-

Oil slides, gold loses lustre as Iran threat recedes

Oil slides, gold loses lustre as Iran threat recedes

-

Russian captain found guilty in fatal North Sea crash

-

Disney earnings boosted by theme parks, as CEO handover nears

Disney earnings boosted by theme parks, as CEO handover nears

-

Sri Lanka drop Test captain De Silva from T20 World Cup squad

-

France demands 1.7 bn euros in payroll taxes from Uber: media report

France demands 1.7 bn euros in payroll taxes from Uber: media report

-

EU will struggle to secure key raw materials supply, warns report

-

France poised to adopt 2026 budget after months of tense talks

France poised to adopt 2026 budget after months of tense talks

-

Latest Epstein file dump rocks UK royals, politics

-

Arteta seeks Arsenal reinforcement for injured Merino

Arteta seeks Arsenal reinforcement for injured Merino

-

Russia uses sport to 'whitewash' its aggression, says Ukraine minister

-

Chile officially backs Bachelet candidacy for UN top job

Chile officially backs Bachelet candidacy for UN top job

-

European stocks rise as oil tumbles, while tech worries weigh on New York

-

England captain Itoje on bench for Six Nations opener against Wales

England captain Itoje on bench for Six Nations opener against Wales

-

Rahm says golfers should be 'free' to play where they want after LIV defections

-

More baby milk recalls in France after new toxin rules

More baby milk recalls in France after new toxin rules

-

Rosenior will not rush Estevao return from Brazil

-

Mercedes ready to win F1 world title, says Russell

Mercedes ready to win F1 world title, says Russell

-

Germany hit by nationwide public transport strike

-

Barca coach Flick 'not happy' with Raphinha thigh strain

Barca coach Flick 'not happy' with Raphinha thigh strain

-

WHO chief says turmoil creates chance for reset

-

European stocks rise as gold, oil prices tumble

European stocks rise as gold, oil prices tumble

-

Rink issues resolved, NHL stars chase Olympic gold at Milan

-

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

-

Rodri rages that officials 'don't want' Man City to win

-

Gaza's Rafah crossing makes limited reopening after two-year war

Gaza's Rafah crossing makes limited reopening after two-year war

-

African players in Europe: Ouattara dents Villa title hopes

-

Liverpool beat Chelsea to Rennes defender Jacquet - reports

Liverpool beat Chelsea to Rennes defender Jacquet - reports

-

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

-

Trump says US talking deal with 'highest people' in Cuba

Trump says US talking deal with 'highest people' in Cuba

-

Trump threatens legal action against Grammy host over Epstein comment

-

Olympic Games in northern Italy have German twist

Olympic Games in northern Italy have German twist

-

Bad Bunny: the Puerto Rican phenom on top of the music world

-

Snapchat blocks 415,000 underage accounts in Australia

Snapchat blocks 415,000 underage accounts in Australia

-

At Grammys, 'ICE out' message loud and clear

-

Dalai Lama's 'gratitude' at first Grammy win

Dalai Lama's 'gratitude' at first Grammy win

-

Bad Bunny makes Grammys history with Album of the Year win

-

Stocks, oil, precious metals plunge on volatile start to the week

Stocks, oil, precious metals plunge on volatile start to the week

-

Steven Spielberg earns coveted EGOT status with Grammy win

-

Knicks boost win streak to six by beating LeBron's Lakers

Knicks boost win streak to six by beating LeBron's Lakers

-

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

-

Japan says rare earth found in sediment retrieved on deep-sea mission

Japan says rare earth found in sediment retrieved on deep-sea mission

-

San Siro prepares for last dance with Winter Olympics' opening ceremony

-

France great Benazzi relishing 'genius' Dupont's Six Nations return

France great Benazzi relishing 'genius' Dupont's Six Nations return

-

Grammy red carpet: black and white, barely there and no ICE

-

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

-

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

-

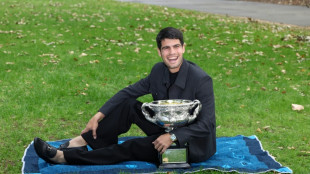

Hatred of losing drives relentless Alcaraz to tennis history

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

| RBGPF | 0.12% | 82.5 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| RYCEF | 4.19% | 16.7 | $ | |

