael Brown said in a note: "Path continues to point to the upside, with the bull case remaining a very solid one indeed, and with participants seeking to ride the coattails of the rally higher, especially amid the increased influence of FOMO/FOMU flows as we move into the end of the year."

However, while market players remain confident that the Fed will continue to cut interest rates into the new year, economists at Bank of America still had a note of caution.

"The most immediate source of volatility remains the US Federal Reserve," they wrote.

"While inflation has moderated and the trajectory of policy easing is intact, uncertainty around timing persists. Any delay in rate cuts could remain a source of volatility."

On currency markets the Indian rupee wallowed at record lows of more than 90 per dollar as investors grow increasingly worried about a lack of progress in trade talks with Washington, as observers say Donald Trump's 50 percent tariffs are taking a toll on the economy.

- Key figures at around 0700 GMT -

Tokyo - Nikkei 225: UP 2.3 percent at 51,028.42 (close)

Hong Kong - Hang Seng Index: UP 0.8 percent at 25,966.14

Shanghai - Composite: DOWN 0.1 percent at 3,875.79 (close)

Euro/dollar: DOWN at $1.1655 from $1.1667 on Wednesday

Pound/dollar: DOWN at $1.3334 from $1.3352

Dollar/yen: UP at 155.36 yen from 155.23 yen

Euro/pound: UP at 87.41 pence from 87.39 pence

West Texas Intermediate: UP 0.7 percent at $59.36 per barrel

Brent North Sea Crude: UP 0.6 percent at $63.02 per barrel

New York - Dow: UP 0.9 percent at 47,882.90 (close)

London - FTSE 100: DOWN 0.1 percent at 9,692.07 (close)

P.Anderson--BTB