-

Breaking men-only musical lore, Jobarteh puts African kora on wider stage

Breaking men-only musical lore, Jobarteh puts African kora on wider stage

-

Usyk heavyweight glory hailed as 'Ukrainian victory'

-

Cannes narco musical star says being trans should be 'unimportant'

Cannes narco musical star says being trans should be 'unimportant'

-

Shelling kills ten in Ukraine region under Russian offensive

-

DR Congo thwarts Kinshasa 'coup attempt' : army

DR Congo thwarts Kinshasa 'coup attempt' : army

-

Injured Sinner back on road to French Open

-

Dominican Republic votes for president in poll overshadowed by Haiti crisis

Dominican Republic votes for president in poll overshadowed by Haiti crisis

-

France says will quell New Caledonia riots 'whatever the cost'

-

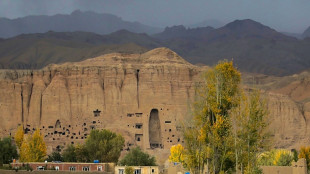

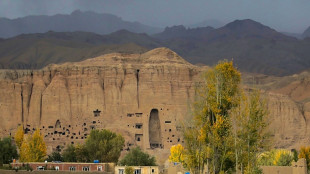

'Blood everywhere': Survivor recounts attack on tourists in Afghanistan

'Blood everywhere': Survivor recounts attack on tourists in Afghanistan

-

Deadly bombs hit Gaza as US security envoy visits Israel

-

World javelin champion Kitaguchi lays down marker in Tokyo

World javelin champion Kitaguchi lays down marker in Tokyo

-

Hundreds protest Taiwan's ruling party on eve of inauguration

-

French forces smash roadblocks in bid to clear key New Caledonia road

French forces smash roadblocks in bid to clear key New Caledonia road

-

Russian exiles in Georgia inspired by protests but scared

-

Taiwan's next president goes shrimp fishing with foreign guests

Taiwan's next president goes shrimp fishing with foreign guests

-

Can Costner lead the revenge of France's much-mocked Kevins?

-

Dramas elevate Iran cinema but it's comedy that sells

Dramas elevate Iran cinema but it's comedy that sells

-

Fury unsure on rematch after Usyk inflicts his first defeat

-

Taiwan coast guard ramps up island patrols ahead of inauguration

Taiwan coast guard ramps up island patrols ahead of inauguration

-

'Maldives what?': Saudi fashionistas attempt beach rebrand

-

Dallas rally to down Thunder, reach NBA Western Conference finals

Dallas rally to down Thunder, reach NBA Western Conference finals

-

The French 'Erin Brockovich' vs Goodyear

-

History-chasing Man City eye Premier League title 'destiny'

History-chasing Man City eye Premier League title 'destiny'

-

Body of second missing Mongolian climber found on Everest

-

Campana's late stunner gives Miami victory over D.C.

Campana's late stunner gives Miami victory over D.C.

-

Iraq father begins legal action against BP over son's cancer death

-

Dominican Republic's vote is dominated by Haiti crisis

Dominican Republic's vote is dominated by Haiti crisis

-

Blue Origin flies thrill seekers to space after two year hiatus

-

Biles launches Olympic year with impressive Core Hydration Classic win

Biles launches Olympic year with impressive Core Hydration Classic win

-

Usyk in tears for late father after historic heavyweight win

-

Can we rid artificial intelligence of bias?

Can we rid artificial intelligence of bias?

