-

Global markets turmoil intensifies on Iran war

Global markets turmoil intensifies on Iran war

-

Iran targets Mideast energy industry and US missions

-

Rahm accuses DP World Tour of 'extorting players' with LIV deal

Rahm accuses DP World Tour of 'extorting players' with LIV deal

-

Thousands of Afghans displaced by Pakistan conflict

-

China, North Korea make winning starts at Women's Asian Cup

China, North Korea make winning starts at Women's Asian Cup

-

EU asylum applications down but Iran concerns mount

-

Rahm accuses DP World Tour of 'exorting players' with LIV deal

Rahm accuses DP World Tour of 'exorting players' with LIV deal

-

Drones hit US embassy as vengeful Iran targets Mideast cities

-

Mideast war exposes fragile oil, gas dependency

Mideast war exposes fragile oil, gas dependency

-

How the T20 World Cup semi-finalists shape up

-

Oil extends gains and stocks dive as Middle East war spreads

Oil extends gains and stocks dive as Middle East war spreads

-

Warming El Nino may return later this year: UN

-

Trump says US-UK relationship 'not like it used to be'

Trump says US-UK relationship 'not like it used to be'

-

Eight years on, trial begins in Argentina submarine implosion

-

Beijing votes out three generals from political advisory body

Beijing votes out three generals from political advisory body

-

Oil extends gains and stocks dive as Iran conflict spreads

-

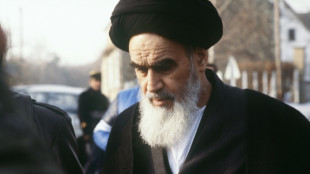

The French village where Ayatollah Khomeini fomented Iran's revolution

The French village where Ayatollah Khomeini fomented Iran's revolution

-

South Africa, India eye T20 World Cup rematch as semi-finals begin

-

Trump hosts Germany's Merz for talks eclipsed by Mideast war

Trump hosts Germany's Merz for talks eclipsed by Mideast war

-

Second-hand phones surf rising green consumer wave

-

Pakistanis at remote border describe scramble to leave Iran

Pakistanis at remote border describe scramble to leave Iran

-

China votes to oust three generals from political advisory body

-

Murray scores 45 as Nuggets hold off Jazz

Murray scores 45 as Nuggets hold off Jazz

-

Five things about the 2026 F1 season

-

Scrum-half Gibson-Park: Ireland's 'petit general'

Scrum-half Gibson-Park: Ireland's 'petit general'

-

Geopolitical storm leaves isolated Greenlanders hanging by a telecoms thread

-

Myong hat-trick as North Korea cruise at Women's Asian Cup

Myong hat-trick as North Korea cruise at Women's Asian Cup

-

AI disinformation turns Nepal polls into 'digital battleground'

-

New Israel, Iran attacks across region: Latest developments in Middle East war

New Israel, Iran attacks across region: Latest developments in Middle East war

-

China's overstretched healthcare looks to AI boom

-

Oil extends gains and stocks drop as Iran conflict spreads

Oil extends gains and stocks drop as Iran conflict spreads

-

Rituals of resilience: how Afghan women stay sane in their 'cage'

-

Strait of Hormuz impasse squeezes world shipping

Strait of Hormuz impasse squeezes world shipping

-

Fresh Israel, Iran attacks across region: Latest developments in Middle East war

-

Oscar-nominated Iranian doc offers different vision of leadership

Oscar-nominated Iranian doc offers different vision of leadership

-

Oscar-nominated docs take on hot-button US social issues

-

'I couldn't breathe': The dark side of Bolivia's silver boom

'I couldn't breathe': The dark side of Bolivia's silver boom

-

Trump warns of longer Iran war as Riyadh, Beirut hit

-

Underground party scene: Israelis celebrate Purim in air raid shelters

Underground party scene: Israelis celebrate Purim in air raid shelters

-

Flowers, music, and soldiers at funeral of drug lord

-

'Safety and wellbeing' will guide F1 Mideast planning: FIA chief

'Safety and wellbeing' will guide F1 Mideast planning: FIA chief

-

Trump to attend White House Correspondents' dinner

-

Will Iran's missiles drain US interceptor stocks?

Will Iran's missiles drain US interceptor stocks?

