-

Oil slides, gold loses lustre as Iran threat recedes

Oil slides, gold loses lustre as Iran threat recedes

-

Russian captain found guilty in fatal North Sea crash

-

Disney earnings boosted by theme parks, as CEO handover nears

Disney earnings boosted by theme parks, as CEO handover nears

-

Sri Lanka drop Test captain De Silva from T20 World Cup squad

-

France demands 1.7 bn euros in payroll taxes from Uber: media report

France demands 1.7 bn euros in payroll taxes from Uber: media report

-

EU will struggle to secure key raw materials supply, warns report

-

France poised to adopt 2026 budget after months of tense talks

France poised to adopt 2026 budget after months of tense talks

-

Latest Epstein file dump rocks UK royals, politics

-

Arteta seeks Arsenal reinforcement for injured Merino

Arteta seeks Arsenal reinforcement for injured Merino

-

Russia uses sport to 'whitewash' its aggression, says Ukraine minister

-

Chile officially backs Bachelet candidacy for UN top job

Chile officially backs Bachelet candidacy for UN top job

-

European stocks rise as oil tumbles, while tech worries weigh on New York

-

England captain Itoje on bench for Six Nations opener against Wales

England captain Itoje on bench for Six Nations opener against Wales

-

Rahm says golfers should be 'free' to play where they want after LIV defections

-

More baby milk recalls in France after new toxin rules

More baby milk recalls in France after new toxin rules

-

Rosenior will not rush Estevao return from Brazil

-

Mercedes ready to win F1 world title, says Russell

Mercedes ready to win F1 world title, says Russell

-

Germany hit by nationwide public transport strike

-

Barca coach Flick 'not happy' with Raphinha thigh strain

Barca coach Flick 'not happy' with Raphinha thigh strain

-

WHO chief says turmoil creates chance for reset

-

European stocks rise as gold, oil prices tumble

European stocks rise as gold, oil prices tumble

-

Rink issues resolved, NHL stars chase Olympic gold at Milan

-

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

-

Rodri rages that officials 'don't want' Man City to win

-

Gaza's Rafah crossing makes limited reopening after two-year war

Gaza's Rafah crossing makes limited reopening after two-year war

-

African players in Europe: Ouattara dents Villa title hopes

-

Liverpool beat Chelsea to Rennes defender Jacquet - reports

Liverpool beat Chelsea to Rennes defender Jacquet - reports

-

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

-

Trump says US talking deal with 'highest people' in Cuba

Trump says US talking deal with 'highest people' in Cuba

-

Trump threatens legal action against Grammy host over Epstein comment

-

Olympic Games in northern Italy have German twist

Olympic Games in northern Italy have German twist

-

Bad Bunny: the Puerto Rican phenom on top of the music world

-

Snapchat blocks 415,000 underage accounts in Australia

Snapchat blocks 415,000 underage accounts in Australia

-

At Grammys, 'ICE out' message loud and clear

-

Dalai Lama's 'gratitude' at first Grammy win

Dalai Lama's 'gratitude' at first Grammy win

-

Bad Bunny makes Grammys history with Album of the Year win

-

Stocks, oil, precious metals plunge on volatile start to the week

Stocks, oil, precious metals plunge on volatile start to the week

-

Steven Spielberg earns coveted EGOT status with Grammy win

-

Knicks boost win streak to six by beating LeBron's Lakers

Knicks boost win streak to six by beating LeBron's Lakers

-

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

-

Japan says rare earth found in sediment retrieved on deep-sea mission

Japan says rare earth found in sediment retrieved on deep-sea mission

-

San Siro prepares for last dance with Winter Olympics' opening ceremony

-

France great Benazzi relishing 'genius' Dupont's Six Nations return

France great Benazzi relishing 'genius' Dupont's Six Nations return

-

Grammy red carpet: black and white, barely there and no ICE

-

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

-

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

-

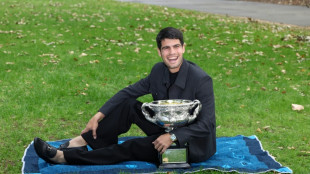

Hatred of losing drives relentless Alcaraz to tennis history

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

| RBGPF | 0.12% | 82.5 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| RYCEF | 4.19% | 16.7 | $ | |

