-

Fiji top sevens standings after comeback win in Singapore

Fiji top sevens standings after comeback win in Singapore

-

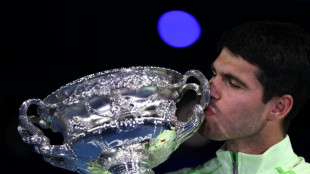

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

-

Death toll from Swiss New Year bar fire rises to 41

Death toll from Swiss New Year bar fire rises to 41

-

Alcaraz says Nadal inspired him to 'special' Australian Open title

-

Pakistan seeks out perpetrators after deadly separatist attacks

Pakistan seeks out perpetrators after deadly separatist attacks

-

Ukraine war talks delayed to Wednesday, Zelensky says

-

Djokovic says 'been a great ride' after Melbourne final loss

Djokovic says 'been a great ride' after Melbourne final loss

-

Von Allmen storms to downhill win in final Olympic tune-up

-

Carlos Alcaraz: tennis history-maker with shades of Federer

Carlos Alcaraz: tennis history-maker with shades of Federer

-

Alcaraz sweeps past Djokovic to win maiden Australian Open title

-

Israel says partially reopening Gaza's Rafah crossing

Israel says partially reopening Gaza's Rafah crossing

-

French IT giant Capgemini to sell US subsidiary after row over ICE links

-

Iran's Khamenei likens protests to 'coup', warns of regional war

Iran's Khamenei likens protests to 'coup', warns of regional war

-

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

-

Italy's extrovert Olympic icon Alberto Tomba insists he is 'shy guy'

Italy's extrovert Olympic icon Alberto Tomba insists he is 'shy guy'

