-

West Indies hope Christmas comes early in must-win New Zealand Test

West Indies hope Christmas comes early in must-win New Zealand Test

-

Knicks beat Spurs in NBA Cup final to end 52-year trophy drought

-

Khawaja revels in late lifeline as Australia 194-5 in 3rd Ashes Test

Khawaja revels in late lifeline as Australia 194-5 in 3rd Ashes Test

-

Grief and fear as Sydney's Jewish community mourns 'Bondi rabbi'

-

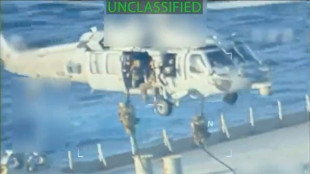

Trump orders blockade of 'sanctioned' Venezuela oil tankers

Trump orders blockade of 'sanctioned' Venezuela oil tankers

-

Brazil Senate to debate bill to slash Bolsonaro jail term

-

New Zealand ex-top cop avoids jail time for child abuse, bestiality offences

New Zealand ex-top cop avoids jail time for child abuse, bestiality offences

-

Eurovision facing fractious 2026 as unity unravels

-

'Extremely exciting': the ice cores that could help save glaciers

'Extremely exciting': the ice cores that could help save glaciers

-

Asian markets drift as US jobs data fails to boost rate cut hopes

-

What we know about Trump's $10 billion BBC lawsuit

What we know about Trump's $10 billion BBC lawsuit

-

Ukraine's lost generation caught in 'eternal lockdown'

-

'Catastrophic mismatch': Safety fears as Jake Paul faces Anthony Joshua

'Catastrophic mismatch': Safety fears as Jake Paul faces Anthony Joshua

-

Australia's Steve Smith ruled out of third Ashes Test

-

Khawaja grabs lifeline as Australia reach 94-2 in 3rd Ashes Test

Khawaja grabs lifeline as Australia reach 94-2 in 3rd Ashes Test

-

Undefeated boxing great Crawford announces retirement

-

Trump says orders blockade of 'sanctioned' Venezuela oil tankers

Trump says orders blockade of 'sanctioned' Venezuela oil tankers

-

UK experiences sunniest year on record

-

Australia holds first funeral for Bondi Beach attack victims

Australia holds first funeral for Bondi Beach attack victims

-

FIFA announces $60 World Cup tickets after pricing backlash

-

Maresca relishes support of Chelsea fans after difficult week

Maresca relishes support of Chelsea fans after difficult week

-

Players pay tribute to Bondi victims at Ashes Test

-

Costa Rican president survives second Congress immunity vote

Costa Rican president survives second Congress immunity vote

-

Married couple lauded for effort to thwart Bondi Beach shootings

-

Australia holds first funerals for Bondi Beach attack victims

Australia holds first funerals for Bondi Beach attack victims

-

Trump has 'alcoholic's personality,' chief of staff says in bombshell interview

-

Rob Reiner killing: son to be charged with double murder

Rob Reiner killing: son to be charged with double murder

-

Chelsea battle into League Cup semis to ease pressure on Maresca

-

Netflix boss promises Warner Bros films would still be seen in cinemas

Netflix boss promises Warner Bros films would still be seen in cinemas

-

Grok spews misinformation about deadly Australia shooting

-

Stocks mostly retreat on US jobs, oil drops on Ukraine hopes

Stocks mostly retreat on US jobs, oil drops on Ukraine hopes

-

Artificial snow woes for Milan-Cortina Winter Olympics organisers

-

Trump imposes full travel bans on seven more countries, Palestinians

Trump imposes full travel bans on seven more countries, Palestinians

-

New Chile leader calls for end to Maduro 'dictatorship'

-

Shiffrin extends slalom domination with Courchevel win

Shiffrin extends slalom domination with Courchevel win

-

Doctor sentenced for supplying ketamine to 'Friends' star Perry

-

Tepid 2026 outlook dents Pfizer shares

Tepid 2026 outlook dents Pfizer shares

-

Rob Reiner murder: son not medically cleared for court

-

FIFA announces $60 World Cup tickets for 'loyal fans'

FIFA announces $60 World Cup tickets for 'loyal fans'

