-

World record-holders Walsh, Smith grab wins at US Open

World record-holders Walsh, Smith grab wins at US Open

-

Ukraine, US to meet for third day, agree 'real progress' depends on Russia

-

Double wicket strike as New Zealand eye victory over West Indies

Double wicket strike as New Zealand eye victory over West Indies

-

Peace medal and YMCA: Trump steals the show at World Cup draw

-

NBA legend Jordan in court as NASCAR anti-trust case begins

NBA legend Jordan in court as NASCAR anti-trust case begins

-

How coaches reacted to 2026 World Cup draw

-

Glasgow down Sale as Stomers win at Bayonne in Champions Cup

Glasgow down Sale as Stomers win at Bayonne in Champions Cup

-

Trump takes aim at Europe in new security strategy

-

Witness in South Africa justice-system crimes probe shot dead

Witness in South Africa justice-system crimes probe shot dead

-

Tuchel urges England not to get carried away plotting route to World Cup glory

-

Russian ambassador slams EU frozen assets plan for Ukraine

Russian ambassador slams EU frozen assets plan for Ukraine

-

2026 World Cup draw is kind to favorites as Trump takes limelight

-

WHO chief upbeat on missing piece of pandemic treaty

WHO chief upbeat on missing piece of pandemic treaty

-

US vaccine panel upends hepatitis B advice in latest Trump-era shift

-

Ancelotti says Brazil have 'difficult' World Cup group with Morocco

Ancelotti says Brazil have 'difficult' World Cup group with Morocco

-

Kriecmayr wins weather-disrupted Beaver Creek super-G

-

Ghostwriters, polo shirts, and the fall of a landmark pesticide study

Ghostwriters, polo shirts, and the fall of a landmark pesticide study

-

Mixed day for global stocks as market digest huge Netflix deal

-

Fighting erupts in DR Congo a day after peace deal signed

Fighting erupts in DR Congo a day after peace deal signed

-

England boss Tuchel wary of 'surprise' in World Cup draw

-

10 university students die in Peru restaurant fire

10 university students die in Peru restaurant fire

-

'Sinners' tops Critics Choice nominations

-

Netflix's Warner Bros. acquisition sparks backlash

Netflix's Warner Bros. acquisition sparks backlash

-

France probes mystery drone flight over nuclear sub base

-

Frank Gehry: five key works

Frank Gehry: five key works

-

US Supreme Court to weigh Trump bid to end birthright citizenship

-

Frank Gehry, master architect with a flair for drama, dead at 96

Frank Gehry, master architect with a flair for drama, dead at 96

-

'It doesn't make sense': Trump wants to rename American football

-

A day after peace accord signed, shelling forces DRC locals to flee

A day after peace accord signed, shelling forces DRC locals to flee

-

Draw for 2026 World Cup kind to favorites as Trump takes center stage

-

Netflix to buy Warner Bros. in deal of the decade

Netflix to buy Warner Bros. in deal of the decade

-

US sanctions equate us with drug traffickers: ICC dep. prosecutor

-

Migration and crime fears loom over Chile's presidential runoff

Migration and crime fears loom over Chile's presidential runoff

-

French officer charged after police fracture woman's skull

-

Fresh data show US consumers still strained by inflation

Fresh data show US consumers still strained by inflation

-

Eurovision reels from boycotts over Israel

-

Trump takes centre stage as 2026 World Cup draw takes place

Trump takes centre stage as 2026 World Cup draw takes place

-

Trump all smiles as he wins FIFA's new peace prize

-

US panel votes to end recommending all newborns receive hepatitis B vaccine

US panel votes to end recommending all newborns receive hepatitis B vaccine

-

Title favourite Norris reflects on 'positive' Abu Dhabi practice

-

Stocks consolidate as US inflation worries undermine Fed rate hopes

Stocks consolidate as US inflation worries undermine Fed rate hopes

-

Volcanic eruptions may have brought Black Death to Europe

-

Arsenal the ultimate test for in-form Villa, says Emery

Arsenal the ultimate test for in-form Villa, says Emery

-

Emotions high, hope alive after Nigerian school abduction

-

Another original Hermes Birkin bag sells for $2.86 mn

Another original Hermes Birkin bag sells for $2.86 mn

-

11 million flock to Notre-Dame in year since rising from devastating fire

-

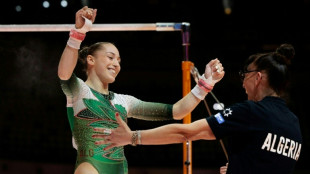

Gymnast Nemour lifts lid on 'humiliation, tears' on way to Olympic gold

