-

US troops in Syria killed in alleged IS ambush

US troops in Syria killed in alleged IS ambush

-

Jalibert masterclass guides Bordeaux-Begles past Scarlets

-

M23 marches on in east DR Congo as US vows action against Rwanda

M23 marches on in east DR Congo as US vows action against Rwanda

-

Raphinha double stretches Barca's Liga lead in Osasuna win

-

Terrific Terrier returns Leverkusen to fourth

Terrific Terrier returns Leverkusen to fourth

-

Colts activate 44-year-old Rivers for NFL game at Seattle

-

US troops in Syria killed in IS ambush attack

US troops in Syria killed in IS ambush attack

-

Liverpool's Slot says 'no issue to resolve' with Salah after outburst

-

'Stop the slaughter': French farmers block roads over cow disease cull

'Stop the slaughter': French farmers block roads over cow disease cull

-

Stormers see off La Rochelle, Sale stun Clermont in Champions Cup

-

Maresca hails Palmer as Chelsea return to winning ways against Everton

Maresca hails Palmer as Chelsea return to winning ways against Everton

-

Hungarian protesters demand Orban quits over abuse cases

-

Belarus frees protest leader Kolesnikova, Nobel winner Bialiatski

Belarus frees protest leader Kolesnikova, Nobel winner Bialiatski

-

Salah sets up goal on return to Liverpool action

-

Palmer strikes as Chelsea return to winning ways against Everton

Palmer strikes as Chelsea return to winning ways against Everton

-

Pogacar targets Tour de France Paris-Roubaix and Milan-San Remo in 2026

-

Salah back in action for Liverpool after outburst

Salah back in action for Liverpool after outburst

-

Atletico recover Liga momentum with battling win over Valencia

-

Meillard leads 'perfect' Swiss sweep in Val d'Isere giant slalom

Meillard leads 'perfect' Swiss sweep in Val d'Isere giant slalom

-

Salah on Liverpool bench for Brighton match

-

Meillard leads Swiss sweep in Val d'Isere giant slalom

Meillard leads Swiss sweep in Val d'Isere giant slalom

-

Indonesia flood death toll passes 1,000 as authorities ramp up aid

-

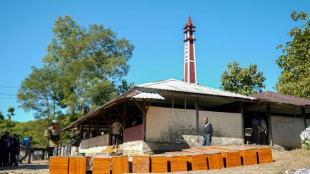

Cambodia shuts Thailand border crossings over deadly fighting

Cambodia shuts Thailand border crossings over deadly fighting

-

First urban cable car unveiled outside Paris

-

Vonn second behind Aicher in World Cup downhill at St Moritz

Vonn second behind Aicher in World Cup downhill at St Moritz

-

Aicher pips Vonn to downhill win at St Moritz

-

Thailand says 4 soldiers killed in Cambodia conflict, denies Trump truce claim

Thailand says 4 soldiers killed in Cambodia conflict, denies Trump truce claim

-

Fans vandalise India stadium after Messi's abrupt exit

-

Women sommeliers are cracking male-dominated wine world open

Women sommeliers are cracking male-dominated wine world open

-

Exhibition of Franco-Chinese print master Zao Wou-Ki opens in Hong Kong

-

Myanmar junta denies killing civilians in hospital strike

Myanmar junta denies killing civilians in hospital strike

-

Why SpaceX IPO plan is generating so much buzz

-

Thailand continues Cambodia strikes despite Trump truce calls

Thailand continues Cambodia strikes despite Trump truce calls

-

US envoy to meet Zelensky, Europe leaders in Berlin this weekend

-

North Korea acknowledges its troops cleared mines for Russia

North Korea acknowledges its troops cleared mines for Russia

-

US unseals warrant for tanker seized off Venezuelan coast

-

Cambodia says Thailand still bombing hours after Trump truce call

Cambodia says Thailand still bombing hours after Trump truce call

-

Machado urges pressure so Maduro understands 'he has to go'

