-

Oil slides, gold loses lustre as Iran threat recedes

Oil slides, gold loses lustre as Iran threat recedes

-

Russian captain found guilty in fatal North Sea crash

-

Disney earnings boosted by theme parks, as CEO handover nears

Disney earnings boosted by theme parks, as CEO handover nears

-

Sri Lanka drop Test captain De Silva from T20 World Cup squad

-

France demands 1.7 bn euros in payroll taxes from Uber: media report

France demands 1.7 bn euros in payroll taxes from Uber: media report

-

EU will struggle to secure key raw materials supply, warns report

-

France poised to adopt 2026 budget after months of tense talks

France poised to adopt 2026 budget after months of tense talks

-

Latest Epstein file dump rocks UK royals, politics

-

Arteta seeks Arsenal reinforcement for injured Merino

Arteta seeks Arsenal reinforcement for injured Merino

-

Russia uses sport to 'whitewash' its aggression, says Ukraine minister

-

Chile officially backs Bachelet candidacy for UN top job

Chile officially backs Bachelet candidacy for UN top job

-

European stocks rise as oil tumbles, while tech worries weigh on New York

-

England captain Itoje on bench for Six Nations opener against Wales

England captain Itoje on bench for Six Nations opener against Wales

-

Rahm says golfers should be 'free' to play where they want after LIV defections

-

More baby milk recalls in France after new toxin rules

More baby milk recalls in France after new toxin rules

-

Rosenior will not rush Estevao return from Brazil

-

Mercedes ready to win F1 world title, says Russell

Mercedes ready to win F1 world title, says Russell

-

Germany hit by nationwide public transport strike

-

Barca coach Flick 'not happy' with Raphinha thigh strain

Barca coach Flick 'not happy' with Raphinha thigh strain

-

WHO chief says turmoil creates chance for reset

-

European stocks rise as gold, oil prices tumble

European stocks rise as gold, oil prices tumble

-

Rink issues resolved, NHL stars chase Olympic gold at Milan

-

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

-

Rodri rages that officials 'don't want' Man City to win

-

Gaza's Rafah crossing makes limited reopening after two-year war

Gaza's Rafah crossing makes limited reopening after two-year war

-

African players in Europe: Ouattara dents Villa title hopes

-

Liverpool beat Chelsea to Rennes defender Jacquet - reports

Liverpool beat Chelsea to Rennes defender Jacquet - reports

-

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

-

Trump says US talking deal with 'highest people' in Cuba

Trump says US talking deal with 'highest people' in Cuba

-

Trump threatens legal action against Grammy host over Epstein comment

-

Olympic Games in northern Italy have German twist

Olympic Games in northern Italy have German twist

-

Bad Bunny: the Puerto Rican phenom on top of the music world

-

Snapchat blocks 415,000 underage accounts in Australia

Snapchat blocks 415,000 underage accounts in Australia

-

At Grammys, 'ICE out' message loud and clear

-

Dalai Lama's 'gratitude' at first Grammy win

Dalai Lama's 'gratitude' at first Grammy win

-

Bad Bunny makes Grammys history with Album of the Year win

-

Stocks, oil, precious metals plunge on volatile start to the week

Stocks, oil, precious metals plunge on volatile start to the week

-

Steven Spielberg earns coveted EGOT status with Grammy win

-

Knicks boost win streak to six by beating LeBron's Lakers

Knicks boost win streak to six by beating LeBron's Lakers

-

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

-

Japan says rare earth found in sediment retrieved on deep-sea mission

Japan says rare earth found in sediment retrieved on deep-sea mission

-

San Siro prepares for last dance with Winter Olympics' opening ceremony

-

France great Benazzi relishing 'genius' Dupont's Six Nations return

France great Benazzi relishing 'genius' Dupont's Six Nations return

-

Grammy red carpet: black and white, barely there and no ICE

-

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

-

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

-

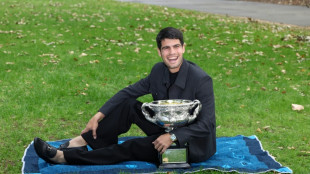

Hatred of losing drives relentless Alcaraz to tennis history

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

| RBGPF | 0.12% | 82.5 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| RYCEF | 4.19% | 16.7 | $ | |