Gymnast Nemour lifts lid on 'humiliation, tears' on way to Olympic gold

-

Lebanon president says country does not want war with Israel

-

France takes anti-drone measures after flight over nuclear sub base

France takes anti-drone measures after flight over nuclear sub base

-

Signing up to DR Congo peace is one thing, delivery another

Modest momentum for US stocks after tech-fuelled Asia rout

US markets moved ahead while European counterparts marked time Friday in response to sharp losses in Asia at the end of a week which has seen heightened fears of a bursting AI bubble.

A blockbuster earnings report from chip bellwether Nvidia on Wednesday seemed to soothe concerns that vast investments in the artificial intelligence sector may have been overdone.

Nvidia was down 0.3 percent, shoring up earlier losses, mid-session on Wall Street as warnings grew that the tech-led rally may have run its course across equities -- which has seen several markets hit record highs and companies clock eye-watering capitalisations.

Adding to unease was mixed US jobs data Thursday that added to expectations that the Federal Reserve could decide against cutting interest rates in December.

That unease spread to Asia, with Tokyo, Hong Kong and Shanghai all ending the week down almost 2.5 percent at the close.

The clouds began to clear to a degree, however, as the Dow stood up 0.9 percent more than two hours in, while the tech-heavy Nasdaq and the broader-based S&P 500 both added more than half of one percent.

"This week's sharp sell-off in US stocks and cryptocurrencies briefly stalled as Fed December rate cut expectations increased from 41 percent to 73 percent after New York Fed President John Williams suggested the Fed may cut rates again soon," said Axel Rudolph, senior technical analyst at IG, even as the Nasdaq headed for a third straight losing week.

Europe lacked direction as London ended just a sliver in the green, Paris was flat -- although Ubisoft provided a glimmer of light with a 4.5 percent rise -- while Frankfurt lost 0.8 percent.

French video game company Ubisoft resumed trading in Paris, a week after stunning investors by postponing its results announcement without an explanation, triggering speculation in the video gaming world, including on a possible takeover operation in a consolidating industry.

The "Assassin's Creed" maker said Friday the move was due to a simple "restatement" of its half-yearly results after new auditors found problems with the way it had accounted for a partnership.

Ubisoft's stock initially soared 11.5 percent before settling back at 7.06 euros -- the company's shares are today some 40 percent lower than a year ago.

"European markets are showing their relative resilience" Friday compared to sharper falls on tech-heavy indices in Asia, noted Joshua Mahony, chief market analyst at trading group Scope Markets.

The rush from risk assets saw bitcoin hit a seven-month low at $81,569.79 before pulling back to around $83,500 -- extending a sell-off suffered since its record high above $126,200 last month.

"The price action across markets has been prolific, and we've seen some truly impressive reversals in risk assets," said analyst Chris Weston at broker Pepperstone.

"Sentiment in so many markets remains highly challenged, and we've seen new evidence that managers are dumping their 2025 winners -- raising expectations that the path of least resistance is for risk to trade lower in the near-term," he added.

- Key figures at around 1645 GMT -

New York - Dow: UP 0.9 percent at 46,181.56 points

New York - S&P 500: UP 0.7 percent at 6,585.36

New York - Nasdaq Composite: UP 0.5 percent at 22,193.86

London - FTSE 100: UP 0.1 percent at 9,539.71 (close)

Paris - CAC 40: FLAT at 7,982.65 (close)

Frankfurt - DAX: DOWN 0.8 percent at 23,091.87 (close)

Tokyo - Nikkei 225: DOWN 2.4 percent at 48,625.88 (close)

Hong Kong - Hang Seng Index: DOWN 2.4 percent at 25,220.02 (close)

Shanghai - Composite: DOWN 2.5 percent at 3,834.89 (close)

Dollar/yen: DOWN at 156.88 yen from 157.55 yen on Thursday

Euro/dollar: DOWN at $1.1495 from $1.1525

Pound/dollar: UP at $1.3086 from $1.3070

Euro/pound: DOWN at 87.84 from 88.18 pence

Brent North Sea Crude: DOWN 1.7 percent at $62.19 per barrel

West Texas Intermediate: DOWN 2.0 percent at $57.82 per barrel

P.Anderson--BTB