-

Oil slides, gold loses lustre as Iran threat recedes

Oil slides, gold loses lustre as Iran threat recedes

-

Russian captain found guilty in fatal North Sea crash

-

Disney earnings boosted by theme parks, as CEO handover nears

Disney earnings boosted by theme parks, as CEO handover nears

-

Sri Lanka drop Test captain De Silva from T20 World Cup squad

-

France demands 1.7 bn euros in payroll taxes from Uber: media report

France demands 1.7 bn euros in payroll taxes from Uber: media report

-

EU will struggle to secure key raw materials supply, warns report

-

France poised to adopt 2026 budget after months of tense talks

France poised to adopt 2026 budget after months of tense talks

-

Latest Epstein file dump rocks UK royals, politics

-

Arteta seeks Arsenal reinforcement for injured Merino

Arteta seeks Arsenal reinforcement for injured Merino

-

Russia uses sport to 'whitewash' its aggression, says Ukraine minister

-

Chile officially backs Bachelet candidacy for UN top job

Chile officially backs Bachelet candidacy for UN top job

-

European stocks rise as oil tumbles, while tech worries weigh on New York

-

England captain Itoje on bench for Six Nations opener against Wales

England captain Itoje on bench for Six Nations opener against Wales

-

Rahm says golfers should be 'free' to play where they want after LIV defections

-

More baby milk recalls in France after new toxin rules

More baby milk recalls in France after new toxin rules

-

Rosenior will not rush Estevao return from Brazil

-

Mercedes ready to win F1 world title, says Russell

Mercedes ready to win F1 world title, says Russell

-

Germany hit by nationwide public transport strike

-

Barca coach Flick 'not happy' with Raphinha thigh strain

Barca coach Flick 'not happy' with Raphinha thigh strain

-

WHO chief says turmoil creates chance for reset

-

European stocks rise as gold, oil prices tumble

European stocks rise as gold, oil prices tumble

-

Rink issues resolved, NHL stars chase Olympic gold at Milan

-

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

-

Rodri rages that officials 'don't want' Man City to win

-

Gaza's Rafah crossing makes limited reopening after two-year war

Gaza's Rafah crossing makes limited reopening after two-year war

-

African players in Europe: Ouattara dents Villa title hopes

-

Liverpool beat Chelsea to Rennes defender Jacquet - reports

Liverpool beat Chelsea to Rennes defender Jacquet - reports

-

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

-

Trump says US talking deal with 'highest people' in Cuba

Trump says US talking deal with 'highest people' in Cuba

-

Trump threatens legal action against Grammy host over Epstein comment

-

Olympic Games in northern Italy have German twist

Olympic Games in northern Italy have German twist

-

Bad Bunny: the Puerto Rican phenom on top of the music world

-

Snapchat blocks 415,000 underage accounts in Australia

Snapchat blocks 415,000 underage accounts in Australia

-

At Grammys, 'ICE out' message loud and clear

-

Dalai Lama's 'gratitude' at first Grammy win

Dalai Lama's 'gratitude' at first Grammy win

-

Bad Bunny makes Grammys history with Album of the Year win

-

Stocks, oil, precious metals plunge on volatile start to the week

Stocks, oil, precious metals plunge on volatile start to the week

-

Steven Spielberg earns coveted EGOT status with Grammy win

-

Knicks boost win streak to six by beating LeBron's Lakers

Knicks boost win streak to six by beating LeBron's Lakers

-

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

-

Japan says rare earth found in sediment retrieved on deep-sea mission

Japan says rare earth found in sediment retrieved on deep-sea mission

-

San Siro prepares for last dance with Winter Olympics' opening ceremony

-

France great Benazzi relishing 'genius' Dupont's Six Nations return

France great Benazzi relishing 'genius' Dupont's Six Nations return

-

Grammy red carpet: black and white, barely there and no ICE

-

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

-

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

-

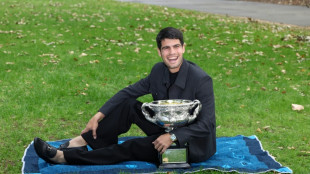

Hatred of losing drives relentless Alcaraz to tennis history

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

| RBGPF | 0.12% | 82.5 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| RYCEF | 4.19% | 16.7 | $ | |

| AZN | 0.84% | 192.06 | $ | |

| CMSC | -0.17% | 23.71 | $ | |

| BTI | 0.25% | 60.845 | $ | |

| GSK | 1.84% | 52.58 | $ | |

| RELX | -0.52% | 35.62 | $ | |

| RIO | 1.75% | 92.705 | $ | |

| BCC | 1.94% | 82.425 | $ | |

| NGG | -0.12% | 85.16 | $ | |

| BCE | 0.1% | 25.871 | $ | |

| CMSD | -0.03% | 24.092 | $ | |

| VOD | 1.51% | 14.875 | $ | |

| JRI | 0.48% | 13.14 | $ | |

| BP | -0.22% | 37.795 | $ |

Wall Street intends to stay open around the clock

The closing and opening bells of the New York Stock Exchange (NYSE) may become a ringing ritual of yesteryear, as the market moves toward nonstop trading.

This week, the Intercontinental Exchange announced it is developing a platform for 24/7 operations that offers "instant settlement."

The around-the-clock operations would rely on digital tokens mirroring the shares of listed companies, the NYSE's parent company said in a statement.

NASDAQ, another New York-based trading exchange, could follow suit as early as this year.

The move is pending approval by federal regulators at the US Securities and Exchange Commission (SEC), and would amount to a minor revolution for the way money moves in US stock markets.

- 'Waste of time' -

In the early days of the exchange, investors had to be physically present in markets on Wall Street to "stand and yell at each other and wave pieces of paper, and then they would have to write down what everybody bought and sold," Sam Burns, chief strategist at Mill Street Research, told AFP.

That meant "having trading go on all day every day would sort of be impossible to keep up with," Burns said.

Digitized transactions can change all that.

Off-hours trading has already been on the rise since 2019, exploding since 2024 when the daily average topped $61 billion, according to a NYSE report in early 2025.

But the appeal remains limited, according to Steve Hanke, a professor of applied economics at Johns Hopkins University.

"Historically, there is little evidence that supports the idea that the benefits of 24-hour trading outweigh the costs," he said, adding that there "are few market-moving events that occur outside of normal business hours in New York City."

"Night trading proved to be a waste of time," he said.

Hanke said the real advantage in the NYSE's announcement lies in the time needed to finalize a trade -- a process that usually occurs the next day in most stock markets.

"Narrowing the settlement window may prove to be a significant competitive advantage," Hanke said.

- Attracting the young and foreigners -

As host to immense market caps, the US market remains the largest in the world, but competition is growing.

Last year, many European indexes generated returns that outpaced their US counterparts.

With extended hours, Wall Street may be able to attract smaller investors and those outside the Americas.

Nearly 18 percent of US shares belonged to non-US holders in 2024, according to the US Treasury's most recent available figures.

And fans of cryptocurrency trading may jump into stocks, said Burns, the Mill Street Research strategist.

"A lot of retail investors nowadays, particularly younger ones, seem to like the idea of being able to trade stocks all the time the way they do cryptocurrencies and other digital assets, whether it's nights or weekends," Burns said.

It is unlikely that the change would move traditional investors from banker's hours because the impacts of any change are likely to be limited," Burns added.

"Most institutional investors that trade the real money aren't really interested in working or trading on the weekends, and the fact (is) that banks are mostly still closed on the weekends," Burns said.

O.Bulka--BTB