-

Australia drug kingpin walks free after police informant scandal

Australia drug kingpin walks free after police informant scandal

-

Dupont wants more after France sparkle and then wobble against Ireland

-

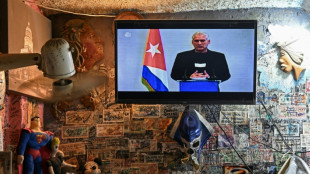

Cuba says willing to talk to US, 'without pressure'

Cuba says willing to talk to US, 'without pressure'

-

NFL names 49ers to face Rams in Aussie regular-season debut

-

Bielle-Biarrey sparkles as rampant France beat Ireland in Six Nations

Bielle-Biarrey sparkles as rampant France beat Ireland in Six Nations

-

Flame arrives in Milan for Winter Olympics ceremony

-

Olympic big air champion Su survives scare

Olympic big air champion Su survives scare

-

89 kidnapped Nigerian Christians released

-

Cuba willing to talk to US, 'without pressure'

Cuba willing to talk to US, 'without pressure'

-

Famine spreading in Sudan's Darfur, UN-backed experts warn

-

2026 Winter Olympics flame arrives in Milan

2026 Winter Olympics flame arrives in Milan

-

Congo-Brazzaville's veteran president declares re-election run

-

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

-

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

-

Leicester at risk of relegation after six-point deduction

Leicester at risk of relegation after six-point deduction

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Trump urges new nuclear treaty after Russia agreement ends

Trump urges new nuclear treaty after Russia agreement ends

-

'Burned in their houses': Nigerians recount horror of massacre

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Emotional reunions, dashed hopes as Ukraine soldiers released

-

Bad Bunny promises to bring Puerto Rican culture to Super Bowl

Bad Bunny promises to bring Puerto Rican culture to Super Bowl

-

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

-

Lower pollution during Covid boosted methane: study

Lower pollution during Covid boosted methane: study

-

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

-

England's Feyi-Waboso in injury scare ahead of Six Nations opener

England's Feyi-Waboso in injury scare ahead of Six Nations opener

-

EU defends Spain after Telegram founder criticism

-

Novo Nordisk vows legal action to protect Wegovy pill

Novo Nordisk vows legal action to protect Wegovy pill

-

Swiss rivalry is fun -- until Games start, says Odermatt

-

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

-

Deadly storm sparks floods in Spain, disrupts Portugal vote

-

Ukrainian flag bearer proud to show his country is still standing

Ukrainian flag bearer proud to show his country is still standing

-

Carney scraps Canada EV sales mandate

-

Morocco says evacuated 140,000 people due to severe weather

Morocco says evacuated 140,000 people due to severe weather

-

Spurs boss Frank says Romero outburst 'dealt with internally'

-

Giannis suitors make deals as NBA trade deadline nears

Giannis suitors make deals as NBA trade deadline nears

-

Carrick stresses significance of Munich air disaster to Man Utd history

-

Record January window for transfers despite drop in spending

Record January window for transfers despite drop in spending

-

'Burned inside their houses': Nigerians recount horror of massacre

-

Iran, US prepare for Oman talks after deadly protest crackdown

Iran, US prepare for Oman talks after deadly protest crackdown

-

Winter Olympics opening ceremony nears as virus disrupts ice hockey

-

Mining giant Rio Tinto abandons Glencore merger bid

Mining giant Rio Tinto abandons Glencore merger bid

-

Davos forum opens probe into CEO Brende's Epstein links

-

ECB warns of stronger euro impact, holds rates

ECB warns of stronger euro impact, holds rates

-

Famine spreading in Sudan's Darfur, warn UN-backed experts

-

Lights back on in eastern Cuba after widespread blackout

Lights back on in eastern Cuba after widespread blackout

-

Russia, US agree to resume military contacts at Ukraine talks

-

Greece aims to cut queues at ancient sites with new portal

Greece aims to cut queues at ancient sites with new portal

-

No time frame to get Palmer in 'perfect' shape - Rosenior

-

Stocks fall as tech valuation fears stoke volatility

Stocks fall as tech valuation fears stoke volatility

-

US Olympic body backs LA28 leadership amid Wasserman scandal

US stocks rise as fears over banks, trade war ease

US stock markets rose Friday as concerns over bank loans and an escalation in the US-China trade war eased.

