-

Brazil mayor's mammoth task: rebuild from floods, prevent more

Brazil mayor's mammoth task: rebuild from floods, prevent more

-

Microsoft unveils 'AI-ready' PCs

-

Trump trial prosecution rests, closing arguments next week

Trump trial prosecution rests, closing arguments next week

-

New Liverpool boss Slot admits he could not resist lure of club

-

OpenAI to 'pause' voice linked to Scarlett Johansson

OpenAI to 'pause' voice linked to Scarlett Johansson

-

Women's tennis signs 'multi-year partnership' with Saudi investment fund

-

Two policemen killed as Colombia rebels launch gun, bomb attacks

Two policemen killed as Colombia rebels launch gun, bomb attacks

-

Murray on the brink in Geneva comeback

-

ICC prosecutor seeks Gaza 'war crimes' arrest warrant for Netanyahu, Hamas leaders

ICC prosecutor seeks Gaza 'war crimes' arrest warrant for Netanyahu, Hamas leaders

-

'Incognito Market' founder arrested in New York

-

Cate Blanchett urges film industry to include refugee voices

Cate Blanchett urges film industry to include refugee voices

-

Sargent returns to US squad for pre-COPA friendlies

-

Microsoft unveils 'Copilot Plus' PC amped with AI

Microsoft unveils 'Copilot Plus' PC amped with AI

-

Biden slams 'outrageous' ICC bid to arrest Israeli leaders

-

Five things to know about incoming Anfield boss Arne Slot

Five things to know about incoming Anfield boss Arne Slot

-

Changing climate influences London's Chelsea Flower Show

-

UK PM sorry for institutional cover-up in infected blood scandal

UK PM sorry for institutional cover-up in infected blood scandal

-

G7 push to use Russian assets for Ukraine 'vital and urgent': Yellen

-

Trump trial closing arguments set for next week

Trump trial closing arguments set for next week

-

US Supreme Court rejects ex-Guantanamo detainee's appeal

-

Japan's Studio Ghibli receives honorary Palme d'Or in Cannes

Japan's Studio Ghibli receives honorary Palme d'Or in Cannes

-

Liverpool confirm Slot will replace Klopp as manager

-

Pogacar 'good enough' to win Giro d'Italia and Tour de France

Pogacar 'good enough' to win Giro d'Italia and Tour de France

-

Cargo ship that destroyed Baltimore bridge towed to port

-

'God works slowly': NGO ship rescues 35 Bangladeshis off Malta

'God works slowly': NGO ship rescues 35 Bangladeshis off Malta

-

Dominican Republic's President Abinader wins resounding re-election

-

England relish 'fear factor' of returning paceman Archer

England relish 'fear factor' of returning paceman Archer

-

Israel, Hamas reject bid before ICC to arrest leaders for war crimes

-

Explosive Trump biopic hits Cannes Film Festival

Explosive Trump biopic hits Cannes Film Festival

-

Demi Moore transforms for Cannes body horror 'The Substance'

