-

Will EU give ground on 2035 combustion-engine ban?

Will EU give ground on 2035 combustion-engine ban?

-

England nemesis Starc stretches Australia lead in Gabba Ashes Test

-

Banana skin 'double whammy' derails McIlroy at Australian Open

Banana skin 'double whammy' derails McIlroy at Australian Open

-

Epic Greaves double ton earns West Indies draw in first NZ Test

-

Thunder roll to 14th straight NBA win, Celtics beat depleted Lakers

Thunder roll to 14th straight NBA win, Celtics beat depleted Lakers

-

Myanmar citizens head to early polls in Bangkok

-

Starvation fears as more heavy rain threaten flood-ruined Indonesia

Starvation fears as more heavy rain threaten flood-ruined Indonesia

-

Sri Lanka unveils cyclone aid plan as rains persist

-

Avatar 3 aims to become end-of-year blockbuster

Avatar 3 aims to become end-of-year blockbuster

-

Contenders plot path to 2026 World Cup glory after Trump steals show at draw

-

Greaves leads dramatic West Indies run chase in NZ Test nail-biter

Greaves leads dramatic West Indies run chase in NZ Test nail-biter

-

World record-holders Walsh, Smith grab wins at US Open

-

Ukraine, US to meet for third day, agree 'real progress' depends on Russia

Ukraine, US to meet for third day, agree 'real progress' depends on Russia

-

Double wicket strike as New Zealand eye victory over West Indies

-

Peace medal and YMCA: Trump steals the show at World Cup draw

Peace medal and YMCA: Trump steals the show at World Cup draw

-

NBA legend Jordan in court as NASCAR anti-trust case begins

-

How coaches reacted to 2026 World Cup draw

How coaches reacted to 2026 World Cup draw

-

Glasgow down Sale as Stomers win at Bayonne in Champions Cup

-

Trump takes aim at Europe in new security strategy

Trump takes aim at Europe in new security strategy

-

Witness in South Africa justice-system crimes probe shot dead

-

Tuchel urges England not to get carried away plotting route to World Cup glory

Tuchel urges England not to get carried away plotting route to World Cup glory

-

Russian ambassador slams EU frozen assets plan for Ukraine

-

2026 World Cup draw is kind to favorites as Trump takes limelight

2026 World Cup draw is kind to favorites as Trump takes limelight

-

WHO chief upbeat on missing piece of pandemic treaty

-

US vaccine panel upends hepatitis B advice in latest Trump-era shift

US vaccine panel upends hepatitis B advice in latest Trump-era shift

-

Ancelotti says Brazil have 'difficult' World Cup group with Morocco

-

Kriecmayr wins weather-disrupted Beaver Creek super-G

Kriecmayr wins weather-disrupted Beaver Creek super-G

-

Ghostwriters, polo shirts, and the fall of a landmark pesticide study

-

Mixed day for global stocks as market digest huge Netflix deal

Mixed day for global stocks as market digest huge Netflix deal

-

Fighting erupts in DR Congo a day after peace deal signed

-

England boss Tuchel wary of 'surprise' in World Cup draw

England boss Tuchel wary of 'surprise' in World Cup draw

-

10 university students die in Peru restaurant fire

-

'Sinners' tops Critics Choice nominations

'Sinners' tops Critics Choice nominations

-

Netflix's Warner Bros. acquisition sparks backlash

-

France probes mystery drone flight over nuclear sub base

France probes mystery drone flight over nuclear sub base

-

Frank Gehry: five key works

-

US Supreme Court to weigh Trump bid to end birthright citizenship

US Supreme Court to weigh Trump bid to end birthright citizenship

-

Frank Gehry, master architect with a flair for drama, dead at 96

-

'It doesn't make sense': Trump wants to rename American football

'It doesn't make sense': Trump wants to rename American football

-

A day after peace accord signed, shelling forces DRC locals to flee

-

Draw for 2026 World Cup kind to favorites as Trump takes center stage

Draw for 2026 World Cup kind to favorites as Trump takes center stage

