-

UK royal finances in spotlight after Andrew's downfall

UK royal finances in spotlight after Andrew's downfall

-

Diplomatic shift and elections see Armenia battle Russian disinformation

-

Undercover probe finds Australian pubs short-pouring beer

Undercover probe finds Australian pubs short-pouring beer

-

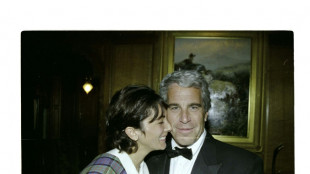

Epstein fallout triggers resignations, probes

-

The banking fraud scandal rattling Brazil's elite

The banking fraud scandal rattling Brazil's elite

-

Party or politics? All eyes on Bad Bunny at Super Bowl

-

Man City confront Anfield hoodoo as Arsenal eye Premier League crown

Man City confront Anfield hoodoo as Arsenal eye Premier League crown

-

Patriots seek Super Bowl history in Seahawks showdown

-

Gotterup leads Phoenix Open as Scheffler struggles

Gotterup leads Phoenix Open as Scheffler struggles

-

In show of support, Canada, France open consulates in Greenland

-

'Save the Post': Hundreds protest cuts at famed US newspaper

'Save the Post': Hundreds protest cuts at famed US newspaper

-

New Zealand deputy PM defends claims colonisation good for Maori

-

Amazon shares plunge as AI costs climb

Amazon shares plunge as AI costs climb

-

Galthie lauds France's remarkable attacking display against Ireland

-

Argentina govt launches account to debunk 'lies' about Milei

Argentina govt launches account to debunk 'lies' about Milei

-

Australia drug kingpin walks free after police informant scandal

-

Dupont wants more after France sparkle and then wobble against Ireland

Dupont wants more after France sparkle and then wobble against Ireland

-

Cuba says willing to talk to US, 'without pressure'

-

NFL names 49ers to face Rams in Aussie regular-season debut

NFL names 49ers to face Rams in Aussie regular-season debut

-

Bielle-Biarrey sparkles as rampant France beat Ireland in Six Nations

-

Flame arrives in Milan for Winter Olympics ceremony

Flame arrives in Milan for Winter Olympics ceremony

-

Olympic big air champion Su survives scare

-

89 kidnapped Nigerian Christians released

89 kidnapped Nigerian Christians released

-

Cuba willing to talk to US, 'without pressure'

-

Famine spreading in Sudan's Darfur, UN-backed experts warn

Famine spreading in Sudan's Darfur, UN-backed experts warn

-

2026 Winter Olympics flame arrives in Milan

-

Congo-Brazzaville's veteran president declares re-election run

Congo-Brazzaville's veteran president declares re-election run

-

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

-

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

-

Leicester at risk of relegation after six-point deduction

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Trump urges new nuclear treaty after Russia agreement ends

-

'Burned in their houses': Nigerians recount horror of massacre

'Burned in their houses': Nigerians recount horror of massacre

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Emotional reunions, dashed hopes as Ukraine soldiers released

Emotional reunions, dashed hopes as Ukraine soldiers released

-

Bad Bunny promises to bring Puerto Rican culture to Super Bowl

-

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

-

Lower pollution during Covid boosted methane: study

-

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

-

England's Feyi-Waboso in injury scare ahead of Six Nations opener

-

EU defends Spain after Telegram founder criticism

EU defends Spain after Telegram founder criticism

-

Novo Nordisk vows legal action to protect Wegovy pill

-

Swiss rivalry is fun -- until Games start, says Odermatt

Swiss rivalry is fun -- until Games start, says Odermatt

-

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

-

Deadly storm sparks floods in Spain, disrupts Portugal vote

Deadly storm sparks floods in Spain, disrupts Portugal vote

-

Ukrainian flag bearer proud to show his country is still standing

-

Carney scraps Canada EV sales mandate

Carney scraps Canada EV sales mandate

-

Morocco says evacuated 140,000 people due to severe weather

-

Spurs boss Frank says Romero outburst 'dealt with internally'

Spurs boss Frank says Romero outburst 'dealt with internally'

-

Giannis suitors make deals as NBA trade deadline nears

Carbon credits 'ineffective', says corporate climate watchdog

The world's top judge of corporate climate action on Tuesday described carbon credits as "ineffective" at addressing global warming and a risk for companies trying to reach net zero targets.

The use of credits by companies to make claims of carbon neutrality has long been challenged and the findings by the influential Science Based Targets Initiative (SBTi) were much anticipated.

SBTi is the gold standard for assessing the net zero plans of big businesses and the tick of approval allows companies to say their climate pledges align with science.

But the nonprofit, which is backed by the UN and WWF, sparked a staff revolt in April when it proposed allowing companies to use more carbon credits to meet their climate goals.

In response to demands that the CEO and board resign, SBTi promised to review third-party literature on carbon credits and present its expert findings in July.

On Tuesday, it said the evidence "suggests that various types of carbon credits are ineffective" and that using such offsets poses "clear risks" for companies.

"This includes potential unintended effects of hindering the net-zero transformation," stated one of the reports published on the SBTi website on Tuesday.

There was no evidence submitted to the review "that identified characteristics or operating conditions associated with effective carbon credits and projects", it added.

"The evaluation of evidence of carbon credit effectiveness reinforces what many academics have been saying for decades: carbon credits of any sort should not be used to compensate for fossil emissions," said Doreen Stabinsky, who sits on SBTI's technical council, an independent advisory body.

Carbon credits are supposed to help tackle global warming by funding activities that reduce or avoid the release of planet-heating emissions, such as protecting tropical forests or peatlands.

Critics say they allow companies that buy them to keep polluting without taking the necessary steps to clean up their act.

SBTi had taken a narrow view on carbon credits, requiring companies take action first to reduce their greenhouse gas output, and only turn to offsets for the remaining, hardest-to-cut emissions.

Then in April, its board flagged relaxing these rules in regards to offsetting Scope 3 emissions, which occur in the value chain, and represent the lion's share of the carbon footprints of most companies.

The proposal was seen as a major shift for a widely respected organisation that has verified the climate pledges of nearly 5,800 companies and financial institutions.

Gilles Dufrasne from Carbon Market Watch, a think tank, said SBTi's reviewed position was a "clear rebuttal" of its earlier move.

"This paper sets the record straight for SBTi, and is proof that SBTi staff are performing high-quality, unbiased work," he said in a statement.

SBTI's chief executive stepped down in July citing personal reasons.

The initiative plans to publish a draft update to its overall net zero corporate standards in late 2024, and said its guidance remained unchanged until then.

R.Adler--BTB