-

Man Utd blow lead three times in 4-4 Bournemouth thriller

Man Utd blow lead three times in 4-4 Bournemouth thriller

-

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

-

Trump 'considering' push to reclassify marijuana as less dangerous

Trump 'considering' push to reclassify marijuana as less dangerous

-

Chiefs coach Reid backing Mahomes recovery after knee injury

-

Trump says Ukraine deal close, Europe proposes peace force

Trump says Ukraine deal close, Europe proposes peace force

-

French minister urges angry farmers to trust cow culls, vaccines

-

Angelina Jolie reveals mastectomy scars in Time France magazine

Angelina Jolie reveals mastectomy scars in Time France magazine

-

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

-

Chile president-elect dials down right-wing rhetoric, vows unity

Chile president-elect dials down right-wing rhetoric, vows unity

-

Five Rob Reiner films that rocked, romanced and riveted

-

Rob Reiner: Hollywood giant and political activist

Rob Reiner: Hollywood giant and political activist

-

Observers say Honduran election fair, but urge faster count

-

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

-

Trump condemned for saying critical filmmaker brought on own murder

-

US military to use Trinidad airports, on Venezuela's doorstep

US military to use Trinidad airports, on Venezuela's doorstep

-

Daughter warns China not to make Jimmy Lai a 'martyr'

-

UK defence chief says 'whole nation' must meet global threats

UK defence chief says 'whole nation' must meet global threats

-

Rob Reiner's death: what we know

-

Zelensky hails 'real progress' in Berlin talks with Trump envoys

Zelensky hails 'real progress' in Berlin talks with Trump envoys

-

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

-

Son arrested after Rob Reiner and wife found dead: US media

Son arrested after Rob Reiner and wife found dead: US media

-

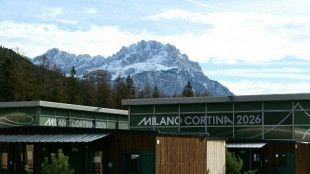

Athletes to stay in pop-up cabins in the woods at Winter Olympics

-

England seek their own Bradman in bid for historic Ashes comeback

England seek their own Bradman in bid for historic Ashes comeback

-

Decades after Bosman, football's transfer war rages on

-

Ukraine hails 'real progress' in Zelensky's talks with US envoys

Ukraine hails 'real progress' in Zelensky's talks with US envoys

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

Stock market optimism returns after tech sell-off

-

Iran Nobel winner unwell after 'violent' arrest: supporters

-

Police suspect murder in deaths of Hollywood giant Rob Reiner and wife

Police suspect murder in deaths of Hollywood giant Rob Reiner and wife

-

'Angry' Louvre workers' strike shuts out thousands of tourists

-

EU faces key summit on using Russian assets for Ukraine

EU faces key summit on using Russian assets for Ukraine

-

Maresca committed to Chelsea despite outburst

-

Trapped, starving and afraid in besieged Sudan city

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

-

'We are angry': Louvre Museum closed as workers strike

'We are angry': Louvre Museum closed as workers strike

-

Australia to toughen gun laws as it mourns deadly Bondi attack

Stocks volatile, oil plunges as trade war cranks higher

Wall Street rose but European and Asian stock markets tumbled along with oil on Wednesday as President Donald Trump's trade war cranked up a notch.

US President Donald Trump's sweeping tariffs against trading partners kicked in, triggering strong retaliation from China which slapped a higher 84-percent levy on US goods.

The EU announced reprisals for steel and aluminium tariffs that entered force last month, targeting more than 20 billion euros ($22 billion) of US products including soybeans, motorcycles and beauty products.

Growing fears of weakened demand sent oil prices to four-year lows, with international benchmark Brent North Sea crude briefly dropping under $60.

Paris and Frankfurt fell more than two percent, as goods from the European Union now face a 20 percent tariff when entering the United States.

London slumped 2.1 percent, with Britain having been hit with a 10 percent levy on Saturday.

Most Asian equities markets fell back into the red -- Tokyo closed down 3.9 percent.

Wall Street's main indices opened mixed but then pushed solidly higher, with Trump urging calm.

"BE COOL! Everything is going to work out well. The USA will be bigger and better than ever before!" Trump posted on his Truth Social network.

But any hopes of a last minute roll-back on tariffs were dashed as the United States earlier hit China -- its major trading partner -- with tariffs now reaching 104 percent.

"The world's largest and second largest economies are now locked in a trade war, and neither nation seems willing to back down," said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

Speculation that Beijing will unveil stimulus measures helped Shanghai and Hong Kong stocks buck the downward trend in Asian equities.

Pharmaceutical firms took a heavy hit after Trump said he would be announcing a major levy on the sector.

Europe's most valuable company, weight-loss drug maker Novo Nordisk, and British pharmaceutical giant AstraZeneca both fell around six percent.

- Bond yields rise -

"Perhaps even more alarmingly, US Treasury markets are also experiencing an incredibly aggressive selloff... adding to the evidence that they're losing their traditional haven status," said Jim Reid, managing director at Deutsche Bank.

The sharp rise in yields on US government bonds triggered similar increases to borrowing costs in the UK and Japan, as expectations for global growth and spending diminished.

"It feels like no asset class has been spared as investors continue to price in a growing probability of a US recession," Reid added.

The rising yields may be an indication that investors need to sell bonds to cover losing positions in equity markets, which have fallen sharply in recent weeks.

"When a few asset classes come under pressure, losses can pile up for investors and traders who are then forced to sell other investments including haven assets like government bonds," said XTB research director Kathleen Brooks.

Foreign exchange markets were similarly rattled on Wednesday -- Beijing has allowed the yuan to weaken to a record low against the dollar, while the South Korean won also hit its weakest since 2009 during the global financial crisis.

The dollar took a knock, while the yen rose more than one percent.

- Key figures around 1400 GMT -

New York - Dow: UP 0.8 percent at 37,950.03 points

New York - S&P 500: UP 1.2 percent at 5,043.39

New York - Nasdaq Composite: UP 2.1 percent at 15,586.93

London - FTSE 100: DOWN 2.1 percent at 7,747.28

Paris - CAC 40: DOWN 2.4 percent at 6,932.91

Frankfurt - DAX: DOWN 2.1 percent at 19,864.30

Tokyo - Nikkei 225: DOWN 3.9 percent at 31,714.03 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 20,264.49 (close)

Shanghai - Composite: UP 1.3 percent at 3,186.81 (close)

Euro/dollar: UP at $1.1041 from $1.0959

Pound/dollar: UP at $1.2780 from $1.2766

Dollar/yen: DOWN at 145.05 yen from 146.23 yen on Tuesday

Euro/pound: UP at 86.39 pence from 85.78 pence

West Texas Intermediate: DOWN 3.7 percent at $57.39 per barrel

Brent North Sea Crude: DOWN 3.7 percent at $60.50 per barrel

burs-rl/lth

R.Adler--BTB