-

Man Utd blow lead three times in 4-4 Bournemouth thriller

Man Utd blow lead three times in 4-4 Bournemouth thriller

-

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

-

Trump 'considering' push to reclassify marijuana as less dangerous

Trump 'considering' push to reclassify marijuana as less dangerous

-

Chiefs coach Reid backing Mahomes recovery after knee injury

-

Trump says Ukraine deal close, Europe proposes peace force

Trump says Ukraine deal close, Europe proposes peace force

-

French minister urges angry farmers to trust cow culls, vaccines

-

Angelina Jolie reveals mastectomy scars in Time France magazine

Angelina Jolie reveals mastectomy scars in Time France magazine

-

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

-

Chile president-elect dials down right-wing rhetoric, vows unity

Chile president-elect dials down right-wing rhetoric, vows unity

-

Five Rob Reiner films that rocked, romanced and riveted

-

Rob Reiner: Hollywood giant and political activist

Rob Reiner: Hollywood giant and political activist

-

Observers say Honduran election fair, but urge faster count

-

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

-

Trump condemned for saying critical filmmaker brought on own murder

-

US military to use Trinidad airports, on Venezuela's doorstep

US military to use Trinidad airports, on Venezuela's doorstep

-

Daughter warns China not to make Jimmy Lai a 'martyr'

-

UK defence chief says 'whole nation' must meet global threats

UK defence chief says 'whole nation' must meet global threats

-

Rob Reiner's death: what we know

-

Zelensky hails 'real progress' in Berlin talks with Trump envoys

Zelensky hails 'real progress' in Berlin talks with Trump envoys

-

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

-

Son arrested after Rob Reiner and wife found dead: US media

Son arrested after Rob Reiner and wife found dead: US media

-

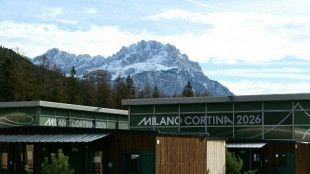

Athletes to stay in pop-up cabins in the woods at Winter Olympics

-

England seek their own Bradman in bid for historic Ashes comeback

England seek their own Bradman in bid for historic Ashes comeback

-

Decades after Bosman, football's transfer war rages on

-

Ukraine hails 'real progress' in Zelensky's talks with US envoys

Ukraine hails 'real progress' in Zelensky's talks with US envoys

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

Stock market optimism returns after tech sell-off

-

Iran Nobel winner unwell after 'violent' arrest: supporters

-

Police suspect murder in deaths of Hollywood giant Rob Reiner and wife

Police suspect murder in deaths of Hollywood giant Rob Reiner and wife

-

'Angry' Louvre workers' strike shuts out thousands of tourists

-

EU faces key summit on using Russian assets for Ukraine

EU faces key summit on using Russian assets for Ukraine

-

Maresca committed to Chelsea despite outburst

-

Trapped, starving and afraid in besieged Sudan city

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

-

'We are angry': Louvre Museum closed as workers strike

'We are angry': Louvre Museum closed as workers strike

-

Australia to toughen gun laws as it mourns deadly Bondi attack

Asian markets rise as traders buoyed by latest Wall St rally

Asian markets rose in limited trade Tuesday following another strong lead from Wall Street fuelled by a rebound in tech firms, while comments from Federal Reserve officials eased concerns that it will embark on an aggressive phase of policy tightening.

US equities rallied for a second day with plenty of support coming from Apple's blowout earnings report last week, while the current reporting season has proved fruitful despite concerns about inflation and central banks withdrawing financial support.

The Wall Street surge came at the end of a volatile month characterised by speculation over the Fed's plans to get a grip on runaway prices, with fears that its new hawkish tilt could see it hike borrowing costs as much as seven times this year with a 50 basis point move in March.

Comments from some leading figures at the bank at the weekend added to expectations the policy board would go hard and fast, though some were out on Monday trying to play down such a move.

Atlanta Fed boss Raphael Bostic said he was not in favour of such a big hike next month, having told the Financial Times at the weekend that his colleagues had not ruled it out.

Meanwhile, Kansas City Fed President Esther George said it was in "no one’s interest to try to upset the economy with unexpected adjustments", and the head of the San Francisco arm, Mary Daly, added that measures "have to be gradual and not disruptive".

The Nasdaq soared more than three percent, paring losses for January to nine percent, having at one point been down almost 15 percent during the month, while The S&P 500 and Dow also chalked up healthy gains.

And the positive energy continued in Asia, with Tokyo, Wellington, Mumbai and Bangkok all up.

Sydney also ended in positive territory as the Australian central bank decided against hiking interest rates to battle inflation, instead just announcing the end to its bond-buying stimulus from next week.

However, business was thin across the region owing to the Chinese New Year break that saw Hong Kong, Shanghai, Singapore, Seoul, Taipei, Manila and Jakarta closed.

There was also hope that the rally could indicate markets are finding a bottom after the recent sell-off.

"The back-to-back consecutive rise in US stocks has got some thinking whether the trough has passed," said National Australia Bank's Tapas Strickland.

"Despite the talk of higher rates, earnings so far have been much better than expected. Whether we have passed the trough is uncertain, but certainly for some value is re-emerging."

And Solita Marcelli, at UBS Global Wealth Management, said in a commentary: "Investors should not lose sight of the fact that the economy remains strong, which should limit downside from current levels."

Traders are now awaiting policy decisions by the Bank of England and European Central Bank this week, while US jobs creation data due Friday could provide a fresh look at the world's top economy in light of inflation and rate hike expectations.

Oil prices extended their recent rally on demand optimism and the Russia-Ukraine standoff that is fanning worries over a possible hit to supplies. OPEC and other major producers' decision not to boost output by more than current levels was also a factor, analysts added.

"January has been a great month for oil prices and $100... might not be too far away as expectations are high that supply will not come close to catching up with demand as OPEC+ will deliver gradual production increase targets that they will fall short of reaching," said OANDA's Edward Moya.

- Key figures around 0620 GMT -

Tokyo - Nikkei 225: UP 0.3 percent at 27,078.48 (close)

Hong Kong - Hang Seng Index: Closed for a holiday

Shanghai - Composite: Closed for a holiday

Euro/dollar: UP at $1.1242 from $1.1235 late Monday

Pound/dollar: UP at $1.3454 from $1.3445

Euro/pound: UP at 83.55 pence from 83.54 pence

Dollar/yen: DOWN at 114.97 yen from 115.13 yen

West Texas Intermediate: UP 0.4 percent at $88.48 per barrel

Brent North Sea crude: UP 0.4 percent at $89.58 per barrel

New York - Dow: UP 1.2 percent at 35,131.86 (close)

London - FTSE 100: FLAT at 7,464.37 (close)

M.Ouellet--BTB