-

Rahm accuses DP World Tour of 'exorting players' with LIV deal

Rahm accuses DP World Tour of 'exorting players' with LIV deal

-

Drones hit US embassy as vengeful Iran targets Mideast cities

-

Mideast war exposes fragile oil, gas dependency

Mideast war exposes fragile oil, gas dependency

-

How the T20 World Cup semi-finalists shape up

-

Oil extends gains and stocks dive as Middle East war spreads

Oil extends gains and stocks dive as Middle East war spreads

-

Warming El Nino may return later this year: UN

-

Trump says US-UK relationship 'not like it used to be'

Trump says US-UK relationship 'not like it used to be'

-

Eight years on, trial begins in Argentina submarine implosion

-

Beijing votes out three generals from political advisory body

Beijing votes out three generals from political advisory body

-

Oil extends gains and stocks dive as Iran conflict spreads

-

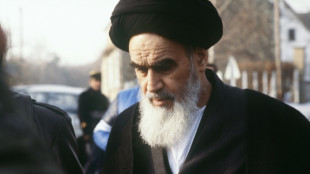

The French village where Ayatollah Khomeini fomented Iran's revolution

The French village where Ayatollah Khomeini fomented Iran's revolution

-

South Africa, India eye T20 World Cup rematch as semi-finals begin

-

Trump hosts Germany's Merz for talks eclipsed by Mideast war

Trump hosts Germany's Merz for talks eclipsed by Mideast war

-

Second-hand phones surf rising green consumer wave

-

Pakistanis at remote border describe scramble to leave Iran

Pakistanis at remote border describe scramble to leave Iran

-

China votes to oust three generals from political advisory body

-

Murray scores 45 as Nuggets hold off Jazz

Murray scores 45 as Nuggets hold off Jazz

-

Five things about the 2026 F1 season

-

Scrum-half Gibson-Park: Ireland's 'petit general'

Scrum-half Gibson-Park: Ireland's 'petit general'

-

Geopolitical storm leaves isolated Greenlanders hanging by a telecoms thread

-

Myong hat-trick as North Korea cruise at Women's Asian Cup

Myong hat-trick as North Korea cruise at Women's Asian Cup

-

AI disinformation turns Nepal polls into 'digital battleground'

-

New Israel, Iran attacks across region: Latest developments in Middle East war

New Israel, Iran attacks across region: Latest developments in Middle East war

-

China's overstretched healthcare looks to AI boom

-

Oil extends gains and stocks drop as Iran conflict spreads

Oil extends gains and stocks drop as Iran conflict spreads

-

Rituals of resilience: how Afghan women stay sane in their 'cage'

-

Strait of Hormuz impasse squeezes world shipping

Strait of Hormuz impasse squeezes world shipping

-

Fresh Israel, Iran attacks across region: Latest developments in Middle East war

-

Oscar-nominated Iranian doc offers different vision of leadership

Oscar-nominated Iranian doc offers different vision of leadership

-

Oscar-nominated docs take on hot-button US social issues

-

'I couldn't breathe': The dark side of Bolivia's silver boom

'I couldn't breathe': The dark side of Bolivia's silver boom

-

Trump warns of longer Iran war as Riyadh, Beirut hit

-

Underground party scene: Israelis celebrate Purim in air raid shelters

Underground party scene: Israelis celebrate Purim in air raid shelters

-

Flowers, music, and soldiers at funeral of drug lord

-

'Safety and wellbeing' will guide F1 Mideast planning: FIA chief

'Safety and wellbeing' will guide F1 Mideast planning: FIA chief

-

Trump to attend White House Correspondents' dinner

-

Will Iran's missiles drain US interceptor stocks?

Will Iran's missiles drain US interceptor stocks?

