-

Vonn claims third podium of the season at Val d'Isere

Vonn claims third podium of the season at Val d'Isere

-

India drops Shubman Gill from T20 World Cup squad

-

Tens of thousands attend funeral of killed Bangladesh student leader

Tens of thousands attend funeral of killed Bangladesh student leader

-

England 'flat' as Crawley admits Australia a better side

-

Australia four wickets from Ashes glory as England cling on

Australia four wickets from Ashes glory as England cling on

-

Beetles block mining of Europe's biggest rare earths deposit

-

French culture boss accused of mass drinks spiking to humiliate women

French culture boss accused of mass drinks spiking to humiliate women

-

NBA champions Thunder suffer rare loss to Timberwolves

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

-

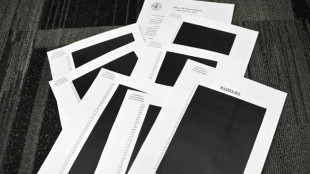

Epstein files opened: famous faces, many blacked-out pages

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

Gold hits record, stocks mixed as Trump fuels Fed fears

Bullion hit another record Tuesday while the dollar weakened and equities fluctuated as US President Donald Trump's latest salvo against Federal Reserve boss Jerome Powell added fuel to fears about the central bank's independence.

With the US tariff blitz still causing ructions on global trading floors, investors are now dealing with the added worry that the US president will try to remove the country's top banker.

Trump took a swipe at Powell last week for his warning that the sweeping levies would likely reignite inflation, saying his "termination cannot come fast enough" and adding that "I'm not happy with him. I let him know it and if I want him out, he'll be out of there real fast, believe me".

While that raised eyebrows, the Republican tycoon sent shivers through markets Monday by calling on the Fed boss again to make pre-emptive cuts to interest rates and calling him a "major loser" and "Mr Too Late".

He said on his Truth Social platform that there was "virtually" no inflation, claiming energy and food costs were well down and pointed to the several reductions by the European Central Bank.

The outbursts have fanned concern that Trump is preparing to oust Powell, with top economic adviser Kevin Hassett saying Friday the president was looking at whether he could do so.

Panicked Wall Street investors once again dumped US assets, with all three main indexes ending down around 2.5 percent on Monday.

"The first volley on Thursday had little market reaction, but Monday's second barrage has seen an intensification of the 'sell America trade'," said National Australia Bank's Tapas Strickland.

"Whether or not President Trump is legally able and willing to move against the US Fed, the jousting underscores the loss of US exceptionalism and the very real policy risk for investors."

The rush for safety saw gold hit yet another record above $3,500, and while the dollar steadied after the previous day's selloff, it remained under pressure against its major peers.

Stocks swung between gains and losses on the first full day of business after the Easter break.

Tokyo, Sydney, Seoul, Wellington, Taipei, Manila and Bangkok fell while Hong Kong, Shanghai, Singapore, Mumbai and Jakarta rose.

London was barely moved, while Paris and Frankfurt edged down.

However, analysts warned of another rout if Trump were to try to fire the Fed boss, which many said could cause a crisis of confidence in the US economy.

"Were Powell to be fired, the initial reaction would be a huge injection of volatility into financial markets, and the most dramatic rush to the exit from US assets that it is possible to imagine," said Pepperstone strategist Michael Brown.

"Lower, much lower, equities; Treasuries sold across the board; and, the dollar falling off a cliff.

"Any sign of the longstanding, independent nature of the Fed coming under threat would see investors across the globe selling every single US-based asset that they have, and also poses the genuinely scary prospect of upending the entire way in which the global financial system operates."

- Key figures at 0715 GMT -

Tokyo - Nikkei 225: DOWN 0.2 percent at 34,220.60 (close)

Hong Kong - Hang Seng Index: UP 0.6 percent at 21,527.95

Shanghai - Composite: UP 0.3 percent at 3,299.76 (close)

London - FTSE 100: FLAT at 8,275.99

Euro/dollar: DOWN at $1.1500 from $1.1510 on Monday

Pound/dollar: UP $1.3389 at $1.3377

Dollar/yen: DOWN at 140.38 yen from 140.89 yen

Euro/pound: DOWN at 85.88 pence from 86.03 pence

West Texas Intermediate: UP 1.1 percent at $63.78 per barrel

Brent North Sea Crude: UP 1.0 percent at $66.95 per barrel

New York - Dow: DOWN 2.5 percent at 38,170.41 (close)

F.Müller--BTB