-

US panel votes to end recommending all newborns receive hepatitis B vaccine

US panel votes to end recommending all newborns receive hepatitis B vaccine

-

Title favourite Norris reflects on 'positive' Abu Dhabi practice

-

Stocks consolidate as US inflation worries undermine Fed rate hopes

Stocks consolidate as US inflation worries undermine Fed rate hopes

-

Volcanic eruptions may have brought Black Death to Europe

-

Arsenal the ultimate test for in-form Villa, says Emery

Arsenal the ultimate test for in-form Villa, says Emery

-

Emotions high, hope alive after Nigerian school abduction

-

Another original Hermes Birkin bag sells for $2.86 mn

Another original Hermes Birkin bag sells for $2.86 mn

-

11 million flock to Notre-Dame in year since rising from devastating fire

-

Gymnast Nemour lifts lid on 'humiliation, tears' on way to Olympic gold

Gymnast Nemour lifts lid on 'humiliation, tears' on way to Olympic gold

-

Lebanon president says country does not want war with Israel

-

France takes anti-drone measures after flight over nuclear sub base

France takes anti-drone measures after flight over nuclear sub base

-

Signing up to DR Congo peace is one thing, delivery another

-

'Amazing' figurines find in Egyptian tomb solves mystery

'Amazing' figurines find in Egyptian tomb solves mystery

-

Palestinians say Israeli army killed man in occupied West Bank

-

McLaren will make 'practical' call on team orders in Abu Dhabi, says boss Brown

McLaren will make 'practical' call on team orders in Abu Dhabi, says boss Brown

-

Stocks rise as investors look to more Fed rate cuts

-

Norris completes Abu Dhabi practice 'double top' to boost title bid

Norris completes Abu Dhabi practice 'double top' to boost title bid

-

Chiba leads Liu at skating's Grand Prix Final

-

Meta partners with news outlets to expand AI content

Meta partners with news outlets to expand AI content

-

Mainoo 'being ruined' at Man Utd: Scholes

-

Guardiola says broadcasters owe him wine after nine-goal thriller

Guardiola says broadcasters owe him wine after nine-goal thriller

-

Netflix to buy Warner Bros. Discovery in deal of the decade

-

French stars Moefana and Atonio return for Champions Cup

French stars Moefana and Atonio return for Champions Cup

-

Penguins queue in Paris zoo for their bird flu jabs

-

Netflix to buy Warner Bros. Discovery for nearly $83 billion

Netflix to buy Warner Bros. Discovery for nearly $83 billion

-

Sri Lanka issues fresh landslide warnings as toll nears 500

-

Root says England still 'well and truly' in second Ashes Test

Root says England still 'well and truly' in second Ashes Test

-

Chelsea's Maresca says rotation unavoidable

-

Italian president urges Olympic truce at Milan-Cortina torch ceremony

Italian president urges Olympic truce at Milan-Cortina torch ceremony

-

Norris edges Verstappen in opening practice for season-ending Abu Dhabi GP

-

Australia race clear of England to seize control of second Ashes Test

Australia race clear of England to seize control of second Ashes Test

-

Stocks, dollar rise before key US inflation data

-

Trump strategy shifts from global role and vows 'resistance' in Europe

Trump strategy shifts from global role and vows 'resistance' in Europe

-

Turkey orders arrest of 29 footballers in betting scandal

-

EU hits X with 120-mn-euro fine, risking Trump ire

EU hits X with 120-mn-euro fine, risking Trump ire

-

Arsenal's Merino has earned striking role: Arteta

-

Putin offers India 'uninterrupted' oil in summit talks with Modi

Putin offers India 'uninterrupted' oil in summit talks with Modi

-

New Trump strategy vows shift from global role to regional

-

World Athletics ditches long jump take-off zone reform

World Athletics ditches long jump take-off zone reform

-

French town offers 1,000-euro birth bonuses to save local clinic

-

After wins abroad, Syria leader must gain trust at home

