-

India drops Shubman Gill from T20 World Cup squad

India drops Shubman Gill from T20 World Cup squad

-

Tens of thousands attend funeral of killed Bangladesh student leader

-

England 'flat' as Crawley admits Australia a better side

England 'flat' as Crawley admits Australia a better side

-

Australia four wickets from Ashes glory as England cling on

-

Beetles block mining of Europe's biggest rare earths deposit

Beetles block mining of Europe's biggest rare earths deposit

-

French culture boss accused of mass drinks spiking to humiliate women

-

NBA champions Thunder suffer rare loss to Timberwolves

NBA champions Thunder suffer rare loss to Timberwolves

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

US strikes Islamic State group in Syria after deadly attack on troops

-

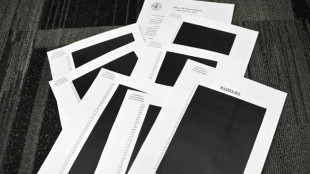

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

Amorim takes aim at Man Utd youth stars over 'entitlement'

-

Mercosur meets in Brazil, EU eyes January 12 trade deal

Autos lead Asian market losses after Trump's latest tariffs salvo

A plunge in automakers hit Asia equities Thursday after Donald Trump announced painful tariffs on all imported vehicles and parts as he presses hardball trade policies many fear will spark a recession.

Indications that levies lined up for the president's "Liberation Day" on April 2 would be less severe than feared had given investors a little hope, and helped markets chalk up much-needed gains.

However, the White House's habit of alternating between tough talk and leniency has fanned uncertainty, and the latest announcement did little to soothe nerves.

"What we're going to be doing is a 25 percent tariff on all cars that are not made in the United States," he said as he signed an order in the Oval Office.

The move takes effect at 12:01 am eastern time (0400 GMT) on April 3 and impacts foreign-made cars and light trucks. Key automobile parts will also be hit within the month.

About half of the cars sold in the United States are made within the country. Of the imported motors, about half come from Mexico and Canada, with Japan, South Korea and Germany also major suppliers.

Japan's government called the tariffs "extremely regrettable" while Canadian Prime Minister Mark Carney called it a "direct attack" on his country's workers.

There was little comfort in Trump's comments that reciprocal measures lined up for next week could be "very lenient".

The auto news hammered carmakers in Asia.

In Tokyo, Toyota and Honda shed more than three percent while Nissan was off 2.5 percent. Seoul-listed Hyundai gave up more than four percent.

US-listed car giants also tumbled with General Motors, Ford and Stellantis all deep in the red in after-hours trade.

"It's a stark reminder: Trump's not bluffing -- or at least he's doing a damn good job pretending he's not," said SPI Asset Management's Stephen Innes.

"And if he goes full throttle with this round of tariffs -- especially the reciprocal measures slated for April 2 -- markets are staring down the barrel of the worst-case macro cocktail: faster inflation, slower growth and a fresh wave of volatility.

The retreat in the auto sector hit broader markets, which were already shaky owing to worries over Trump's trade agenda.

Tokyo and Seoul almost one percent, with Sydney, Wellington, Taipei and Manila also down.

However, Hong Kong and Shanghai eked out gains with Singapore

There was a little cheer after Trump told reporters at the White House that he might offer to reduce tariffs on China to get Beijing's approval for the sale of popular social media platform TikTok.

Earlier this month, Trump said Washington was in talks with four groups interested in buying TikTok, which has been in limbo after a US law ordered it to divest from its Chinese owner ByteDance or be banned in the country owing to national security concerns.

The broadly negative day followed losses on all three of Wall Street's main indexes ahead of the president's announcement, with the CBOE Volatility Index -- or "fear gauge" -- jumping almost seven percent.

Market jitters were compounded by data Tuesday showing consumer sentiment had fallen to its lowest level since 2021 as concerns about higher prices increase.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: UP 0.9 percent at 37,674.03 (break)

Hong Kong - Hang Seng Index: UP 0.6 percent at 23,624.74

Shanghai - Composite: UP 0.2 percent at 3,374.63

Euro/dollar: UP at $1.0766 from $1.0757 on Wednesday

Pound/dollar: UP at $1.2900 from $1.2891

Dollar/yen: DOWN at 150.11 yen from 150.54 yen

Euro/pound: UP at 83.46 pence from 83.41 pence

West Texas Intermediate: UP 0.1 percent at $69.72 per barrel

Brent North Sea Crude: UP 0.1 percent at $73.85 per barrel

New York - Dow: DOWN 0.3 percent at 42,454.79 (close)

London - FTSE 100: UP 0.3 percent at 8,689.59 (close)

F.Müller--BTB