-

England 'flat' as Crawley admits Australia a better side

England 'flat' as Crawley admits Australia a better side

-

Australia four wickets from Ashes glory as England cling on

-

Beetles block mining of Europe's biggest rare earths deposit

Beetles block mining of Europe's biggest rare earths deposit

-

French culture boss accused of mass drinks spiking to humiliate women

-

NBA champions Thunder suffer rare loss to Timberwolves

NBA champions Thunder suffer rare loss to Timberwolves

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

US strikes Islamic State group in Syria after deadly attack on troops

-

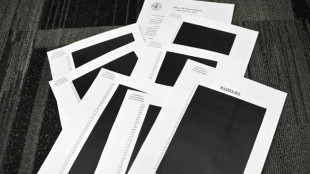

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

Amorim takes aim at Man Utd youth stars over 'entitlement'

-

Mercosur meets in Brazil, EU eyes January 12 trade deal

-

US Fed official says no urgency to cut rates, flags distorted data

US Fed official says no urgency to cut rates, flags distorted data

-

Rome to charge visitors for access to Trevi Fountain

China stimulus hopes help stock markets rise

Global stock markets started the week on the front foot on Monday as investors welcomed China's plans to kickstart consumption in the world's number two economy, with upcoming central bank rate decisions also in focus.

Relief about a US government shutdown being avoided helped counterbalance disappointing US economic data.

Investors were keeping tabs on Beijing as officials were set to outline their plans to kickstart spending by the country's army of consumers after years of post-Covid weakness, which has been a major drag on economic growth.

The plan looks to boost income with property reforms, stabilise the stock market and encourage lenders to provide more consumption loans with reasonable limits, terms and interest rates.

"Hopes that a new consumer life raft in China will buoy up the country's prospects of recovery have helped lift sentiment slightly, but caution remains," said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

Officials were also looking at raising pension benefits, establishing a childcare subsidy system, and ensuring workers' rights to rest and holidays are legally protected.

The move comes after data showed consumer prices dropped into deflation in February for the first time in a year, while producer prices continued to fall.

Observers have warned that leaders have a tough job ahead of them amid US President Donald Trump's trade war.

"With China firmly in US President Donald Trump's sights, deflation concerns in China will worsen," said economists at Moody's Analytics.

"The chaos of tariffs and rising unemployment will keep consumer spending weak, denting inflation's demand drivers."

Hong Kong built on a blockbuster start to the year fuelled by a chase into Chinese tech giants, while Shanghai and Tokyo also enjoyed healthy buying.

London, Paris and Frankfurt all advanced, tracking gains in Asia.

Wall Street was mostly higher in early afternoon trading, shaking off data showing US retail sales logged smaller gains than expected in February, edging up by 0.2 percent compared to a 0.7 percent increase expected by Briefing.com.

Despite the miss, Briefing.com analyst Patrick O'Hare pointed to a more encouraging reading of control group sales that excludes certain volatile elements, which jumped 1.0 percent.

However a key survey showed a jump in prices paid by businesses, which O'Hare said "plays into some of the stagflation worries that have infiltrated the market".

Investors are concerned that the tariff war could create the conditions for stagflation: high inflation, weak demand and high unemployment.

"The economy will be a focal point throughout the week" for investors, noted O'Hare.

This week's calendar includes policy decisions from the US Federal Reserve, the Bank of Japan and the Bank of England -- and all are expected to keep interest rates on hold.

Alongside its rate decision, the Fed will release its summary of economic projections and outlook for borrowing costs this year, which comes as policymakers try to navigate the potential inflationary impacts of Trump's tariffs campaign.

Gold was trading around the $3,000 an ounce mark on Monday, after it broke the symbolic threshold for the first time on Friday owing to a rush into safe havens as traders fret over Trump's tariffs.

"A faltering US dollar and heightened risk aversion, courtesy of Trump's latest trade brinkmanship, continue to drive demand," said City Index and FOREX.com analyst Fawad Razaqzada.

- Key figures around 1630 GMT -

New York - Dow: UP 0.5 percent at 41,679.25 points

New York - S&P 500: UP 0.1 percent at 5,644.55

New York - Nasdaq Composite: DOWN 0.5 percent at 17,673.19

London - FTSE 100: UP 0.6 percent at 8,680.29 (close)

Paris - CAC 40: UP 0.6 percent at 8,073.98 (close)

Frankfurt - DAX: UP 0.7 percent at 23,154.57 (close)

Tokyo - Nikkei 225: UP 0.9 percent at 37,396.52 (close)

Hong Kong - Hang Seng Index: UP 0.8 percent at 24,145.57 (close)

Shanghai - Composite: UP 0.2 percent at 3,426.13 (close)

Euro/dollar: UP at $1.0921 from $1.0884 on Friday

Pound/dollar: UP at $1.2987 from $1.2936

Dollar/yen: DOWN at 148.55 yen from 148.62 yen

Euro/pound: DOWN at 84.10 pence from 84.14 pence

Brent North Sea Crude: UP 0.7 percent at $71.09 per barrel

West Texas Intermediate: UP 0.7 percent at $67.63 per barrel

burs-rl/sbk

M.Ouellet--BTB