Sentiment had soured Thursday after two regional US banks disclosed issues with loans, sparking a sell-off in banking stocks.

"As well as ongoing trade war uncertainty between the US and China, sluggish global growth and stretched valuations, credit risk in US regional banks has added to the list of growing worries," said Fawad Razaqzada, market analyst at City Index and Forex.com.

But Wall Street's main indices were in the green in morning trading as shares in regional banks rose following the sell-off.

Investors have been nervously watching the US banking sector since parts company First Brands and subprime lender Tricolor filed for bankruptcy in September, with the former owing billions to lenders.

Those fears deepened this week after Zions Bancorp disclosed a $50-million charge tied to commercial loans from its California arm, while Western Alliance said a borrower failed to deliver the promised collateral.

Zion Bancorp shares were up 5.5 percent on Friday after having plunged 13.1 percent the previous day, while those of other regional banks also recovered some of their losses.

"It's also worth considering that the banking sell-off may be overdone," said David Morrison, analyst at investment platform Trade Nation.

"It's possible that these are all isolated incidents which are completely unconnected," Morrison said.

"Then again, a few analysts have been warning about a lack of transparency across private credit and private equity for a while now. So, there’s certainly a risk of more bad news to come."

In Europe, London and Frankfurt were in the red in afternoon deals but Paris rose after French Prime Minister Sebastien Lecornu survived two no-confidence votes the previous day.

Deutsche Bank shares slumped 4.6 percent, while French bank Societe Generale shed 3.9 percent and Britain's Barclays dropped around four percent.

Hong Kong and Shanghai dropped more than two percent, and Tokyo also closed lower.

The bank worries sent safe-haven gold to another record, of $4,379.93 an ounce, and led investors to pile into government bonds.

Investors also remained on edge as Washington and Beijing exchanged salvos this week on trade and shipping, after Trump warned he would hit China with 100-percent tariffs over its rare-earth export controls.

Analysts, however, said Trump eased some concern by saying in a Fox Business interview that the higher tariffs were "not sustainable".

Adding to unease, lawmakers in Washington are still no closer to ending a government shutdown that has delayed the release of key economic data used by the Federal Reserve to decide on policy.

Still, expectations the Fed will cut interest rates at least once more this year has given traders some support.

- Key figures at around 1355 GMT -

New York - Dow: UP 0.4 percent at 46,149.99 points

New York - S&P 500: UP 0.2 percent at 6,640.78

New York - Nasdaq Composite: UP 0.1 percent at 22,584.51

London - FTSE 100: DOWN 0.6 percent at 9,379.13

Paris - CAC 40: UP 0.3 percent at 8,209.62

Frankfurt - DAX: DOWN 1.3 percent at 23,949.55

Tokyo - Nikkei 225: DOWN 1.4 percent at 47,582.15 (close)

Hong Kong - Hang Seng Index: DOWN 2.5 percent at 25,247.10 (close)

Shanghai - Composite: DOWN 2.0 percent at 3,839.76 (close)

New York - Dow: DOWN 0.7 percent at 45,952.24 (close)

Euro/dollar: DOWN $1.1664 from $1.1692 on Thursday

Pound/dollar: DOWN at $1.3398 from $1.3436

Dollar/yen: UP at 150.49 yen from 150.35 yen

Euro/pound: DOWN at 87.01 percent from 87.02 pence

West Texas Intermediate: UP 0.2 percent at $57.10 per barrel

Brent North Sea Crude: UP 0.2 percent at $60.16 per barrel

A.Gasser--BTB