-

England 'flat' as Crawley admits Australia a better side

England 'flat' as Crawley admits Australia a better side

-

Australia four wickets from Ashes glory as England cling on

-

Beetles block mining of Europe's biggest rare earths deposit

Beetles block mining of Europe's biggest rare earths deposit

-

French culture boss accused of mass drinks spiking to humiliate women

-

NBA champions Thunder suffer rare loss to Timberwolves

NBA champions Thunder suffer rare loss to Timberwolves

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

US strikes Islamic State group in Syria after deadly attack on troops

-

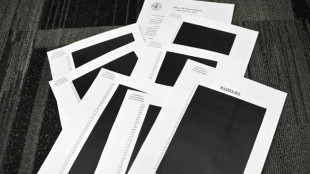

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

Amorim takes aim at Man Utd youth stars over 'entitlement'

-

Mercosur meets in Brazil, EU eyes January 12 trade deal

-

US Fed official says no urgency to cut rates, flags distorted data

US Fed official says no urgency to cut rates, flags distorted data

-

Rome to charge visitors for access to Trevi Fountain

Europe stocks sink, oil rebounds as peace talks stall

European stocks sank and oil rebounded Thursday as key peace talks stalled between Russia and Ukraine in a rollercoaster week before a eurozone interest rate decision and key US inflation data.

Frankfurt, London and Paris equities slid after surging the previous day on sliding oil prices and a glimmer of hope for an end to the Ukraine conflict.

However, crude futures rebounded after tanking Wednesday on reports that huge amounts of sanctions-hit Russian oil could be largely replaced by sourcing from elsewhere.

Investors digested news that Russian Foreign Minister Sergei Lavrov and Ukrainian counterpart Dmytro Kuleba made no progress on a ceasefire in a face-to-face meeting in the Turkish resort of Antalya.

Markets have been rocked by extreme volatility in the two weeks since Russia invaded its neighbour, sparking a wave of sanctions against Moscow.

Trading of shares in Russia's steelmaking giant Evraz, whose key shareholders include Roman Abramovich, was suspended in London after the UK slapped an asset freeze on the Russian oligarch over his alleged Kremlin links.

It includes a halt to Abramovich's plan to sell football giants Chelsea.

Elsewhere Thursday, haven asset gold stood above $2,000 per ounce after almost striking a record on Wednesday, while other commodities that hit recent all-time highs -- including wheat and nickel -- also retreated.

- No breakthrough -

"The latest talks between Russia and Ukraine failed to provide breakthrough in ending the war," said ThinkMarkets analyst Fawad Razaqzada.

"Markets have reacted in the way you would expect."

The euro slid before an interest rate call from the European Central Bank, whose outlook has been upended by both Russia's assault on Ukraine and rocketing inflation fuelled by sky-high energy costs.

Markets are also on tenterhooks before vital US inflation data that could reveal the Federal Reserve's thinking ahead of a widely-expected interest rate hike next week.

Sentiment would normally be dominated by the ECB and US inflation, but war is still raging in eastern Europe.

"While these events may provide some volatility, the focus for the wider markets remains firmly fixated on Russia's invasion of Ukraine -- and whether there will be any progress in peace talks in the coming days," added Razaqzada.

Lavrov stated Moscow wanted to continue negotiations while Kuleba insisted that it would not surrender, 14 days after Russia invaded its pro-Western neighbour.

- Oil attempts rebound -

European benchmark Brent North Sea oil and New York's WTI gained about 4.5 percent on hopes of rising crude supplies.

Both contracts had collapsed Wednesday by more than 12 percent, with Brent hitting a low of $105.60 two days after soaring to a peak of $139 on fears over Russian oil.

The United Arab Emirates said late Wednesday that it would urge fellow states in the OPEC oil producers' cartel to boost output to plug any supply shortfall.

"Crude prices rebounded ... after being whipsawed on various Russia headlines," said Markets.com analyst Neil Wilson.

"Brent and WTI plunged yesterday in a brutal reversal as the UAE indicated it could start pumping more oil and call on friends at OPEC to do more.

"Comments from Russian and Ukrainian officials also pointed towards a path to peace, but the situation on the ground is no different."

Elsewhere, Asian equities had rallied Thursday on bargain-buying after a strong Wall Street showing.

Frankfurt and Paris soared by more than seven percent on Wednesday and London won 3.3 percent, as diving oil prices eased worries over elevated inflation.

- Key figures around 1130 GMT -

London - FTSE 100: DOWN 1.2 percent at 7,107.76 points

Frankfurt - DAX: DOWN 2.4 percent at 13,518.72

Paris - CAC 40: DOWN 2.3 percent at 6,244.42

EURO STOXX 50: DOWN 2.5 percent at 3,672.66

Brent North Sea crude: UP 4.6 percent at $116.32 per barrel

West Texas Intermediate: UP 4.4 percent at $113.46

Tokyo - Nikkei 225: UP 3.9 percent at 25,690.40 (close)

Hong Kong - Hang Seng Index: UP 1.3 percent at 20,890.26 (close)

Shanghai - Composite: UP 1.2 percent at 3,296.09 (close)

New York - Dow: UP 2.0 percent at 33,286.25 (close)

Euro/dollar: DOWN at $1.1049 from $1.1076 Wednesday

Pound/dollar: DOWN at $1.3164 from $1.3181

Euro/pound: DOWN at 83.95 pence from 84.03 pence

Dollar/yen: UP at 115.94 yen from 115.83 yen

burs-rfj/bcp/ach

M.Furrer--BTB