-

Oil slides, gold loses lustre as Iran threat recedes

Oil slides, gold loses lustre as Iran threat recedes

-

Russian captain found guilty in fatal North Sea crash

-

Disney earnings boosted by theme parks, as CEO handover nears

Disney earnings boosted by theme parks, as CEO handover nears

-

Sri Lanka drop Test captain De Silva from T20 World Cup squad

-

France demands 1.7 bn euros in payroll taxes from Uber: media report

France demands 1.7 bn euros in payroll taxes from Uber: media report

-

EU will struggle to secure key raw materials supply, warns report

-

France poised to adopt 2026 budget after months of tense talks

France poised to adopt 2026 budget after months of tense talks

-

Latest Epstein file dump rocks UK royals, politics

-

Arteta seeks Arsenal reinforcement for injured Merino

Arteta seeks Arsenal reinforcement for injured Merino

-

Russia uses sport to 'whitewash' its aggression, says Ukraine minister

-

Chile officially backs Bachelet candidacy for UN top job

Chile officially backs Bachelet candidacy for UN top job

-

European stocks rise as oil tumbles, while tech worries weigh on New York

-

England captain Itoje on bench for Six Nations opener against Wales

England captain Itoje on bench for Six Nations opener against Wales

-

Rahm says golfers should be 'free' to play where they want after LIV defections

-

More baby milk recalls in France after new toxin rules

More baby milk recalls in France after new toxin rules

-

Rosenior will not rush Estevao return from Brazil

-

Mercedes ready to win F1 world title, says Russell

Mercedes ready to win F1 world title, says Russell

-

Germany hit by nationwide public transport strike

-

Barca coach Flick 'not happy' with Raphinha thigh strain

Barca coach Flick 'not happy' with Raphinha thigh strain

-

WHO chief says turmoil creates chance for reset

-

European stocks rise as gold, oil prices tumble

European stocks rise as gold, oil prices tumble

-

Rink issues resolved, NHL stars chase Olympic gold at Milan

-

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

-

Rodri rages that officials 'don't want' Man City to win

-

Gaza's Rafah crossing makes limited reopening after two-year war

Gaza's Rafah crossing makes limited reopening after two-year war

-

African players in Europe: Ouattara dents Villa title hopes

-

Liverpool beat Chelsea to Rennes defender Jacquet - reports

Liverpool beat Chelsea to Rennes defender Jacquet - reports

-

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

-

Trump says US talking deal with 'highest people' in Cuba

Trump says US talking deal with 'highest people' in Cuba

-

Trump threatens legal action against Grammy host over Epstein comment

-

Olympic Games in northern Italy have German twist

Olympic Games in northern Italy have German twist

-

Bad Bunny: the Puerto Rican phenom on top of the music world

-

Snapchat blocks 415,000 underage accounts in Australia

Snapchat blocks 415,000 underage accounts in Australia

-

At Grammys, 'ICE out' message loud and clear

-

Dalai Lama's 'gratitude' at first Grammy win

Dalai Lama's 'gratitude' at first Grammy win

-

Bad Bunny makes Grammys history with Album of the Year win

-

Stocks, oil, precious metals plunge on volatile start to the week

Stocks, oil, precious metals plunge on volatile start to the week

-

Steven Spielberg earns coveted EGOT status with Grammy win

-

Knicks boost win streak to six by beating LeBron's Lakers

Knicks boost win streak to six by beating LeBron's Lakers

-

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

-

Japan says rare earth found in sediment retrieved on deep-sea mission

Japan says rare earth found in sediment retrieved on deep-sea mission

-

San Siro prepares for last dance with Winter Olympics' opening ceremony

-

France great Benazzi relishing 'genius' Dupont's Six Nations return

France great Benazzi relishing 'genius' Dupont's Six Nations return

-

Grammy red carpet: black and white, barely there and no ICE

-

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

-

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

-

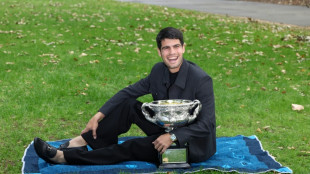

Hatred of losing drives relentless Alcaraz to tennis history

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

| RBGPF | 0.12% | 82.5 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| RYCEF | 4.19% | 16.7 | $ | |