-

Dembele and Bonmati scoop FIFA Best awards

-

Shiffrin dominates first run in Courchevel slalom

Shiffrin dominates first run in Courchevel slalom

-

EU weakens 2035 combustion-engine ban to boost car industry

-

Arctic sees unprecedented heat as climate impacts cascade

Arctic sees unprecedented heat as climate impacts cascade

-

French lawmakers adopt social security budget, suspend pension reform

-

Afrikaners mark pilgrimage day, resonating with their US backers

Afrikaners mark pilgrimage day, resonating with their US backers

-

Lawmakers grill Trump officials on US alleged drug boat strikes

-

Hamraoui loses case against PSG over lack of support after attack

Hamraoui loses case against PSG over lack of support after attack

-

Trump - a year of ruling by executive order

-

Iran refusing to allow independent medical examination of Nobel winner: family

Iran refusing to allow independent medical examination of Nobel winner: family

-

Brazil megacity Sao Paulo struck by fresh water crisis

Stocks consolidate after bumper week buoyed by resilient US economy

US and European stock markets stalled or trimmed gains on Friday after a bullish week buoyed by US data and upbeat company earnings.

New York -- whose S&P 500 and Nasdaq Composite struck record highs on Thursday -- mainly held on to gains but made little further headway. The Dow fell.

In Europe, London's blue-chip FTSE was up though just under its all-time record reached on Tuesday. Paris was flat and Frankfurt slipped a little on profit-taking.

Asian markets had closed higher -- except for Tokyo, which was dragged down ahead of weekend upper-house elections that could spell trouble for Prime Minister Shigeru Ishiba.

The week's strong performance in equities showed that worries -- for now -- were largely being set aside over US President Donald Trump's threats of piling on further tariffs from August 1 if governments did not agree on trade deals.

"With the president toning down his rhetoric, markets are quick to forget tariff risks and concentrate on the positives including a resilient US economy," Kathleen Brooks, research director at trading firm XTB, said.

The overall optimism was fuelled by data suggesting the US economy was still well, with no persuasive indication that the tariffs were pushing up inflation.

A June consumer price index report released this week "does not reveal tariff-induced price increases, but a closer look shows clear signs" they could be building, said Holger Schmieding, chief economist at Berenberg bank.

"We expect (US) annual core inflation to approach 3.5 percent by year-end and the Fed to hold the policy rate at the 4.25-4.50 percent target range," he said.

The dollar retreated on Friday as traders bet on the Federal Reserve cutting US interest rates.

One Federal Reserve governor, Christopher Waller, on Thursday argued for a July rate cut, saying he saw limited upside inflation risks.

Trump this week denied he was planning to sack Fed boss Jerome Powell, whom he had been urging to reduce US borrowing costs to further boost the world's top economy.

A meeting in South Africa of G20 finance ministers on Friday pointedly stressed that "central bank independence is crucial" around the world.

In corporate news, American Express followed big US banks in reporting better-than-expected second-quarter results.

Results from streaming giant Netflix also outperformed -- though its share price slipped on Friday as investors weighed whether it had been overvalued.

In London, British luxury brand Burberry said sales had not fallen as much as analysts expected, "which is a sign that the company's new strategic direction could be working", said XTB's Brooks. Its shares rose nearly six percent.

On the downside, shares in GlaxoSmithKline slid more than four percent after the British pharmaceutical giant reported a US regulatory setback for its blood cancer drug Blenrep.

Oil prices initially rose after fresh EU sanctions aimed at crimping Russia's crude exports, to pressure Moscow over its war on Ukraine. But then they fell back.

- Key figures at around 1545 GMT -

New York - Dow: DOWN 0.3 percent at 44,346.88 points

New York - S&P 500: FLAT at 6,299.17

New York - Nasdaq Composite: FLAT at 20,893.97

London - FTSE 100: UP 0.2 percent at 8,992.12 (close)

Paris - CAC 40: FLAT at 7,822.67 (close)

Frankfurt - DAX: DOWN 0.3 percent at 24,289.51 (close)

Tokyo - Nikkei 225: DOWN 0.2 percent at 39,819.11 (close)

Hong Kong - Hang Seng Index: UP 1.3 percent at 24,825.66 (close)

Shanghai - Composite: UP 0.5 percent at 3,534.48 (close)

Euro/dollar: UP at $1.1652 from $1.1600 on Thursday

Pound/dollar: UP at $1.3439 from $1.3415

Dollar/yen: DOWN at 148.49 yen from 148.60 yen

Euro/pound: UP at 86.71 pence from 86.43 pence

Brent North Sea Crude: DOWN 0.1 percent at $69.44 per barrel

West Texas Intermediate: FLAT at $66.24 per barrel

burs/rmb/djt

O.Krause--BTB