-

India drops Shubman Gill from T20 World Cup squad

India drops Shubman Gill from T20 World Cup squad

-

Tens of thousands attend funeral of killed Bangladesh student leader

-

England 'flat' as Crawley admits Australia a better side

England 'flat' as Crawley admits Australia a better side

-

Australia four wickets from Ashes glory as England cling on

-

Beetles block mining of Europe's biggest rare earths deposit

Beetles block mining of Europe's biggest rare earths deposit

-

French culture boss accused of mass drinks spiking to humiliate women

-

NBA champions Thunder suffer rare loss to Timberwolves

NBA champions Thunder suffer rare loss to Timberwolves

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

US strikes Islamic State group in Syria after deadly attack on troops

-

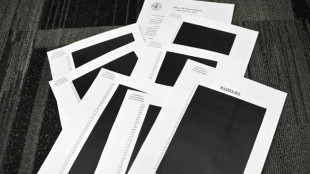

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

Amorim takes aim at Man Utd youth stars over 'entitlement'

-

Mercosur meets in Brazil, EU eyes January 12 trade deal

Fed's Powell to hammer home inflation-fighting message

With US inflation at a 40-year high, economists say there is no doubt about the Federal Reserve's policy course: Interest rates will continue to rise.

Against the backdrop of the majestic Grand Teton mountains, Fed Chair Jerome Powell is expected to once again send a clear message at the annual gathering of central bankers in Jackson Hole, Wyoming on Friday that the fight against inflation is not over.

Modest signs of slowing in the world's largest economy and easing price pressures spurred hope in financial markets that the central bank might ease up on its aggressive rate hikes, and perhaps even start to reverse course next year.

But former Bank of England board member Adam Posen called that view "nonsense."

"I think there's wishful thinking on the part of the markets," said Posen, who leads the Peterson Institute for International Economics in Washington.

"Right now there's no debate," he told reporters. "They've got no choice but to hike."

Until and unless there is a recession that also pushes down inflation expectations, "nothing else matters" besides bringing down prices.

A succession of Fed officials, even those like Posen who are considered to be "doves" on inflation, have repeated the same message.

Kansas City Fed President Esther George, host of the Jackson Hole conference, did so Thursday, telling Fox Business Network that rates are likely to rise through the end of the year until "inflation begins to meaningfully decelerate."

Posen said he expects the benchmark lending rate will reach four percent by February, and will be "willing to go further if needed, with the chances of a reversal in 2023 year "very, very low."

- New price data -

Economist Tim Duy of SGH Macro Advisors agreed, and said Powell will "push the story... they will do what they need to get inflation under control."

"What that means is pushing rates into restrictive territory," he told AFP.

But he said the Fed chief will have to be "humble" about any forecasts on the path of the economy or inflation, after telling the conference last year that price spikes would be transitory.

Powell's speech last year "didn't age well, to say the least," Duy said.

Supply chain issues have continued, worsened by a series of Covid lockdowns in China, and have combined with Russia's war in Ukraine, to send prices soaring worldwide.

In the battle to contain red-hot US inflation, which topped nine percent in June, the Fed has hiked rates four times, including massive, three-quarter point increases in June and July -- steep moves unheard of since the early 1980s -- to the current level of a range of 2.25 to 2.5 percent.

But recent data has shown signs of a slowing in price increases.

Before his speech, Powell will get a look at the latest report on the Fed's preferred inflation measure, the personal consumption expenditures price index.

That is expected to show a dramatic slowdown from the 1.0 percent surge in June, although central bankers may not take much comfort since it is likely to reflect the recent sharp retreat in global oil prices.

Avoiding a recession as interest rates rise remains a tough job for central bankers everywhere.

"The post-pandemic economy globally will have more constraints that we faced for the last 25 years," Duy warned.

K.Brown--BTB