After wins abroad, Syria leader must gain trust at home

-

Slot spots 'positive' signs at struggling Liverpool

-

Eyes of football world on 2026 World Cup draw with Trump centre stage

Eyes of football world on 2026 World Cup draw with Trump centre stage

-

South Africa rugby coach Erasmus extends contract until 2031

-

Ex-Manchester Utd star Lingard announces South Korea exit

Ex-Manchester Utd star Lingard announces South Korea exit

-

Australia edge ominously within 106 runs of England in second Ashes Test

-

Markets rise ahead of US data, expected Fed rate cut

Markets rise ahead of US data, expected Fed rate cut

-

McIlroy survives as Min Woo Lee surges into Australian Open hunt

-

German factory orders rise more than expected

German factory orders rise more than expected

-

India's Modi and Russia's Putin talk defence, trade and Ukraine

| RBGPF | 0% | 78.35 | $ | |

| CMSC | -0.34% | 23.4 | $ | |

| RIO | -0.5% | 73.365 | $ | |

| AZN | 0.23% | 90.24 | $ | |

| SCS | -0.5% | 16.149 | $ | |

| BCC | -1.5% | 73.16 | $ | |

| GSK | -0.75% | 48.21 | $ | |

| BP | -2.69% | 36.255 | $ | |

| BTI | -1.49% | 57.19 | $ | |

| NGG | -0.57% | 75.48 | $ | |

| RELX | -0.32% | 40.41 | $ | |

| CMSD | -0.32% | 23.245 | $ | |

| BCE | 1.04% | 23.465 | $ | |

| JRI | 0.22% | 13.78 | $ | |

| RYCEF | -0.96% | 14.51 | $ | |

| VOD | -1.14% | 12.49 | $ |

Stocks firm as US rate cut outlook tempers Japan bond unease

Stocks mostly rose Tuesday following the previous day's stutter, as weak data reinforced optimism for US interest rate cuts and tempered concerns over rising Japanese bond yields.

Expectations that the Federal Reserve will lower borrowing costs have buoyed markets in recent weeks, helping them recover early November's losses driven by tech bubble fears.

Major European indices advanced after a mostly positive session in Asia.

Official data on Tuesday showed Eurozone inflation edged up to 2.2 percent in November, moving slightly away from the European Central Bank's two-percent target.

The ECB will announce its rate decision on December 18.

The data "comes at a time where some had claimed we could yet see another cut from the ECB, although the likeliness is that their easing cycle is over," said Joshua Mahony, chief market analyst at Scope Markets.

Meanwhile, bets on the US central bank easing monetary policy for a third successive meeting have been rising since several Fed decision-makers flagged concerns over labour market weakness.

Those comments have been compounded by figures showing the economy continues to soften while inflation appears to have stabilised for now.

The latest round of data added to that narrative, with a survey of manufacturers by the Institute for Supply Management indicating that activity in the sector contracted for a ninth straight month.

Across Asia, most markets closed higher Tuesday.

Hong Kong, Sydney, Seoul, Singapore, Taipei, Manila and Jakarta were all up, though Shanghai, Mumbai and Bangkok dipped.

Tokyo was flat after erasing early gains, following Monday's losses triggered by Bank of Japan boss Kazuo Ueda hinting at a possible interest rate hike this month.

His remarks lifted the yen and provided a jolt to equities as the yield of Japanese two-year government bonds rose past one percent to their highest since 2008 during the global financial crisis.

The Japanese unit eased slightly Tuesday as an auction of 10-year bonds received healthy interest.

Ueda's hint also weighed on Wall Street after last week's Thanksgiving run-up and dented overall risk sentiment, pulling bitcoin lower.

The comments "could mark a de-anchoring of the carry trade, in which traders borrow yen at low cost to invest in riskier assets", wrote City Index senior market analyst Fiona Cincotta.

"A higher rate in Japan could suck liquidity out of the markets. Tech stocks and crypto are particularly sensitive to even the smallest shifts in liquidity."