-

Netflix to buy Warner Bros. in deal of the decade

-

US sanctions equate us with drug traffickers: ICC dep. prosecutor

US sanctions equate us with drug traffickers: ICC dep. prosecutor

-

Migration and crime fears loom over Chile's presidential runoff

-

French officer charged after police fracture woman's skull

French officer charged after police fracture woman's skull

-

Fresh data show US consumers still strained by inflation

-

Eurovision reels from boycotts over Israel

Eurovision reels from boycotts over Israel

-

Trump takes centre stage as 2026 World Cup draw takes place

-

Trump all smiles as he wins FIFA's new peace prize

Trump all smiles as he wins FIFA's new peace prize

-

US panel votes to end recommending all newborns receive hepatitis B vaccine

| RBGPF | 0% | 78.35 | $ | |

| AZN | 0.17% | 90.18 | $ | |

| RELX | -0.55% | 40.32 | $ | |

| RYCEF | -0.34% | 14.62 | $ | |

| CMSC | -0.21% | 23.43 | $ | |

| SCS | -0.56% | 16.14 | $ | |

| BTI | -1.81% | 57.01 | $ | |

| VOD | -1.31% | 12.47 | $ | |

| NGG | -0.66% | 75.41 | $ | |

| GSK | -0.33% | 48.41 | $ | |

| BCC | -1.66% | 73.05 | $ | |

| CMSD | -0.3% | 23.25 | $ | |

| RIO | -0.92% | 73.06 | $ | |

| JRI | 0.29% | 13.79 | $ | |

| BCE | 1.4% | 23.55 | $ | |

| BP | -3.91% | 35.83 | $ |

Asian markets rise as US rate cut bets temper Japan bond unease

Stocks rose Tuesday following the previous day's stutter as more weak US data helped solidify US interest rate cut optimism and tempered nervousness over rising Japanese bond yields.

Expectations the Federal Reserve will lower borrowing costs has provided a boon to markets in the past few weeks and saw them recover early November's losses that had been stoked by fears of a tech bubble.

Bets on the central bank easing monetary policy for a third successive meeting have been rising since a number of decision-makers said protecting jobs was a bigger concern for them that keeping a lid on elevated inflation.

Those comments have been compounded by figures showing the economy -- particularly the labour market -- continues to soften while inflation appears to be stabilised for now.

The latest round of data added to that narrative, with a survey of manufacturers by the Institute for Supply Management indicating that activity in the sector contracted for a ninth straight month.

After a mixed day to start the week, Asia's markets resumed their recent rally Tuesday.

Hong Kong, Sydney, Seoul, Singapore, Taipei, Wellington, Manila and Jakarta were all up, though Shanghai dipped.

Tokyo also advanced, clawing back some of Monday's losses that came on the back of comments from Bank of Japan boss Kazuo Ueda that hinted at a possible interest rate hike this month.

The remarks boosted the yen and provided a jolt to equities as the yield of Japanese two-year government bonds rose past one percent to their highest since 2008 during the global financial crisis. The Japanese unit was steady on Tuesday.

They also helped pin back Wall Street after last week's Thanksgiving run-up and dented overall risk sentiment, pulling bitcoin back down.

Ueda's comments could mark a de-anchoring of the carry trade, in which traders borrow yen at low cost to invest in riskier assets", wrote City Index senior market analyst Fiona Cincotta.

"A higher rate in Japan could suck liquidity out of the markets. Tech stocks and crypto are particularly sensitive to even the smallest shifts in liquidity."

Still, National Australia Bank's Rodrigo Catril said Ueda also mentioned the need "to confirm the momentum of initial moves toward next year's annual spring labour-management wage negotiations".

He said that "implies that the December meeting may be too soon to have a good understanding of the wage momentum for next year".

Investors are watching nervously an auction of 10-year bonds due later Tuesday.

