-

Asian markets rise as US inflation eases, Micron soothes tech fears

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Giant lanterns light up Christmas in Catholic Philippines

-

TikTok: key things to know

TikTok: key things to know

-

Putin, emboldened by Ukraine gains, to hold annual presser

-

Deportation fears spur US migrants to entrust guardianship of their children

Deportation fears spur US migrants to entrust guardianship of their children

-

Upstart gangsters shake Japan's yakuza

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

Stokes's 83 gives England hope as Australia lead by 102 in 3rd Test

-

Go long: the rise and rise of the NFL field goal

Go long: the rise and rise of the NFL field goal

-

Australia announces gun buyback, day of 'reflection' after Bondi shooting

-

New Zealand Cricket chief quits after split over new T20 league

New Zealand Cricket chief quits after split over new T20 league

-

England all out for 286, trail Australia by 85 in 3rd Test

-

Australian announces gun buyback, day of 'reflection' after Bondi shooting

Australian announces gun buyback, day of 'reflection' after Bondi shooting

-

Joshua takes huge weight advantage into Paul fight

-

TikTok signs joint venture deal to end US ban threat

TikTok signs joint venture deal to end US ban threat

-

Conway's glorious 200 powers New Zealand to 424-3 against West Indies

-

WNBA lockout looms closer after player vote authorizes strike

WNBA lockout looms closer after player vote authorizes strike

-

Honduras begins partial vote recount in Trump-dominated election

-

Nike shares slump as China struggles continue

Nike shares slump as China struggles continue

-

Hundreds swim, float at Bondi Beach to honour shooting victims

-

Crunch time for EU leaders on tapping Russian assets for Ukraine

Crunch time for EU leaders on tapping Russian assets for Ukraine

-

Pope replaces New York's pro-Trump Cardinal with pro-migrant Chicagoan

-

Trump orders marijuana reclassified as less dangerous drug

Trump orders marijuana reclassified as less dangerous drug

-

Rams ace Nacua apologizes over 'antisemitic' gesture furor

-

McIlroy wins BBC sports personality award for 2025 heroics

McIlroy wins BBC sports personality award for 2025 heroics

-

Napoli beat Milan in Italian Super Cup semi-final

-

Violence erupts in Bangladesh after wounded youth leader dies

Violence erupts in Bangladesh after wounded youth leader dies

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

US hosting new Gaza talks to push next phase of deal

US hosting new Gaza talks to push next phase of deal

-

Chicago Bears mulling Indiana home over public funding standoff

-

Trump renames Kennedy arts center after himself

Trump renames Kennedy arts center after himself

-

Trump rebrands housing supplement as $1,776 bonuses for US troops

-

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

Assange files complaint against Nobel Foundation over Machado win

-

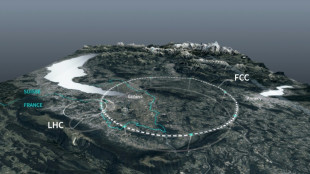

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

Protection racket? Asian semiconductor giants fear looming tariffs

Inside one of South Korea's oldest semiconductor research institutes, the cleanrooms and workshops are calm and immaculate, but outside the Seoul National University campus, a chip storm is brewing.

Last month, Washington announced a national security probe into imports of semiconductor technology, which could put the industry in the crosshairs of President Donald Trump's trade bazooka and inflict potentially devastating levies.

For chipmaking powerhouses South Korea and Taiwan, the consequences could be enormous.

South Korea is home to Samsung Electronics and SK hynix, while Taiwan hosts the world's largest contract chipmaker, TSMC. Collectively, they produce a significant chunk of high-end chips that have become the lifeblood of the global economy, powering everything from smartphones to missiles.

Taiwan exported $7.4 billion worth of semiconductors to the United States in 2024, while South Korea's exports surged to $10.7 billion, a historic high.

Experts say the spectre of looming tariffs has spurred stockpiling, with fears levies will drive up consumer prices and hurt chipmakers.

The clear intention of Trump's policies is to force the Asian chip giants to relocate production stateside, a former engineer at Taiwanese chip firm MediaTek told AFP.

"TSMC going overseas to the US to build fabs is like paying protection money," they said, adding that the projects barely made a profit with margins "super low" in high-cost America.

"From the American point of view, it's logical to sacrifice the rest of the world for its own interests, only that we happen to be the ones being sacrificed," the engineer said.

- A 'heavy blow' -

The US president's tolls could be "quite complex", Kim Yang-paeng, senior researcher at Korea Institute for Industrial Economics and Trade (KIET), told AFP.

Rather than hitting the industry with a blanket levy, the United States could target different products such as HBM, which is essential for high-speed computing, and DRAM, which is used for memory.

Any significant tariffs on the sector, which relies on complex manufacturing chains to produce high-end tech products, would be a "heavy blow", the MediaTek engineer said.

Samsung, the world's largest memory chipmaker, and leading memory chip supplier SK hynix rely heavily on indirect exports to the United States via China, Taiwan and Vietnam.

For example, Samsung produces television panels in South Korea, which are then assembled into finished televisions in Vietnam before being shipped to the United States.

For these companies, there is "concern about a decline in demand due to rising prices in other sectors using semiconductors", said Jung Jae-wook, professor at Sogang University.

Meanwhile, Seoul and Washington are negotiating a "trade package" aimed at preventing new US tariffs before the July 8 expiration of Trump's pause in his "reciprocal" levies.

- Few alternatives -

US Trade Representative Jamieson Greer is expected to visit South Korea for the APEC trade ministers' meeting this week.

Experts say that in the short term, chips like HBM are less likely to be impacted by tariff wars owing to strong demand driven by artificial intelligence.

And unlike many other sectors such as the auto industry -- which is already hit by tariffs -- "semiconductors have no substitutes from the US perspective", said Kim Dae-jong, a professor at Sejong University.

It is also not feasible to shift chip production entirely stateside, given America's limited capacity, so any measures "are unlikely to be sustained in the long run", said Sogang University's Jung.

"There are not many alternative countries (the United States) can rely on for imports, making price increases inevitable if tariffs are imposed," he said.

While Washington is eager to bolster domestic production, South Korea and Taiwan are keenly aware of the strategic significance of the industry and are not likely to give up capacity.

For Taiwan, semiconductors are a matter of national security, said Kim from KIET.

"Taiwan may expand its manufacturing presence in the United States, but significant changes to its domestic semiconductor ecosystem are unlikely."

Back at the Seoul National University semiconductor institute, its director, Lee Hyuk-jae -- who is also an outside director for Samsung -- spends his days urging the government to invest more in the sector, which he says "holds great importance" for the country.

L.Janezki--BTB