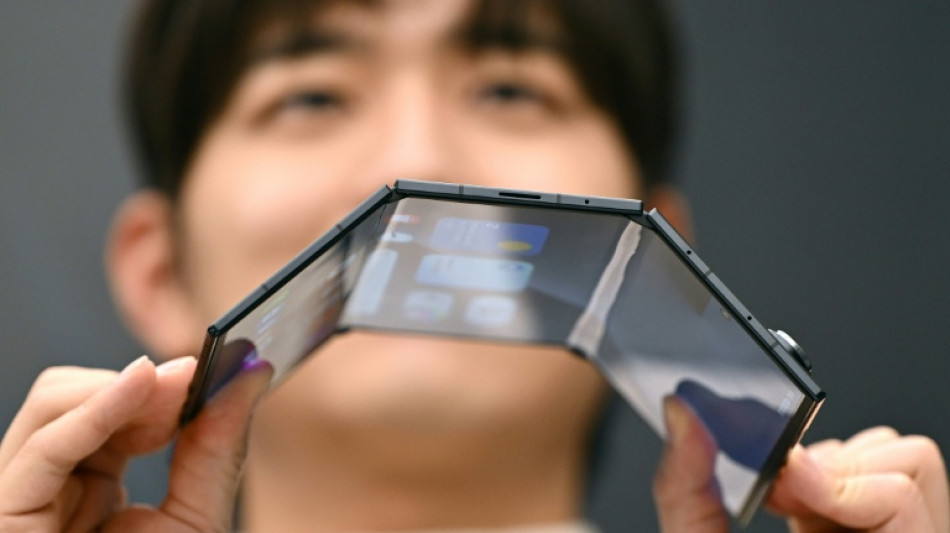

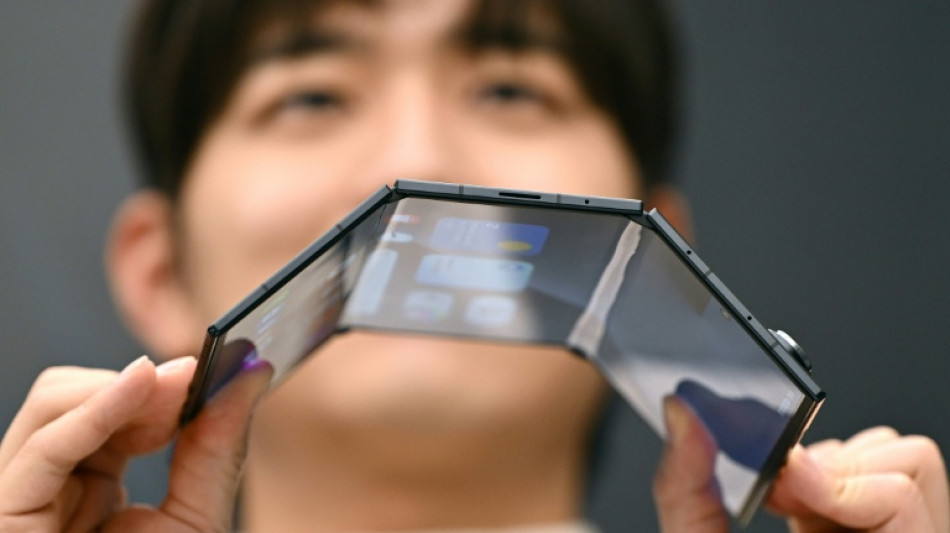

South Korean tech titan Samsung Electronics jumped more than two percent in Seoul as it launched its first triple-folding phone, even as its more than $2,400 price tag places it out of reach for the average customer.

Oil prices were stable ahead of talks between US envoy Steve Witkoff and Russian President Vladimir Putin in Moscow on the Trump administration's controversial proposal to end the war in Ukraine.

- Key figures at around 1110 GMT -

London - FTSE 100: UP 0.4 percent at 9,740.40 points

Paris - CAC 40: UP 0.4 percent at 8,128.00

Frankfurt - DAX: UP 0.8 percent at 23,766.87

Tokyo - Nikkei 225: FLAT at 49,303.45 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 26,095.05 (close)

Shanghai - Composite: DOWN 0.4 percent at 3,897.71 (close)

New York - Dow: DOWN 0.9 percent at 47,289.33 (close)

Dollar/yen: UP at 156.01 yen from 155.50 yen on Monday

Euro/dollar: DOWN at $1.1607 from $1.1608

Pound/dollar: DOWN at $1.3197 from $1.3211

Euro/pound: UP at 87.98 pence from 87.87 pence

West Texas Intermediate: UP 0.1 percent at $59.36 per barrel

Brent North Sea Crude: FLAT at $63.16 per barrel

P.Anderson--BTB