| AZN | 0.84% | 192.06 | $ | |

| CMSC | -0.17% | 23.71 | $ | |

| BTI | 0.25% | 60.845 | $ | |

| GSK | 1.84% | 52.58 | $ | |

| RELX | -0.52% | 35.62 | $ | |

| RIO | 1.75% | 92.705 | $ | |

| BCC | 1.94% | 82.425 | $ | |

| NGG | -0.12% | 85.16 | $ | |

| BCE | 0.1% | 25.871 | $ | |

| CMSD | -0.03% | 24.092 | $ | |

| VOD | 1.51% | 14.875 | $ | |

| JRI | 0.48% | 13.14 | $ | |

| BP | -0.22% | 37.795 | $ |

Stocks gain tracking tech, Fed and trade

Stock markets gained Tuesday as investors geared up for the US Federal Reserve's policy meeting and earnings from tech titans, which will be pored over for signs of AI momentum.

Nearing the half-way stage in Europe, London and Paris advanced while Frankfurt dipped, following also news that the European Union and India had struck a free trade deal.

Brushing off South Korea-US tariff concerns, Asian stocks markets were buoyed by "hopes of strong earnings from the US tech heavyweights in the next couple of days", said Richard Hunter, head of markets at Interactive investor.

Tech firms are enjoying a fresh boost ahead of earnings releases as traders continue to pile into all things artificial intelligence.

Apple, Meta, Microsoft and Tesla give updates this week, with other bellwethers including Texas Instruments, Boeing and Mastercard providing an idea about the state of the US economy.

However, concerns remain over the scale of investment in AI, leaving some nervousness on trading floors about when profits will be realised.

Investors attention was also on the Federal Reserve's policy meeting starting Tuesday.

The US central bank is Wednesday widely expected to maintain the level of its key interest rates.

"Markets aren't expecting any changes to lending rates, but markets will be watching keenly to see if Chair (Jerome) Powell, who's kept a tight grip on monetary policy, is to be replaced by a Trump dove," said Derren Nathan, head of equity research at Hargreaves Lansdown.

US President Donald Trump has meanwhile reverted back to tariff threats this week, warning South Korea he would impose 25 percent tolls on goods including autos for falling short of expectations on an earlier pact struck with Washington.

The announcement comes months after the two sides struck a trade and security deal following tense negotiations, setting levies at 15 percent.

Still, Seoul's Kospi continued its run to fresh record highs by jumping 2.8 percent, with observers pointing to Trump's history of rowing back the worst of his threats.

While carmakers slipped, tech firms ploughed higher with chipmaking giant SK hynix up 8.7 percent and Samsung Electronics up 4.8 percent.

Trump's outburst follows a warning to Canada on Saturday that it faced 100 percent levies if it signed a trade deal with China.

That came days after the president backed down from a threat to hit several European countries with measures over their opposition to his grab for Greenland.

There were also big gains in Hong Kong and Shanghai.

Mumbai advanced after India and the European Union unveiled a free-trade deal totalling about a quarter of global GDP, following two decades of negotiations.

Indian Prime Minister Narendra Modi said the agreement "will bring many opportunities for India's 1.4 billion and many millions of people of the EU".

The dollar remained under pressure after a selloff sparked by talk of a joint intervention between US and Japanese authorities to support the yen.

Shares in German sportswear brand Puma climbed strongly in Frankfurt with Chinese athletic goods giant Anta Sports set to purchase a leading stake in the company.

But although posting a rise of almost 11 percent Puma stock, at 23.80 euros, was quoted far below the 35 euros per share that Anta is paying for its 29-percent stake.

This, analysts said, reflects investor caution about the group's chances of turning its fortunes around, after seeing its market capitalisation plunge by about a third over the past year.

- Key figures at around 1115 GMT -

London - FTSE 100: UP 0.6 percent at 10,207.38 points

Paris - CAC 40: UP 0.2 percent at 8,143.44

Frankfurt - DAX: DOWN 0.1 percent at 24,902.16

Tokyo - Nikkei 225: UP 0.9 percent at 53,333.54 (close)

Hong Kong - Hang Seng Index: UP 1.4 percent at 27,126.95 (close)

Shanghai - Composite: UP 0.2 percent at 4,139.90 (close)

Dollar/yen: DOWN at 153.64 yen from 153.98 yen on Monday

Euro/dollar: UP at $1.1892 from $1.1883

Pound/dollar: UP at $1.3704 from $1.3682

Euro/pound: DOWN at 86.77 pence from 86.85 pence

Brent North Sea Crude: UP 0.3 percent at $64.94 per barrel

West Texas Intermediate: UP 0.4 percent at $60.86 per barrel

K.Thomson--BTB