-

Trump warns of longer Iran war as violence spreads

-

Energy infrastructure emerges as war target, lifting prices

Energy infrastructure emerges as war target, lifting prices

-

Trump warns of longer Iran war, Rubio points at Israel

-

US urges to 'depart now' from Middle East: Latest developments in Iran war

US urges to 'depart now' from Middle East: Latest developments in Iran war

-

Ecuador launches joint anti-drug operations with US

-

Getafe deal flat Real Madrid La Liga title race blow

Getafe deal flat Real Madrid La Liga title race blow

-

Rubio, Hezbollah and Qatar: Latest developments in Iran war

-

Rubio says Israel's strike plan triggered US attack on Iran

Rubio says Israel's strike plan triggered US attack on Iran

-

'Thank you, madam president': Melania Trump leads UN Security Council as Iran war rages

-

Bombing Iran, Trump has 'epic fury' but endgame undefined

Bombing Iran, Trump has 'epic fury' but endgame undefined

-

US slaps sanctions on Rwanda military over DR Congo 'violation'

-

US Congress to debate Trump's war powers

US Congress to debate Trump's war powers

-

US appeals court denies Trump bid to delay tariff refund lawsuits

Asian markets mixed as torrid week draws to close

Asian markets were mixed on Friday, at the end of a broadly damaging week for global investors as the Federal Reserve gave notice that the days of ultra-cheap cash were coming to an end quicker than some had envisaged.

Rising tensions between Russia and the West over the Ukraine crisis are adding to the increasingly fractious mood on trading floors, where a selling frenzy this month has wiped around $7 trillion off valuations around the world.

While recent data has shown economies picking up as they reopen and the Covid-19 threat wanes, commentators warn that the volatility seen in recent months will likely continue for the near-term as the Fed tightens policy.

The US central bank has in recent weeks taken a more hawkish turn as it looks to fight four-decade-high inflation by ramping up interest rates and offloading its vast bond holdings that have helped keep costs down.

Officials plan a hike in March, but debate among investors is now on by how much and how many more will follow. Some have suggested a 50 basis point rise and another possible five before 2023.

Fed boss Jerome Powell's commented this week that the economy, which grew last year at its fastest pace since the 80s, is well placed to handle the tightening.

Markets have rallied for the best part of two years to record or multi-year highs, and analysts say a hefty pullback is to be expected, owing to profit-taking and the removal of a pandemic-era central bank and government stimulus.

"Really what we are seeing is historic intraday volatility," Chris Murphy, of Susquehanna International Group, told Bloomberg Television. "It's been a pretty amazing ride so far this year."

And Federated Hermes senior global equities portfolio manager Lewis Grant said the Covid threat looked like being replaced by a "fractious geo-political landscape".

"Global supply chain disruptions look to worsen as the relationship between Russia and the West deteriorates" as Moscow massed troops on Ukraine's border.

"Russia's supply of natural gas to Western Europe could further spark volatility across financial markets and as we turn the corner on the pandemic we now see a possible conflict as one of the biggest threats to markets in 2022," he warned.

On Wall Street, all three main indexes ended in the red -- reversing early gains as they had the day before -- with the Nasdaq leading the way again as tech firms are more susceptible to higher borrowing costs.

Asia fared a little better, with bargain-buying providing support after Thursday's steep drops.

Tokyo and Sydney piled on around two percent apiece -- while Singapore, Seoul, Manila and Jakarta were also up.

But Hong Kong lost more than one percent, while Shanghai and Wellington were also deep in negative territory.

Still, markets strategist Louis Navellier remains upbeat.

"While the Fed's intention of getting tougher on inflation will likely result in interest rates creeping up, the reopening of the US and global economies post-pandemic should result in upside growth surprises," he said in a note.

"Already Covid hospitalisation rates have peaked and are falling, and health restrictions are being lifted in many locations.

"The recent volatility may continue to play out as the Fed officially takes away the punch bowl of monetary support, but growth should continue to offset inflation and interest rate increases."

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: UP 2.1 percent at 26,720.06 (break)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 23,548.75

Shanghai - Composite: DOWN 0.8 percent at 3,366.72

Dollar/yen: UP at 115.45 yen from 115.36 yen late Thursday

Euro/dollar: UP at $1.1149 from $1.1147

Pound/dollar: UP at $1.3395 from $1.3381

Euro/pound: DOWN at 83.23 pence from 83.27 pence

West Texas Intermediate: UP 0.5 percent at $87.07 per barrel

Brent North Sea crude: UP 0.4 percent at $89.68 per barrel

New York - Dow: FLAT at 34,160.78 (close)

London - FTSE 100: UP 1.1 percent at 7,554.31 (close)

-- Bloomberg News contributed to this story --

F.Pavlenko--BTB