-

Trump warns of longer Iran war as violence spreads

-

Energy infrastructure emerges as war target, lifting prices

Energy infrastructure emerges as war target, lifting prices

-

Trump warns of longer Iran war, Rubio points at Israel

-

US urges to 'depart now' from Middle East: Latest developments in Iran war

US urges to 'depart now' from Middle East: Latest developments in Iran war

-

Ecuador launches joint anti-drug operations with US

-

Getafe deal flat Real Madrid La Liga title race blow

Getafe deal flat Real Madrid La Liga title race blow

-

Rubio, Hezbollah and Qatar: Latest developments in Iran war

Stocks tumble on US rate hike uncertainty

Equity markets mostly retreated Thursday, with the sharpest losses in Asia, after Federal Reserve chief Jerome Powell refused to be drawn on the pace of US interest rate hikes to battle decades-high inflation.

Although Powell on Wednesday firmed market expectations of a rate increase in March, investors were spooked by what happens thereafter.

His reluctance to give clear guidance on further tightening helped the dollar to reach a two-month high against the euro Thursday.

"Federal Reserve chair Jay Powell failed to stop the market rout with the central bank's latest policy update, with US stocks falling further after the announcement and the equity sell-off extending to most of Asia and Europe on Thursday," said AJ Bell investment director Russ Mould.

"It's what he didn't say that troubled investors. The key concerns are how aggressive the Fed will be with raising rates -- will they go up at every meeting this year, and will they go up by more than 0.25 percentage points each time?"

Fed officials still believe the price rises will be brought under control as economies reopen and supply chain problems abate, but the need to prevent them from running away is forcing them into an aggressive pivot.

The meeting "played out more hawkishly than we expected", said Steven Englander at Standard Chartered Bank.

"The (policy board) statement was largely as anticipated, but... Powell emphasised upside risks to inflation, pointing to a steady pace of policy withdrawal."

Powell's comments sent Wall Street sharply lower from their intra-day levels with tech firms, which are more susceptible to higher borrowing costs, taking the brunt.

Sharp Asian losses followed, particularly among tech stocks.

Seoul tanked more than three percent into a bear market -- a 20 percent drop from its recent high hit in August -- while Sydney fell into a correction, having given up 10 percent from its latest peak.

Tokyo took a 3.1-percent pounding as market heavyweights Sony and SoftBank -- which invests heavily in the tech sector -- led losses, while Hong Kong was two percent off.

Europe was mixed, with gains for London, Milan and Madrid, while Frankfurt and Paris fell in midday deals awaiting the Wall Street open.

- Oil below $90 -

Elsewhere, oil prices steadied, a day after benchmark European contract Brent North Sea briefly broke $90 per barrel for the first time in seven years owing to rising Ukraine-Russia tensions and falling US crude stockpiles.

Eyes are on the upcoming meeting of OPEC and other key producers, where they will discuss plans to continue to increase output.

"Energy traders are anticipating higher energy prices on potential geopolitical risks and as OPEC+ will stick to their plan to deliver another modest increase to production at next week's meeting," said OANDA's Edward Moya.

- Key figures around 1145 GMT -

London - FTSE 100: UP 0.5 percent at 7,504.16 points

Paris - CAC 40: DOWN 0.2 percent at 6,971.66

Frankfurt - DAX: DOWN 0.5 percent at 15,389.22

EURO STOXX 50: DOWN 0.3 percent at 4,150.27

Tokyo - Nikkei 225: DOWN 3.1 percent at 26,170.30 (close)

Hong Kong - Hang Seng Index: DOWN 2.0 percent at 23,807.00 (close)

Shanghai - Composite: DOWN 1.8 percent at 3,394.25 (close)

New York - Dow: DOWN 0.4 percent at 34,168.09 (close)

Euro/dollar: DOWN at $1.1188 from $1.1238 late Wednesday

Pound/dollar: DOWN at $1.3403 from $1.3458

Euro/pound: UP at 83.47 pence from 83.45 pence

Dollar/yen: UP at 115.18 yen from 114.64 yen

Brent North Sea crude: UP 0.2 percent at $88.89 per barrel

West Texas Intermediate: UP 0.1 percent at $87.39 per barrel

B.Shevchenko--BTB