-

Spain demands Milei public apology for 'corrupt wife' comment

Spain demands Milei public apology for 'corrupt wife' comment

-

Gold hits record high as Iran shock triggers haven support

-

Ship that destroyed Baltimore bridge being towed to port

Ship that destroyed Baltimore bridge being towed to port

-

Max wins but Red Bull supremacy challenged: Emilia Romagna GP talking points

-

US inflation fight will take 'further time': senior Fed official

US inflation fight will take 'further time': senior Fed official

-

UK report finds cover-up of decades-long infected blood scandal

-

Trump trial resumes, closing arguments expected next week

Trump trial resumes, closing arguments expected next week

-

Ruto on first state visit by Kenyan leader to US in two decades

-

African players in Europe: Superb Kudus goal in vain as City take title

African players in Europe: Superb Kudus goal in vain as City take title

-

Pope to visit Belgium, Luxembourg in September

-

Gold hits high as Iran shock triggers haven support

Gold hits high as Iran shock triggers haven support

-

Strikes pound Gaza as Israel voices 'duty' to expand Rafah incursion

-

Russia tries playwright and director on terror charges

Russia tries playwright and director on terror charges

-

Iran mourns president Raisi's death in helicopter crash

-

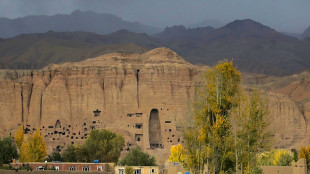

Attack on tourists rocks fledgling Afghanistan tourism sector

Attack on tourists rocks fledgling Afghanistan tourism sector

-

Paralympics should put disability back on global agenda, says IPC chief

-

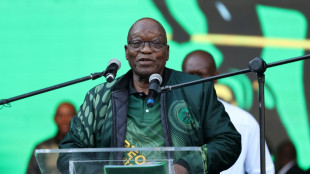

South Africa's top court strikes Zuma from ballot

South Africa's top court strikes Zuma from ballot

-

Crunch time looms for BHP's bid buy Anglo American

-

Kane to face old club Spurs for first time in Seoul

Kane to face old club Spurs for first time in Seoul

-

Markets rise as traders cheered by China property plan

UK economy exits recession in pre-vote boost for PM Sunak

Britain has emerged from a short-lived recession with better-than-expected growth in the first quarter, official data showed Friday, boosting embattled Prime Minister Rishi Sunak before this year's general election.

Gross domestic product expanded 0.6 percent in the first three months of this year, the Office for National Statistics (ONS) said, with strong growth in services and car manufacturing.

That beat market expectations of 0.4-percent growth and sent London's stock market to a fresh record peak, with sentiment buoyed also by the Bank of England (BoE) on Thursday signalling an interest-rate cut in the summer.

Sunak -- whose governing Conservatives are trailing the main opposition Labour Party in polls before a general election -- has made growth one of his top priorities.

The economy contracted slightly for two quarters in a row in the second half of 2023, meeting the technical definition of a recession that was caused by elevated inflation that has prolonged a cost-of-living crisis.

- 'Return to health' -

"There is no doubt it has been a difficult few years, but today's growth figures are proof that the economy is returning to full health for the first time since the pandemic," said finance minister Jeremy Hunt.

Labour finance spokesperson Rachel Reeves slammed the government's stewardship of the economy.

"From no growth to low growth -- is that really the scale of the Conservatives' ambitions? Food prices are still high, families are paying more on their monthly mortgage bills and working people are worse off," she said.

Richard Carter, head of fixed interest research at wealth manager Quilter Cheviot, said the UK was "clearly entering a more optimistic period".

"The government will be hoping to take advantage of this in the lead up to the general election," he added.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said that the UK economy "has jogged out of recession" after output shrank 0.3 percent in the final quarter of last year and by 0.1 percent in the prior three months.

She added: "It's clear a corner has been turned, as intense cost-of-living pressures subside, and consumers and companies eye lower borrowing costs on the horizon."

The Bank of England on Thursday left borrowing costs at 5.25 percent, the highest level since the 2008 global financial crisis, hurting borrowers but boosting savers.

- 'Don't cut too soon' -

The BoE maintained its main interest rate for a sixth meeting in a row, mirroring a wait-and-see approach by the US Federal Reserve and European Central Bank.

Signalling that a rate cut was on the horizon, two members of the bank's nine-strong Monetary Policy Committee voted for rates to be cut by 0.25 percentage points.

Cautioning over the timing of a cut, Hunt on Thursday said the BoE should not "rush into a decision that they had to reverse at a later stage".

Latest data showed UK annual inflation fell less than expected in March to 3.2 percent, keeping it well above the BoE's two-percent target.

The rate, however, has come down sharply from a four-decade high above 11 percent in late 2022, when energy and food prices soared following Russia's invasion of Ukraine.

O.Krause--BTB