-

Oil slides, gold loses lustre as Iran threat recedes

Oil slides, gold loses lustre as Iran threat recedes

-

Russian captain found guilty in fatal North Sea crash

-

Disney earnings boosted by theme parks, as CEO handover nears

Disney earnings boosted by theme parks, as CEO handover nears

-

Sri Lanka drop Test captain De Silva from T20 World Cup squad

-

France demands 1.7 bn euros in payroll taxes from Uber: media report

France demands 1.7 bn euros in payroll taxes from Uber: media report

-

EU will struggle to secure key raw materials supply, warns report

-

France poised to adopt 2026 budget after months of tense talks

France poised to adopt 2026 budget after months of tense talks

-

Latest Epstein file dump rocks UK royals, politics

-

Arteta seeks Arsenal reinforcement for injured Merino

Arteta seeks Arsenal reinforcement for injured Merino

-

Russia uses sport to 'whitewash' its aggression, says Ukraine minister

-

Chile officially backs Bachelet candidacy for UN top job

Chile officially backs Bachelet candidacy for UN top job

-

European stocks rise as oil tumbles, while tech worries weigh on New York

-

England captain Itoje on bench for Six Nations opener against Wales

England captain Itoje on bench for Six Nations opener against Wales

-

Rahm says golfers should be 'free' to play where they want after LIV defections

-

More baby milk recalls in France after new toxin rules

More baby milk recalls in France after new toxin rules

-

Rosenior will not rush Estevao return from Brazil

-

Mercedes ready to win F1 world title, says Russell

Mercedes ready to win F1 world title, says Russell

-

Germany hit by nationwide public transport strike

-

Barca coach Flick 'not happy' with Raphinha thigh strain

Barca coach Flick 'not happy' with Raphinha thigh strain

-

WHO chief says turmoil creates chance for reset

-

European stocks rise as gold, oil prices tumble

European stocks rise as gold, oil prices tumble

-

Rink issues resolved, NHL stars chase Olympic gold at Milan

-

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

-

Rodri rages that officials 'don't want' Man City to win

-

Gaza's Rafah crossing makes limited reopening after two-year war

Gaza's Rafah crossing makes limited reopening after two-year war

-

African players in Europe: Ouattara dents Villa title hopes

-

Liverpool beat Chelsea to Rennes defender Jacquet - reports

Liverpool beat Chelsea to Rennes defender Jacquet - reports

-

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

-

Trump says US talking deal with 'highest people' in Cuba

Trump says US talking deal with 'highest people' in Cuba

-

Trump threatens legal action against Grammy host over Epstein comment

-

Olympic Games in northern Italy have German twist

Olympic Games in northern Italy have German twist

-

Bad Bunny: the Puerto Rican phenom on top of the music world

-

Snapchat blocks 415,000 underage accounts in Australia

Snapchat blocks 415,000 underage accounts in Australia

-

At Grammys, 'ICE out' message loud and clear

-

Dalai Lama's 'gratitude' at first Grammy win

Dalai Lama's 'gratitude' at first Grammy win

-

Bad Bunny makes Grammys history with Album of the Year win

-

Stocks, oil, precious metals plunge on volatile start to the week

Stocks, oil, precious metals plunge on volatile start to the week

-

Steven Spielberg earns coveted EGOT status with Grammy win

-

Knicks boost win streak to six by beating LeBron's Lakers

Knicks boost win streak to six by beating LeBron's Lakers

-

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

-

Japan says rare earth found in sediment retrieved on deep-sea mission

Japan says rare earth found in sediment retrieved on deep-sea mission

-

San Siro prepares for last dance with Winter Olympics' opening ceremony

-

France great Benazzi relishing 'genius' Dupont's Six Nations return

France great Benazzi relishing 'genius' Dupont's Six Nations return

-

Grammy red carpet: black and white, barely there and no ICE

-

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

-

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

-

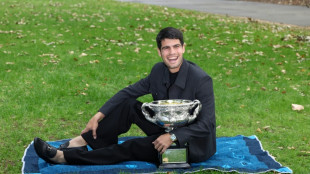

Hatred of losing drives relentless Alcaraz to tennis history

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

| RBGPF | 0.12% | 82.5 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| RYCEF | 4.19% | 16.7 | $ | |