| AZN | 0.84% | 192.06 | $ | |

| CMSC | -0.17% | 23.71 | $ | |

| BTI | 0.25% | 60.845 | $ | |

| GSK | 1.84% | 52.58 | $ | |

| RELX | -0.52% | 35.62 | $ | |

| RIO | 1.75% | 92.705 | $ | |

| BCC | 1.94% | 82.425 | $ | |

| NGG | -0.12% | 85.16 | $ | |

| BCE | 0.1% | 25.871 | $ | |

| CMSD | -0.03% | 24.092 | $ | |

| VOD | 1.51% | 14.875 | $ | |

| JRI | 0.48% | 13.14 | $ | |

| BP | -0.22% | 37.795 | $ |

Asian stocks hit by fresh tech fears as gold retreats from peak

Asian stocks sank Friday amid fresh worries over vast investments in artificial intelligence, gold and silver tumbled after hitting multiple record highs and oil retreated on hopes for an easing of US-Iran tensions.

Markets have endured a rollercoaster ride this week as traders weathered a weaker dollar, Donald Trump's threats against Tehran, a resumption of tariff warnings and a possible US government shutdown.

Fresh optimism in the tech sector about the future of AI has provided support, however, with healthy earnings from companies including Meta, Samsung and SK hynix providing much cheer.

However, the positivity took a hit Thursday after Microsoft announced a surge in spending on AI infrastructure and revived concerns that companies could take some time before seeing a return on their investments.

There are also fears that firms' valuations may be a little too stretched and markets could be in a bubble, having soared in recent years to record highs on the back of a tech-fuelled rally.

"Microsoft suffered its worst session since the COVID‑era crash, falling 12 percent and accounting for over two‑thirds of the S&P 500's decline," wrote National Australia Bank's Rodrigo Catril.

"Concerns centred on rising investment spending, slower Azure (cloud service) growth, and a longer runway to monetising AI."

Wall Street ended mostly in the red, with the Dow the only advancer.

And Asia also struggled.

Hong Kong and Shanghai fell more than one percent while Tokyo, Sydney, Singapore, Taipei and Manila were also down. Seoul and Wellington rose.

Jakarta saw more losses but seemed to be stabilising after a rout over the previous two days sparked by index compiler MSCI calling on regulators to look into ownership concerns.

MSCI also said it would hold off adding Indonesian stocks to its indexes or increasing their weighting, while there are concerns it could announce a downgrade from emerging market to frontier market, which could spark an outflow of foreign capital.

Gold was also in retreat, sitting around $5,200 an ounce, a day after topping out above $5,595. Silver was at $110 from a peak of more than $121.

The previous metals were also weighed by a slight uptick in the dollar, having tumbled on Trump appearing to be happy to see the world's reserve currency weaken despite the potential risk of pushing up US inflation.

Investors are keeping tabs on developments in the Middle East after the US president sent an "armada" to the region and warned Iran of possible strikes if it did not reach a fresh nuclear deal.

Both main contracts were down more than one percent, having spiked as much as five percent Thursday.

Still, concerns remain about a conflict in the crude-rich region, which would send prices soaring, also putting upward pressure on inflation.

- Key figures at around 0310 GMT -

Tokyo - Nikkei 225: DOWN 0.9 percent at 52,923.12 (break)

Hong Kong - Hang Seng Index: DOWN 1.4 percent at 27,564.02

Shanghai - Composite: DOWN 1.3 percent at 4,102.41

West Texas Intermediate: UP 1.5 percent at $64.14 per barrel

Brent North Sea Crude: DOWN 1.1 percent at $69.91 per barrel

Euro/dollar: DOWN at $1.1917 from $1.1962 on Thursday

Pound/dollar: DOWN at $1.3754 from $1.3800

Dollar/yen: UP at 153.84 yen from 153.04 yen

Euro/pound: DOWN at 86.64 pence from 86.67 pence

New York - Dow: UP 0.1 percent at 49,071.56 (close)

London - FTSE 100: UP 0.2 percent at 10,171.76 (close)

J.Fankhauser--BTB