-

Russia uses sport to 'whitewash' its aggression, says Ukraine minister

Russia uses sport to 'whitewash' its aggression, says Ukraine minister

-

Chile officially backs Bachelet candidacy for UN top job

-

European stocks rise as oil tumbles, while tech worries weigh on New York

European stocks rise as oil tumbles, while tech worries weigh on New York

-

England captain Itoje on bench for Six Nations opener against Wales

-

Rahm says golfers should be 'free' to play where they want after LIV defections

Rahm says golfers should be 'free' to play where they want after LIV defections

-

More baby milk recalls in France after new toxin rules

-

Rosenior will not rush Estevao return from Brazil

Rosenior will not rush Estevao return from Brazil

-

Mercedes ready to win F1 world title, says Russell

-

Germany hit by nationwide public transport strike

Germany hit by nationwide public transport strike

-

Barca coach Flick 'not happy' with Raphinha thigh strain

-

WHO chief says turmoil creates chance for reset

WHO chief says turmoil creates chance for reset

-

European stocks rise as gold, oil prices tumble

-

Rink issues resolved, NHL stars chase Olympic gold at Milan

Rink issues resolved, NHL stars chase Olympic gold at Milan

-

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

-

Rodri rages that officials 'don't want' Man City to win

Rodri rages that officials 'don't want' Man City to win

-

Gaza's Rafah crossing makes limited reopening after two-year war

-

African players in Europe: Ouattara dents Villa title hopes

African players in Europe: Ouattara dents Villa title hopes

-

Liverpool beat Chelsea to Rennes defender Jacquet - reports

-

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

-

Trump says US talking deal with 'highest people' in Cuba

-

Trump threatens legal action against Grammy host over Epstein comment

Trump threatens legal action against Grammy host over Epstein comment

-

Olympic Games in northern Italy have German twist

-

Bad Bunny: the Puerto Rican phenom on top of the music world

Bad Bunny: the Puerto Rican phenom on top of the music world

-

Snapchat blocks 415,000 underage accounts in Australia

-

At Grammys, 'ICE out' message loud and clear

At Grammys, 'ICE out' message loud and clear

-

Dalai Lama's 'gratitude' at first Grammy win

-

Bad Bunny makes Grammys history with Album of the Year win

Bad Bunny makes Grammys history with Album of the Year win

-

Stocks, oil, precious metals plunge on volatile start to the week

-

Steven Spielberg earns coveted EGOT status with Grammy win

Steven Spielberg earns coveted EGOT status with Grammy win

-

Knicks boost win streak to six by beating LeBron's Lakers

-

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

-

Japan says rare earth found in sediment retrieved on deep-sea mission

-

San Siro prepares for last dance with Winter Olympics' opening ceremony

San Siro prepares for last dance with Winter Olympics' opening ceremony

-

France great Benazzi relishing 'genius' Dupont's Six Nations return

-

Grammy red carpet: black and white, barely there and no ICE

Grammy red carpet: black and white, barely there and no ICE

-

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

-

South Korea football bosses in talks to avert Women's Asian Cup boycott

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

British singer Olivia Dean wins Best New Artist Grammy

-

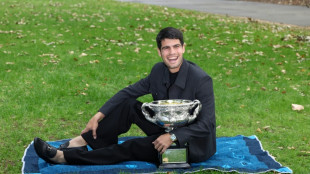

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

-

Surging euro presents new headache for ECB

-

Djokovic hints at retirement as time seeps away on history bid

Djokovic hints at retirement as time seeps away on history bid

-

US talking deal with 'highest people' in Cuba: Trump

-

UK ex-ambassador quits Labour over new reports of Epstein links

UK ex-ambassador quits Labour over new reports of Epstein links

-

Trump says closing Kennedy Center arts complex for two years

-

Formerra and Evonik Expand Distribution Partnership for Healthcare Grades

Formerra and Evonik Expand Distribution Partnership for Healthcare Grades

-

Hans Vestberg, Former Verizon Chairman and CEO, Joins Digipower X As Senior Advisor

-

Reigning world champs Tinch, Hocker among Millrose winners

Reigning world champs Tinch, Hocker among Millrose winners

-

Venezuelan activist ends '1,675 days' of suffering in prison

Gold, silver prices tumble as investors soothed by Trump's Fed pick

Gold and silver prices dived Friday and European stock markets climbed, while Wall Street opened just into the red with investors reassured by US President Donald Trump's pick to take over as head of the Federal Reserve.

