-

Australia four wickets from Ashes glory as England cling on

Australia four wickets from Ashes glory as England cling on

-

Beetles block mining of Europe's biggest rare earths deposit

-

French culture boss accused of mass drinks spiking to humiliate women

French culture boss accused of mass drinks spiking to humiliate women

-

NBA champions Thunder suffer rare loss to Timberwolves

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

-

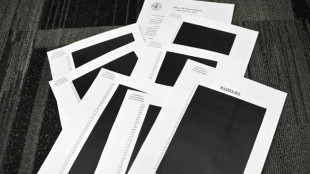

Epstein files opened: famous faces, many blacked-out pages

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

-

Mercosur meets in Brazil, EU eyes January 12 trade deal

Mercosur meets in Brazil, EU eyes January 12 trade deal

-

US Fed official says no urgency to cut rates, flags distorted data

-

Rome to charge visitors for access to Trevi Fountain

Rome to charge visitors for access to Trevi Fountain

-

Spurs 'not a quick fix' for under-fire Frank

French public spending watchdog warns about post-Covid debt

France's public accounts watchdog warned Wednesday about the state of the country's finances, which have deteriorated dramatically in the last two years due to a massive Covid-19 rescue package, tax cuts and spending commitments.

The influential Cour des comptes, which acts as a state auditor, forecast in its annual report that public debt would increase by 560 billion euros ($640 billion) between the end of 2019 and the end of 2022.

Most of the rise -- which will take total debt to an equivalent of 113 percent of GDP -- was down to Covid-19 after President Emmanuel Macron promised to spend "whatever it costs" to save the economy.

"This considerable effort will weigh long-term on the deficit and public debt, the reduction of which will require unprecedented efforts to control public spending," the watchdog said.

The rescue package and other state spending had left France with some of the most unbalanced public accounts among the 19 EU countries that use the euro, the Cour des comptes said.

According to its calculations, only Italy was worse off than France, which was in a similar position to Belgium and Spain.

France is "among the group of countries in the eurozone, two years after the start of the Covid-19 pandemic, where the public finances have deteriorated the most," it said.

- Debt 'volcano?' -

Even with strong economic growth of 7.0 percent last year and an estimated 4.0 percent in 2022, the watchdog warned that France risked running large and unsustainable deficits.

It forecast a deficit of 5.0 percent of GDP this year "of a completely structural nature" -- meaning that it was due to permanent over-spending, rather than one-off outlays linked to Covid-19.

The auditor cited "significant" tax cuts announced by Macron that would come into force in 2022, as well as extra spending commitments, including permanent additional funding for the health system.

The findings come at a highly sensitive moment as France gears up for presidential elections in April.

Macron, who is shown by polls as the front-runner, came into power in 2017 promising to balance France's accounts after decades of over-spending.

His first prime minister, Edouard Philippe, called the country's debt level "intolerable" in 2017, adding that "we are dancing on a volcano that is rumbling ever louder."

Macron is pushing for a permanent loosening of public spending rules for the eurozone that are meant to restrict states to running annual deficits below 3.0 percent of GDP.

After announcing massive public investments in strategic industries of the future under his so-called "France 2030" plan, he is seeking to persuade fellow members in the bloc to follow suit.

Y.Bouchard--BTB