-

England 'flat' as Crawley admits Australia a better side

England 'flat' as Crawley admits Australia a better side

-

Australia four wickets from Ashes glory as England cling on

-

Beetles block mining of Europe's biggest rare earths deposit

Beetles block mining of Europe's biggest rare earths deposit

-

French culture boss accused of mass drinks spiking to humiliate women

-

NBA champions Thunder suffer rare loss to Timberwolves

NBA champions Thunder suffer rare loss to Timberwolves

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

US strikes Islamic State group in Syria after deadly attack on troops

-

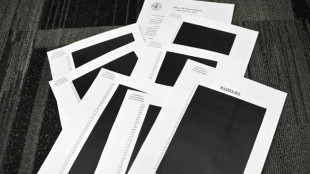

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

Amorim takes aim at Man Utd youth stars over 'entitlement'

-

Mercosur meets in Brazil, EU eyes January 12 trade deal

-

US Fed official says no urgency to cut rates, flags distorted data

US Fed official says no urgency to cut rates, flags distorted data

-

Rome to charge visitors for access to Trevi Fountain

Grain prices ease back but fertiliser costs a growing risk

Grain prices have dropped sharply from the record highs they reached following Russia's invasion of Ukraine, but another menace to global food security remains: a shortage of fertiliser.

The conflict sparked fears of famine in poorer countries reliant on agricultural goods from Ukraine and Russia, two nations that were responsible for nearly a third of global wheat exports last year.

Wheat prices reached a peak of nearly 440 euros ($440) a tonne on the European market in mid-May, double the level of one year ago, as crucial Ukrainian shipments were stuck at port due to a Russian naval blockade in the Black Sea.

But prices have fallen to around 300 euros in August.

"The situation began to calm down at the end of May, beginning of June with the first reassuring harvest forecasts for Europe and the resumption of Ukrainian exports, first by road and rail, then by sea," said Gautier Le Molgat, analyst at consultancy Agritel.

Kyiv and Moscow reached an agreement in July, brokered by the United Nations and Turkey, that allowed Ukraine to resume grain shipments in the Black Sea.

The agreement opened a shipping corridor for 20 million tonnes of maize, wheat and sunflower seed oil stocked in Ukraine. According to the Joint Coordination Centre which manages the sea corridor, more than 720,000 tonnes have already left Ukraine.

"Thanks to intensive international cooperation, Ukraine is on track to export as much as four million metric tonnes of agricultural products in August," a senior US State Department official told AFP on Tuesday.

- Strong ruble -

In addition to more supplies reaching markets and helping lower prices, the deal has led to a drop in insurance premiums, reducing transport costs.

But the reduction in tensions is, for the moment, benefitting Ukraine more than Russia, which is expecting a bumper harvest of 88 million tonnes of wheat.

Russian wheat exports in July and August are running 27 percent lower than last year, according to estimates by the Russian market research firm SovEcon.

That is due to fierce competition on the international grain market, as well as the strong value of the ruble and a high Russian export tax.

"As a result, farmers remain reluctant sellers," said Andrei Sizov, SovEcon's managing director.

The low volume of Russian exports is one of the main reasons why wheat prices have remained so high, said Sizov.

- Fertiliser costs a growing problem -

One of the reasons prices have not come down further is the surge in energy prices, due to the post-pandemic recovery and the war.

Higher oil prices impact transportation costs, while natural gas is a feedstock for manufacturing the chemical fertilisers that most farmers now use.

"Fertiliser prices have tripled in the last 18 months and the hard part of my job is forecasting what they will do in the next 18 months," Joel Jackson, a fertiliser analyst at BMO Capital Markets, said at an analyst conference in July in the United States.

With European gas prices soaring above 300 euros per megawatt hour, compared to an average of 20 euros over the past decades, "we've got a big problem as it's untenable for ammonia manufacturers," said Nicolas Broutin, head of the French subsidiary of Yara, the Norwegian firm which is Europe's largest fertiliser producer.

Yara announced Thursday it was reducing once again its production in Europe of ammonia, which is made using hydrogen obtained from natural gas and which provides the nitrogen in synthetic fertilisers.

The firm will only be using 35 percent of its production capacity in Europe. A number of other European manufacturers have either reduced or halted output.

Although fertilisers do not fall under international sanctions, farmers are also at risk of shortages of another major element of fertiliser -- potassium or potash -- as both Russia and Belarus are major producers.

BMO Capital Markets' Joel Jackson said fertiliser manufacturers worry that the high prices will prompt farmers to reduce or eliminate their use.

"We're already seeing that throughout Europe," said Yara's Nicolas Broutin.

CyclOpe, a French-based commodities research firm, said "it's in 2023-2024 that the rise in fertiliser prices and eventually their reduced use will be felt."

Farmers will try to pass on higher fertiliser costs to consumers, driving up food costs.

Meanwhile, reduced fertiliser use will result in lower crop yields and harvests, which will also drive up food prices.

CyclOpe expects in particular "considerably reduced" output in Africa, where farmers and consumers are both more sensitive to prices.

Y.Bouchard--BTB