The precious metals, viewed as safe-haven investments, had already begun sliding on reports, later confirmed, that Trump had nominated former Fed official Kevin Warsh to replace Jerome Powell as chair of the US central bank.

Trump confirmed his choice Friday on Truth Social.

"I have known Kevin for a long period of time, and have no doubt that he will go down as one of the GREAT Fed Chairmen, maybe the best," Trump wrote on his social media platform.

"On top of everything else, he is 'central casting,' and he will never let you down."

Kathleen Brooks, research director at XTB trading group, said the "interesting pick... may give the market some hope that Fed independence will be preserved".

Trump's personal attacks on Fed boss Jerome Powell -- set to depart in May -- have fuelled widespread fears among investors that the central bank's policy independence is under threat, potentially posing an inflation risk to the US economy.

Precious metals prices tumbled on Friday after surging in recent days when investors sought a safe haven over doubts about Trump's policies.

Gold was down seven percent to $5,072 an ounce after reaching a record high of $5,595.47 Thursday.

Silver, which Thursday reached an all-time peak above $120 an ounce, shed 15 percent meanwhile in sliding to $101 an ounce.

Financial markets have endured a rollercoaster ride this week as traders weathered a weaker dollar, Trump's threats against Tehran, the president's resumption of tariff threats and a possible US government shutdown.

Asian stock markets closed out the week with some hefty losses following Thursday's tech-led retreat on Wall Street on renewed concerns over vast investments in artificial intelligence.

Healthy earnings from Meta, Samsung and SK Hynix provided much cheer early in the week but the positivity took a hit on Thursday after Microsoft announced a surge in spending on AI infrastructure and revived concerns that companies could take some time before seeing a return on their investments.

There are fears that firms' valuations may be a little too stretched and markets could be in a bubble, having soared in recent years to record highs on the back of a tech-fuelled rally.

Among tech giants, Apple was down 1.4 percent with higher chips hitting margins while Meta was off two percent.

Oil prices regained their poise after an early fall Friday, having surged the day before as Trump ramped up geopolitical tensions with threats of a military strike on Iran.

"The building tensions between Iran and the US have driven Brent crude prices to a six-month high," said Megan Fisher, assistant economist at Capital Economics.

"That said, we think that the historical example of last year's 12-day war (between Iran and Israel with US involvement), and a well-supplied oil market, will still bear down on Brent crude prices by end-2026."

- Key figures at around 1450 GMT -

New York - Dow: DOWN 0.3 percent at 48,942.69

New York - S&P 500: DOWN 0.2 percent at 6,958.62

New York - NASDAQ Composite: DOWN 0.2 percent at 23,634.99

London - FTSE 100: UP 0.5 percent at 10,214.90 points

Paris - CAC 40: UP 0.8 percent at 8,136.82

Frankfurt - DAX: UP 1.0 percent at 24,572.54

Tokyo - Nikkei 225: DOWN 0.1 percent at 53,322.85 (close)

Hong Kong - Hang Seng Index: DOWN 2.1 percent at 27,387.11 (close)

Shanghai - Composite: DOWN 1.0 percent at 4,117.95 (close)

Euro/dollar: DOWN at $1.1916 from $1.1962 on Thursday

Pound/dollar: DOWN at $1.3753 from $1.3800

Dollar/yen: UP at 154.39 yen from 153.04 yen

Euro/pound: DOWN at 86.65 pence from 86.67 pence

Brent North Sea Crude: UP 0.2 percent at $70.83 per barrel

West Texas Intermediate: UP 0.3 percent at $65.64 per barrel

E.Schubert--BTB