-

Forgotten D-Day cameramen out of shadows, 80 years on

-

Hollywood battles aging -- in film reels

Hollywood battles aging -- in film reels

-

'Blood in the water' for record low scores in PGA final round

-

Usyk beats Fury to become undisputed world heavyweight boxing champion

Usyk beats Fury to become undisputed world heavyweight boxing champion

-

Seize the Grey wins Preakness for 88-year-old trainer Lukas

-

Lowry's 62 equals low major round as Schauffele, Morikawa lead PGA

Lowry's 62 equals low major round as Schauffele, Morikawa lead PGA

-

Second major win would mean a lot for danger-man Lowry

-

Tourists wounded in deadly Afghanistan shooting are stable: hospital

Tourists wounded in deadly Afghanistan shooting are stable: hospital

-

Lowry matches low major round with 62 as Schauffele leads PGA

-

Top-ranked Korda takes LPGA lead at Liberty National

Top-ranked Korda takes LPGA lead at Liberty National

-

Benjamin wins LA 400m hurdles in blistering 46.64sec

-

Ahly stay on track for 12th title after holding Esperance

Ahly stay on track for 12th title after holding Esperance

-

Three Spaniards, three Afghans killed in shooting in Afghanistan

-

Canadian oil city lifts wildfire evacuation orders

Canadian oil city lifts wildfire evacuation orders

-

Schauffele clings to PGA lead as Lowry makes epic charge

-

Swiatek 'staying humble' for French Open after third Rome title

Swiatek 'staying humble' for French Open after third Rome title

-

Chinese director Jia mines leftover footage for top Cannes film

-

Zelensky expects Russia offensive in northeast Ukraine to intensify

Zelensky expects Russia offensive in northeast Ukraine to intensify

-

Bengaluru win six in row to make IPL play-offs, Chennai out

Stock markets mostly rise on lower rates optimism

Stock markets extended the week's rally Tuesday on optimism that the US Federal Reserve will cut interest rates this year.

Friday's big miss on US jobs creation for April, a largely well-received earnings season and soothing comments about the rates outlook by central bank chief Jerome Powell have combined to push equities higher.

"Powell has... played a key role in driving market sentiment, with recent comments from the Fed Chair shifting market expectations towards a November cut instead of December," noted Joshua Mahony, chief market analyst at Scope Markets.

Positive soundings out of Beijing on help for China's struggling economy has given an added boost, as have hope of rate cuts in Europe.

London reached yet another record high Tuesday.

"This week is light on high-profile economic data, but heavy on Fed members hitting the speaking circuit," said Chris Larkin at E*Trade from Morgan Stanley.

"Traders will be dissecting any comments they make about potential rate cuts."

Focus is also on the first-quarter earnings season.

Swiss banking giant UBS on Tuesday said net profit rose 71 percent to nearly $1.8 billion in the January-March period, far exceeding expectations, after two quarters in the red owing to its mammoth takeover of Credit Suisse.

Switzerland's biggest bank said its turnover increased by 46 percent to $12.7 billion, largely thanks to its investment banking arm, which had been the key part in the mega-merger.

UBS shares rallied on the Swiss stock exchange, rising more than nine percent at 27.20 Swiss francs each in midday trading.

On the downside, shares in BP eased after the British energy giant said its net profit slumped 72 percent in the first quarter, as gas prices declined from a year earlier.

Profit after tax tumbled to $2.3 billion from $8.2 billion in the first three months of 2023.

- Key figures around 1100 GMT -

London - FTSE 100: UP 1.1 percent at 8,300.11 points

Paris - CAC 40: UP 0.4 percent at 8,025.24

Frankfurt - DAX: UP 0.8 percent at 18,312.02

EURO STOXX 50: UP 0.6 percent at 4,985.84

Tokyo - Nikkei 225: UP 1.6 percent at 38,835.10 (close)

Hong Kong - Hang Seng Index: DOWN 0.5 percent at 18,479.37 (close)

Shanghai - Composite: UP 0.2 percent at 3,147.74 (close)

New York - Dow: UP 0.5 percent at 38,852.27 (close)

Euro/dollar: DOWN at $1.0769 from $1.0772 on Monday

Pound/dollar: DOWN at $1.2544 from $1.2564

Dollar/yen: UP at 154.48 yen from 153.86 yen

Euro/pound: UP at 85.82 from 85.72 pence

West Texas Intermediate: DOWN 0.3 percent at $78.22 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $83.05 per barrel

E.Schubert--BTB