| AZN | 0.84% | 192.06 | $ | |

| CMSC | -0.17% | 23.71 | $ | |

| BTI | 0.25% | 60.845 | $ | |

| GSK | 1.84% | 52.58 | $ | |

| RELX | -0.52% | 35.62 | $ | |

| RIO | 1.75% | 92.705 | $ | |

| BCC | 1.94% | 82.425 | $ | |

| NGG | -0.12% | 85.16 | $ | |

| BCE | 0.1% | 25.871 | $ | |

| CMSD | -0.03% | 24.092 | $ | |

| VOD | 1.51% | 14.875 | $ | |

| JRI | 0.48% | 13.14 | $ | |

| BP | -0.22% | 37.795 | $ |

Dollar sinks on yen intervention talk, gold breaks $5,100

The dollar fell and gold hit fresh high on Monday amid uncertainty over domestic US policies and speculation of US-Japanese coordination to support the yen.

Equity markets were mostly lower, with most major European indices in the red after a weak lead from Asia.

The price of safe-haven asset gold pushed above $5,100 an ounce after surpassing $5,000 on Sunday, amid rising global uncertainty and turmoil set off by US President Donald Trump's policies.

Silver broke $100 Friday and spiked above $110 Monday.

"The relentless quest for hard assets continued amid yet more talk of tariffs and US government shutdowns," said Neil Wilson, investor strategist at Saxo UK.

Multiple US senators have said they would vote against upcoming government spending bills after federal agents killed a second American citizen in Minneapolis, significantly increasing the chances of a government shutdown next week.

The dollar was also weighed down by a surge in the yen on speculation that authorities may intervene to prop up the Japanese currency.

"The FX (foreign exchange) market is front and centre at the start of this week and the focus is on the huge move higher in the yen," said Kathleen Brooks, research director at XTB trading group.

"Reports suggest that Japanese officials were joined by the Federal Reserve Bank of New York who bought yen to support the beleaguered currency," she added.

The yen has been sliding amid worries about Japan's fiscal position, the central bank's decision not to hike interest rates further and expectations that the US Fed will hold off cutting its own borrowing costs this week.

Tokyo's stock market sank 1.8 percent owing to the stronger yen, which weighs on Japanese exporters.

The prospect of authorities stepping into financial markets saw the dollar retreat across the board, with the euro, pound and South Korean won also well up while the Singapore dollar hit an 11-year high.

The US Federal Reserve is expected to hold interest rates this week, despite Trump's pressure to slash levels as it guards against threats to its independence.

Trump has made no secret of his disdain for Federal Reserve boss Jerome Powell, claiming there is "no inflation" and repeatedly questioning the Fed chair's competence and integrity.

Oil prices extended Friday gains that came after Trump said a US "armada" was heading towards the Gulf and that Washington was watching Iran closely.

The president has repeatedly left open the option of new military action against Tehran after Washington backed and joined Israel's 12-day war in June aimed at degrading Iranian nuclear and ballistic missile programmes.

- Key figures at around 1120 GMT -

London - FTSE 100: UP 0.1 percent at 10,148.13 points

Paris - CAC 40: DOWN 0.4 percent at 8,112.25

Frankfurt - DAX: DOWN 0.4 percent at 24,806.68

Tokyo - Nikkei 225: DOWN 1.8 percent at 52,885.25 (close)

Hong Kong - Hang Seng Index: UP 0.1 percent at 26,765.52 (close)

Shanghai - Composite: DOWN 0.1 percent at 4,132.61 (close)

New York - Dow: DOWN 0.6 percent at 49,098.71 (close)

Dollar/yen: DOWN at 153.77 yen from 157.00 yen on Friday

Euro/dollar: UP at $1.1849 from $1.1823

Pound/dollar: UP at $1.3666 from $1.3636

Euro/pound: FLAT at 86.70 pence

Brent North Sea Crude: UP 0.2 percent at $66.02 per barrel

West Texas Intermediate: UP 0.2 percent at $61.16 per barrel

R.Adler--BTB