-

Leinster stutter before beating Leicester in Champions Cup

Leinster stutter before beating Leicester in Champions Cup

-

World stocks mostly slide, consolidating Fed-fuelled gains

-

Crypto firm Tether bids for Juventus, is quickly rebuffed

Crypto firm Tether bids for Juventus, is quickly rebuffed

-

Union sink second-placed Leipzig to climb in Bundesliga

-

US Treasury lifts sanctions on Brazil Supreme Court justice

US Treasury lifts sanctions on Brazil Supreme Court justice

-

UK king shares 'good news' that cancer treatment will be reduced in 2026

-

Wembanyama expected to return for Spurs in NBA Cup clash with Thunder

Wembanyama expected to return for Spurs in NBA Cup clash with Thunder

-

Five takeaways from Luigi Mangione evidence hearings

-

UK's king shares 'good news' that cancer treatment will be reduced in 2026

UK's king shares 'good news' that cancer treatment will be reduced in 2026

-

Steelers' Watt undergoes surgery to repair collapsed lung

-

Iran detains Nobel-prize winner in 'brutal' arrest

Iran detains Nobel-prize winner in 'brutal' arrest

-

NBA Cup goes from 'outside the box' idea to smash hit

Dow, S&P 500 end at records despite AI fears

The Dow and S&P 500 finished at fresh records Thursday while a big drop in Oracle shares dragged the Nasdaq lower and revived worries over pricey artificial intelligence valuations.

The records followed a positive day on European bourses and mixed one in Asia and reflected optimism after the Federal Reserve cut interest rates on Wednesday and offered less hawkish commentary than feared.

Banks and industrial stocks were among the best performing on the blue-chip Dow index, which ended 1.3 percent higher, while the Nasdaq lost 0.3 percent.

"Even as investors were reassured by the Fed's latest rate cut, familiar concerns about AI are still very much top of mind right now," said Deutsche Bank managing director Jim Reid.

Those concerns were reignited after Oracle reported after markets closed on Wednesday that quarterly revenue had fallen short of lofty expectations and revealed a surge in spending on data centers to boost AI capacity.

Shares in the Texas-based company finished down 10.8 percent after dropping even more during the session.

Dave Grecsek of Aspiriant Wealth Management said the market's reaction to Oracle's results underscored its discomfort with aggressive AI investments.

"There's still a lot of apprehension about how sustainable some of these capital spending plans are, what the return on those investments are, and especially now that they're financed with debt," he said.

Markets globally suffered a wobble last month with investors worried over the vast sums poured into AI, with some observers warning of an AI bubble that could burst and cause a market rout.

The Fed, as expected, cut interest rates on Wednesday. But an unusually heavy number of dissents (three) complicates the outlook for monetary policy.

"Investors have shrugged off the Fed's latest reduction in US borrowing costs as it is becoming harder to guess where rates might go next," said AJ Bell investment director Russ Mould.

Fed policymakers were highly divided about whether to cut rates again in 2026 and if so, how often.

But eToro US analyst Bret Kenwell pointed out that Fed Chair Jerome Powell had highlighted the fact that none of the Fed policymakers sees rate hikes in 2026 in their base scenario.

"The lack of an outright hawkish tone from the Fed combined with its third consecutive rate cut could pave the way for a potential year-end rally in equities, provided that next week's macroeconomic data doesn't derail the recent bullish momentum," Kenwell said.

The latest cut in borrowing costs -- to their lowest level in three years -- comes as monetary policymakers try to support the US jobs market, which has been showing signs of weakness for much of the year.

The dollar weakened while oil prices retreated.

Among individual companies, Disney jumped 2.4 percent after announcing a three-year licensing deal with OpenAI that will allow users to create short videos featuring beloved Disney characters through artificial intelligence.

- Key figures at around 2130 GMT -

New York - Dow: UP 1.3 percent at 48,704.01 (close)

New York - S&P 500: UP 0.2 percent at 6,901.00 (close)

New York - Nasdaq Composite: DOWN 0.3 percent at 23,593.86 (close)

London - FTSE 100: UP 0.5 percent at 9,703.16 (close)

Paris - CAC 40: UP 0.8 percent at 8,085.76 (close)

Frankfurt - DAX: UP 0.7 percent at 24,294.61 (close)

Tokyo - Nikkei 225: DOWN 0.9 percent at 50,148.82 (close)

Hong Kong - Hang Seng Index: FLAT at 25,530.51 (close)

Shanghai - Composite: DOWN 0.7 percent at 3,873.32 (close)

Dollar/yen: DOWN at 155.58 yen from 156.02 yen on Wednesday

Euro/dollar: UP at $1.1741 from $1.1695

Pound/dollar: UP at $1.3394 from $1.3383

Euro/pound: UP at 87.65 pence from 87.39 pence

Brent North Sea Crude: DOWN 1.5 percent at $61.28 per barrel

West Texas Intermediate: DOWN 1.5 percent at $57.60 per barrel

burs-jmb/bgs

P.Anderson--BTB