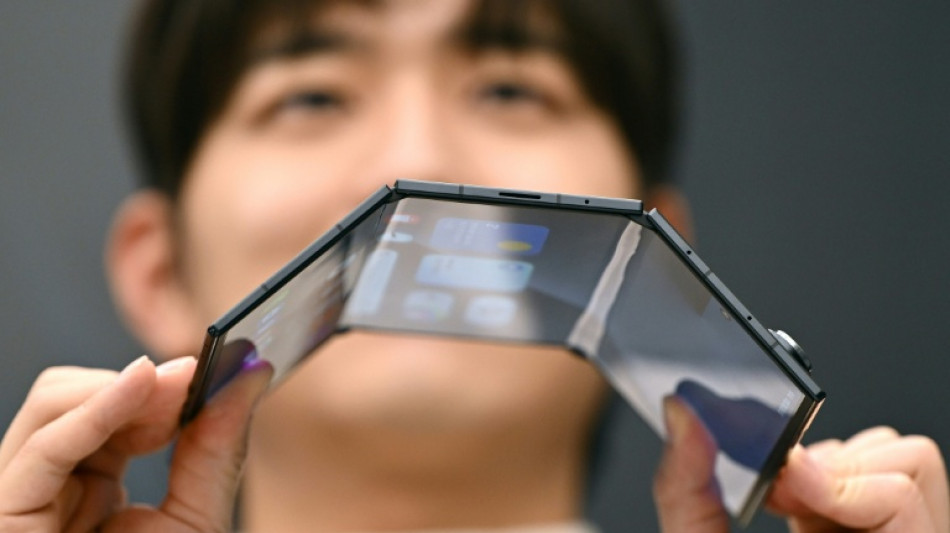

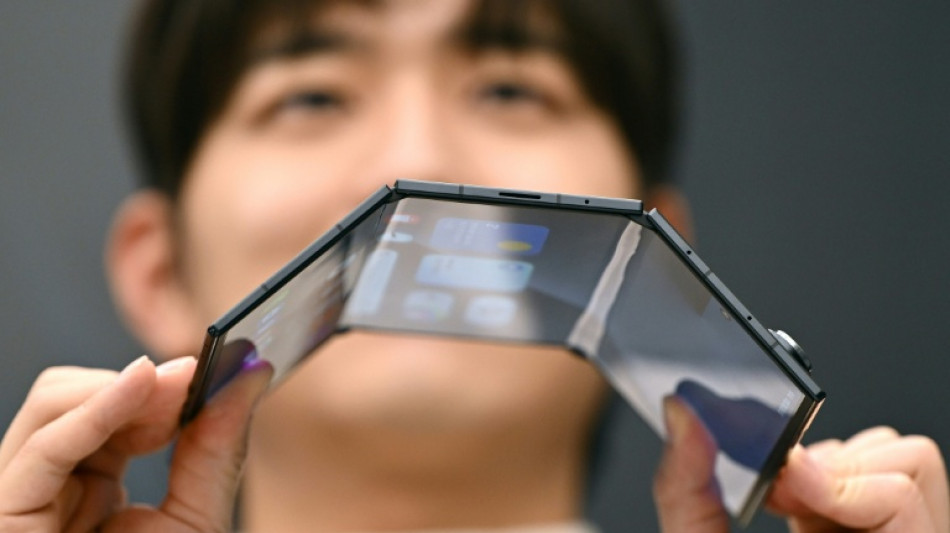

South Korean tech titan Samsung Electronics surged more than two percent in Seoul as it launched its first triple-folding phone, even admitting that its more than $2,400 price tag would place it far out of reach for the average customer.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 0.4 percent at 49,499.06 (break)

Hong Kong - Hang Seng Index: UP 0.8 percent at 26,245.11

Shanghai - Composite: DOWN 0.3 percent at 3,904.02

Dollar/yen: UP at 155.60 yen from 155.50 yen on Monday

Euro/dollar: UP at $1.1610 from $1.1608

Pound/dollar: UP at $1.3212 from $1.3211

Euro/pound: DOWN at 87.86 pence from 87.87 pence

West Texas Intermediate: UP 0.2 percent at $59.42 per barrel

Brent North Sea Crude: UP 0.1 percent at $63.23 per barrel

New York - Dow: DOWN 0.9 percent at 47,289.33 (close)

London - FTSE 100: DOWN 0.2 percent at 9,702.53 (close)

S.Keller--BTB