| AZN | 0.84% | 192.06 | $ | |

| CMSC | -0.17% | 23.71 | $ | |

| BTI | 0.25% | 60.845 | $ | |

| GSK | 1.84% | 52.58 | $ | |

| RELX | -0.52% | 35.62 | $ | |

| RIO | 1.75% | 92.705 | $ | |

| BCC | 1.94% | 82.425 | $ | |

| NGG | -0.12% | 85.16 | $ | |

| BCE | 0.1% | 25.871 | $ | |

| CMSD | -0.03% | 24.092 | $ | |

| VOD | 1.51% | 14.875 | $ | |

| JRI | 0.48% | 13.14 | $ | |

| BP | -0.22% | 37.795 | $ |

US Fed set to pause rate cuts as it defies Trump pressure

The US Federal Reserve is broadly expected to pause its series of interest rate cuts Wednesday, resisting mounting attacks from President Donald Trump, while policymakers await more data on the world's biggest economy.

The US central bank lowered rates in each of its last three policy meetings -- bringing them to a range between 3.50 percent and 3.75 percent -- as officials fretted about the cooling jobs market.

But solid GDP growth, relatively low unemployment and stubborn inflation have given them reason to shift into wait-and-see mode.

The lack of urgency, however, could put the central bank again at odds with Trump, who has repeatedly called for large rate reductions.

Trump has sharply escalated pressure on the Fed since returning to the White House a year ago, seeking to oust Fed Governor Lisa Cook over mortgage fraud allegations while his administration launched an investigation into chairman Jerome Powell.

In a rare rebuke this month, Powell slammed the threat of criminal charges against him -- over the Fed's headquarters renovation -- as a threat to central bank independence.

Yet, "while the Fed has been politically pressured to cut rates, it is not pressed by the data," said EY-Parthenon chief economist Gregory Daco.

Officials appear to have converged on a near-term halt in rate reductions, with their debate now centering around what conditions justify further rate cuts -- and how quickly these should take place.

"The hurdle for additional near-term cuts has risen," Daco said.

Officials will be looking for "clearer, more durable evidence of disinflation" or renewed deterioration in the labor market before lowering rates again, he added.

- 'Less dissent' -

While the Fed has seen deepening divides over interest rates, Dan North of Allianz Trade North America told AFP that he expects "less dissent" in Wednesday's decision.

Fed Governor Stephen Miran, appointed by Trump last year to fill a term lasting until late January, is likely to again push for lower rates, North said.

But it is unclear if others on the board of governors like Michelle Bowman and Christopher Waller would join him.

Financial markets generally expect the Fed to continue keeping rates unchanged until its June meeting, according to CME FedWatch.

Looking ahead, all eyes are on how Trump's nominee to succeed Powell -- whose chairmanship of the bank ends in May -- shapes Fed policy.

"We think inflation peaks and starts to turn lower (this year) but also importantly, we think a new Fed chair would be more open to helping to navigate lower interest rates," said Nationwide chief economist Kathy Bostjancic.

- Credibility issues -

One issue is whether the new chairman can corral the rest of the rate-setting Federal Open Market Committee into more rate cuts, ING analysts said in a note.

Outside the Fed, it could be harder for the next chairman to convince investors that the bank will continue pursuing its mandate of low and stable inflation and maximum employment, independent of political influence, said Michael Strain of the conservative American Enterprise Institute.

"I think the stakes are higher," he said.

Given the way the Trump administration has targeted Powell, Strain added that "establishing credibility will be much more challenging” for Powell's successor than it has been for previous Fed chiefs over the last few decades.

Strain, who is AEI's director of economic policy studies, also cautioned that the Fed may have gone too far in lowering rates last year.

He warned that the labor market might be stronger than officials think, while there remains a risk that inflation accelerates again.

"Certainly, the Fed should not continue to cut," he said. "I'm worried the Fed's going to have to hike in 2026."

A.Gasser--BTB