| AZN | 0.84% | 192.06 | $ | |

| CMSC | -0.17% | 23.71 | $ | |

| BTI | 0.25% | 60.845 | $ | |

| GSK | 1.84% | 52.58 | $ | |

| RELX | -0.52% | 35.62 | $ | |

| RIO | 1.75% | 92.705 | $ | |

| BCC | 1.94% | 82.425 | $ | |

| NGG | -0.12% | 85.16 | $ | |

| BCE | 0.1% | 25.871 | $ | |

| CMSD | -0.03% | 24.092 | $ | |

| VOD | 1.51% | 14.875 | $ | |

| JRI | 0.48% | 13.14 | $ | |

| BP | -0.22% | 37.795 | $ |

Equities sink, gold and silver hit records as Greenland fears mount

Asian markets extended losses Tuesday, while precious metals hit fresh peaks on fears of a US-EU trade war fuelled by Donald Trump's tariff threat over opposition to his grab for Greenland.

After a bright start to the year fuelled by fresh hopes for the artificial intelligence sector, investors have taken fright since the US president ramped up his demands for the Danish autonomous territory, citing national security.

With Copenhagen and other European capitals pushing back, Trump on Saturday said he would impose 10 percent levies on eight countries -- including Denmark, France, Germany and Britain -- from February 1, lifting them to 25 percent on June 1.

The move has raised questions about the outlook for last year's US-EU trade deal, while French President Emmanuel Macron has called for the deployment of a powerful, unused instrument aimed at deterring economic coercion.

In response, US Treasury chief Scott Bessent said Monday that any retaliatory EU tariffs would be "unwise".

Trump ramped up his rhetoric against France on Tuesday, warning he would impose 200 percent tariffs on French wine and champagne over its intentions to decline his invitation to join his "Board of Peace" set up to oversee the rebuilding of Gaza.

The prospect of another trade standoff between two of the world's biggest economic powers has fuelled a rush to safety and dealt a blow to risk assets.

After hefty selling in Europe, Asia equities extended losses.

Tokyo, Hong Kong, Sydney, Seoul, Singapore, Mumbai, Manila and Wellington were all down, while Shanghai was flat. Taipei, Bangkok and Jakarta edged up.

Gold hit a fresh record of $4,717.78 and silver also peaked, touching $94.73.

Meanwhile, Treasury yields rose amid a move out of US assets fuelled by the uncertainty sparked by Trump's latest volley.

Japanese government bonds yields also rise, with that on the 40-year note hitting the highest since it was launched in 2007, after Prime Minister Sanae Takaichi called snap elections Monday and pledged to cut a tax on food for a two-year period.

The announcement fuelled fresh worries the government will borrow more cash at a time when questions are already be asked about the country's finances.

Her cabinet approved a record 122.3-trillion-yen ($768 billion) budget for the fiscal year from April 2026, and she has vowed to get parliamentary approval as soon as possible to address rising prices and shore up the world's fourth-largest economy.

Eyes are now on Davos, Switzerland, where the US president is expected to give a speech to the World Economic Forum.

"Davos now becomes the theatre that matters. Not for soundbites, but for whether the adults step back into the room," wrote Stephen Innes of SPI Asset Management.

"If this turns sour, volatility will not stay bottled. What would normally be a Ukraine-focused week risks being hijacked by a far more destabilising question, namely, whether the transatlantic alliance is being stress-tested in public.

"A NATO fracture, even a rhetorical one, is not something markets are trained to shrug off."

- Key figures at around 0710 GMT -

Tokyo - Nikkei 225: DOWN 1.1 percent at 52,991.10 (close)

Hong Kong - Hang Seng Index: DOWN 0.4 percent at 26,468.59

Shanghai - Composite: FLAT at 4,113.65 (close)

Euro/dollar: UP at $1.1666 from $1.1641 on Monday

Pound/dollar: UP at $1.3431 from $1.3428

Dollar/yen: UP at 158.59 yen from 158.09 yen

Euro/pound: UP at 86.85 pence from 86.71 pence

West Texas Intermediate: UP 0.2 percent at $59.58 per barrel

Brent North Sea Crude: UP 0.1 percent at $64.01 per barrel

New York - Dow: Closed for a holiday

London - FTSE 100: DOWN 0.4 percent at 10,195.35 (close)

O.Krause--BTB