-

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

-

Pakistan combing for perpetrators after deadly separatist attacks

Pakistan combing for perpetrators after deadly separatist attacks

-

Israel partially reopens Gaza's Rafah crossing

-

Iran declares European armies 'terrorist groups' after IRGC designation

Iran declares European armies 'terrorist groups' after IRGC designation

-

Snowstorm disrupts travel in southern US as blast of icy weather widens

-

Denmark's Andresen swoops to win Cadel Evans Road Race

Denmark's Andresen swoops to win Cadel Evans Road Race

-

Volkanovski beats Lopes in rematch to defend UFC featherweight title

-

Sea of colour as Malaysia's Hindus mark Thaipusam with piercings and prayer

Sea of colour as Malaysia's Hindus mark Thaipusam with piercings and prayer

-

Exiled Tibetans choose leaders for lost homeland

-

Afghan returnees in Bamiyan struggle despite new homes

Afghan returnees in Bamiyan struggle despite new homes

-

Mired in economic trouble, Bangladesh pins hopes on election boost

-

Chinese cash in jewellery at automated gold recyclers as prices soar

Chinese cash in jewellery at automated gold recyclers as prices soar

-

Israel to partially reopen Gaza's Rafah crossing

-

'Quiet assassin' Rybakina targets world number one after Melbourne win

'Quiet assassin' Rybakina targets world number one after Melbourne win

-

Deportation raids drive Minneapolis immigrant family into hiding

-

Nvidia boss insists 'huge' investment in OpenAI on track

Nvidia boss insists 'huge' investment in OpenAI on track

-

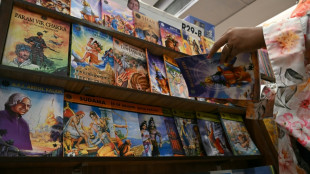

'Immortal' Indian comics keep up with changing times

-

With Trump mum, last US-Russia nuclear pact set to end

With Trump mum, last US-Russia nuclear pact set to end

-

In Sudan's old port of Suakin, dreams of a tourism revival

-

Narco violence dominates as Costa Rica votes for president

Narco violence dominates as Costa Rica votes for president

-

Snowstorm barrels into southern US as blast of icy weather widens

-

LA Olympic chief 'deeply regrets' flirty Maxwell emails in Epstein files

LA Olympic chief 'deeply regrets' flirty Maxwell emails in Epstein files

-

Rose powers to commanding six-shot lead at Torrey Pines

-

Barca wasteful but beat Elche to extend Liga lead

Barca wasteful but beat Elche to extend Liga lead

-

Konate cut short compassionate leave to ease Liverpool injury crisis

-

Separatist attacks in Pakistan kill 33, dozens of militants dead

Separatist attacks in Pakistan kill 33, dozens of militants dead

-

Dodgers manager Roberts says Ohtani won't pitch in Classic

-

Arsenal stretch Premier League lead as Chelsea, Liverpool stage comebacks

Arsenal stretch Premier League lead as Chelsea, Liverpool stage comebacks

-

Korda defies cold and wind to lead LPGA opener

-

New head of US mission in Venezuela arrives as ties warm

New head of US mission in Venezuela arrives as ties warm

-

Barca triumph at Elche to extend Liga lead

-

Ekitike, Wirtz give Liverpool sight of bright future in Newcastle win

Ekitike, Wirtz give Liverpool sight of bright future in Newcastle win

-

West Indies 'tick boxes' in shortened T20 against South Africa

-

Chelsea have something 'special' says Rosenior

Chelsea have something 'special' says Rosenior

-

De Zerbi 'ready to go to war' to solve Marseille troubles

How tariffs in the EU work

Customs duties, or tariffs, have become a political punching ball as the European Union prepares to respond to US President Donald Trump's recent offensive.

But what exactly do we mean when we talk about tariffs? How does the EU policy work? Who pays them and what are they for?

Some answers:

- What are tariffs? -

Used by almost every country, tariffs are a tax on products imported from abroad.

They take many forms, the most common being a percentage of the economic value of the product -- the "ad valorem" duty.

The EU, like other economies, also uses so-called "specific" tariffs, such as an amount set per kilogramme or per litre of any given product.

Globally in 2022, the average tariff was 3.6 percent, according to the CCI-Cepii database (Centre for Prospective Studies and International Information).

In other words, each product crosses a border at a price 3.6 percent higher than its cost domestically.

"This average figure hides very strong differences between countries and sectors," Houssein Guimbard, a trade policies specialist at Cepii, told AFP.

- What are they for? -

The most immediate objective of these taxes is to give domestic producers a competitive advantage against foreign competition, said Guimbard.

Another goal, which is more the case in developing countries, is to supplement the government budget.

Some African or island countries, for example, finance more than 30 percent of their expenses this way, according to Guimbard.

Countries also use tariffs to maintain a positive trade balance and keep the amount of imports down by taxing them.

"It's a bit like President Trump's current logic," Guimbard told AFP.

- Who decides them in the EU? -

As a consequence of the customs union, the 27 member states have a common customs tariff for imported goods.

They do not apply any internal customs duties. The common customs tariff rates are set by the EU Council, based on proposals from the European Commission (EC).

They vary depending on agreements negotiated with trade partners and according to the "economic sensitivity of the products," the Commission says.

Typically, very low customs duties are applied to oil or liquefied gas "because consumers and companies need them, and the European Union does not necessarily produce them," said Guimbard.

Conversely, agriculture is highly protected: 40 to 60 percent protection on beef or dairy products, including all rights and quotas, compared to an average protection of 2.2 percent in the EU in 2022, according to Guimbard.

Since 2023, the EC has planned a "graduated response if our companies were victims of a significant increase in customs duties," Yann Ambach, head of the Tariff and Trade Policy Office at the Directorate General of French Customs, told AFP.

"It is within this framework that the countermeasures currently being considered by the EC would be implemented," Ambach said.

- Who pays them? -

In the EU, as a general rule, the importer, rather than the exporter, pays the customs duties.

If they increase, the main question is whether companies pass on the additional costs to the consumer.

"One must consider how important the product is for consumers and whether companies can raise the price of this product without reducing their margins," said Guimbard.

"The translation of the increase in customs duty also depends on the ability of companies to find alternative sources when importing, or alternative destinations when exporting."

- Who collects them? -

The member states are responsible for collecting customs duties.

They "must have adequate control infrastructure to ensure that their administrations, especially their customs authorities, carry out their tasks in an appropriate manner", according to the EC.

"The American measures and the subsequent European retaliatory measures correspond to an intensification of the missions of monitoring, verification, and control of imports and exports," said Ambach.

- Where do they go? -

For the period 2021-2027, the member states retain 25 percent of the collected customs duties.

"This measure not only covers collection costs but also serves as an incentive to ensure a diligent collection of the amounts due," the EC says.

The remaining 75 percent directly funds the EU budget. Tariffs on imported goods therefore account for approximately 14 percent of the community budget.

M.Ouellet--BTB