-

England dig in as they chase a record 435 to keep Ashes alive

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

US strikes Islamic State group in Syria after deadly attack on troops

-

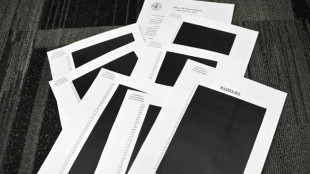

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

Amorim takes aim at Man Utd youth stars over 'entitlement'

-

Mercosur meets in Brazil, EU eyes January 12 trade deal

-

US Fed official says no urgency to cut rates, flags distorted data

US Fed official says no urgency to cut rates, flags distorted data

-

Rome to charge visitors for access to Trevi Fountain

-

Spurs 'not a quick fix' for under-fire Frank

Spurs 'not a quick fix' for under-fire Frank

-

Poland president accuses Ukraine of not appreciating war support

-

Stocks advance with focus on central banks, tech

Stocks advance with focus on central banks, tech

-

Amorim unfazed by 'Free Mainoo' T-shirt ahead of Villa clash

-

PSG penalty hero Safonov ended Intercontinental win with broken hand

PSG penalty hero Safonov ended Intercontinental win with broken hand

-

French court rejects Shein suspension

-

'It's so much fun,' says Vonn as she milks her comeback

'It's so much fun,' says Vonn as she milks her comeback

-

Moscow intent on pressing on in Ukraine: Putin

Asian markets track Wall St plunge on growing rate fears

Asian markets fell again Tuesday and the dollar held gains as traders grow increasingly worried that the Federal Reserve will continue to ramp up interest rates to fight inflation.

With the Jackson Hole symposium of central bankers and finance chiefs taking place this week, the focus is on what Fed chief Jerome Powell says about its plans to tackle prices, with many fearing officials could send the economy into recession.

The equities' losses appear to mark the end of a near-two-month rally from June lows, which was powered by signs of economic weakness that observers hoped would allow the bank to be less hawkish.

"Investors are becoming increasingly concerned that Jerome Powell will deliver a hawkish speech at Jackson hole, whilst warning that the coming months will be hard to navigate (and fan fears of a recession)," said Matthew Simpson at SoneX Financial.

"Public comments from various Fed members have become increasingly hawkish as they seemingly read from the same script ahead of Jackson Hole – which is an event typically associated with important Fed announcements."

Bets that the central bank will keep lifting rates for some time have sent 10-year Treasury yields higher and ramped up fears of a contraction in the world's number one economy.

But the United States is not the only economy under pressure, with governments and banks around the world facing an uphill battle against inflation, which is at multi-decade highs owing to spiking energy costs and supply chain snarls.

That comes as uncertainty rules owing to the ongoing war in Ukraine and a sharp slowdown in China caused by lockdowns put in place as part of the country's zero-Covid strategy.

Wall Street fell deep into the red with the S&P 500 and Nasdaq off more than two percent each.

And Asia followed suit.

Hong Kong and Shanghai dropped as investors brushed off a loan rate cut by the People's Bank of China, which also called for banks to lend more to help the battered property market.

Tokyo, Sydney, Seoul, Singapore, Taipei, Manila and Wellington were also down.

The dollar held its strength on rate hike expectations, with 24-year highs against the yen and two-decade highs against the euro, having broken parity with the single currency.

The euro has been hammered for months by recession expectations as it is hit by an energy crisis caused by sanctions on Russia for its invasion of Ukraine.

Fears have increased after Russia's Gazprom said Friday that the Nord Stream pipeline would be closed for maintenance at the end of the month, cutting Europe's crucial gas deliveries.

Oil prices -- which have fallen for weeks as recession worries hit demand expectations -- bounced after Saudi Arabia suggested OPEC and other major producers could cut output citing "volatility" on crude markets.

Such a move would deal a blow to the fight against inflation and could offset the possible flow of Iranian oil if a deal is struck on Tehran's nuclear programme.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 1.2 percent at 28,456.92 (break)

Hong Kong - Hang Seng Index: DOWN 0.5 percent at 19,552.76

Shanghai - Composite: DOWN 0.2 percent at 3,270.21

Euro/dollar: UP at $0.9942 from $0.9941 Monday

Pound/dollar: UP at $1.1772 from $1.1763

Euro/pound: DOWN at 84.45 pence from 84.51 pence

Dollar/yen: DOWN at 137.13 yen from 137.48 yen

West Texas Intermediate: UP 0.8 percent at $91.11 per barrel

Brent North Sea crude: UP 0.8 percent at $97.26

New York - Dow: DOWN 1.9 percent at 33,063.61 (close)

London - FTSE 100: DOWN 0.2 percent at 7,533.79 (close)

N.Fournier--BTB