-

New photo dump fuels Capitol Hill push on Epstein files release

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

Assange files complaint against Nobel Foundation over Machado win

-

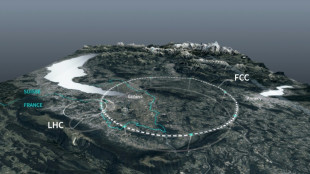

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

-

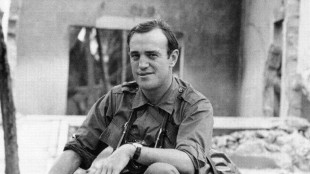

Pulitzer-winning combat reporter Peter Arnett dies at 91

Pulitzer-winning combat reporter Peter Arnett dies at 91

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Lyon humbled to surpass childhood hero McGrath's wicket tally

Lyon humbled to surpass childhood hero McGrath's wicket tally

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

England vow to keep 'fighting and scrapping' as Ashes slip away

England vow to keep 'fighting and scrapping' as Ashes slip away

-

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

-

Most Asian markets track Wall St lower as AI fears mount

Most Asian markets track Wall St lower as AI fears mount

-

Cambodia says Thailand bombs casino hub on border

-

Thai queen wins SEA Games gold in sailing

Thai queen wins SEA Games gold in sailing

-

England Ashes dreams on life-support as Australia rip through batting

-

Masterful Conway, Latham in 323 opening stand as West Indies wilt

Masterful Conway, Latham in 323 opening stand as West Indies wilt

-

Danish 'ghetto' tenants hope for EU discrimination win

-

Cricket Australia boss slams technology as Snicko confusion continues

Cricket Australia boss slams technology as Snicko confusion continues

-

Conway and Latham's 323-run opening stand batters hapless West Indies

-

Alleged Bondi shooters holed up in hotel for most of Philippines visit

Alleged Bondi shooters holed up in hotel for most of Philippines visit

-

Japan govt sued over 'unconstitutional' climate inaction

Stocks rise after China-US framework on trade

Stock markets rose Wednesday as investors welcomed a China-US agreement to lower trade tensions that stoked hopes the economic superpowers will eventually reach a broader tariff deal.

After two days of closely watched talks in London, the two sides said they had set up a framework to move towards a pact, following negotiations in Geneva last month that saw them slash tit-for-tat levies.

The news provided some relief to markets after US President Donald Trump accused Beijing of violating that deal.

"Constructive talks between the US and China have put markets on a firmer footing, as investors hope that the worst of the tariff turbulence may have passed," said Richard Hunter, head of markets at Interactive Investor.

Paris and Frankfurt enjoyed modest gains in midday deals.

London edged higher also as investors awaited finer details of the UK government's latest spending and investment decisions due Wednesday.

Asian stock markets won a lift on the China-US progress, with Hong Kong among the best performers.

Analysts said investors would be keen to get a closer look of the agreement's details.

"There's perhaps a little disappointment... that we haven't yet got a bigger announcement, even though there's time to hear the full conclusions of the meeting," said Deutsche Bank economist Jim Reid.

As well as tariffs, a key issue in the discussions was China's export of rare earths used in smartphones and electric vehicles, while Beijing was keen to see an easing of restrictions on its access to tech goods.

China said the trade talks made new progress, and vice premier He Lifeng stressed the need for Beijing and Washington to strengthen cooperation.

US Commerce Secretary Howard Lutnick said he was upbeat that concerns over rare earths "will be resolved" eventually, as the agreement is implemented.

Chinese President Xi Jinping and Trump must approve the framework first.

The talks came as World Bank downgraded its 2025 forecast for global economic growth to 2.3 percent -- from the 2.7 percent predicted in January -- citing trade tensions and policy uncertainty.

It also said the US economy would expand 1.4 percent this year, half of its 2024 growth.

In a speech in Beijing, European Central Bank chief Christine Lagarde called for a de-escalation in the tariffs standoffs, warning that "coercive trade policies" risked harming supply chains and the global economy.

"Once the US reaches an agreement with China, we expect the EU to be next in line," said Kathleen Brooks, research director at trading group XTB, referring to US-EU negotiations to avert steeper tariffs next month.

Investors also awaited US inflation data due Wednesday, which analysts expect to reinforce the Federal Reserve's slower pace of interest rate cuts.

The dollar was mixed against main rivals ahead of the release, while oil prices firmed.

In company news Wednesday, shares in Zara owner Inditex fell more than three percent in Madrid, after the world's biggest fashion retailer posted disappointing first quarter sales.

- Key figures at around 1040 GMT -

London - FTSE 100: UP 0.1 percent at 8,859.25 points

Paris - CAC 40: UP 0.3 percent at 7,823.94

Frankfurt - DAX: UP 0.2 percent at 24,046.23

Tokyo - Nikkei 225: UP 0.6 percent at 38,421.19 (close)

Hong Kong - Hang Seng Index: UP 0.8 percent at 24,366.94 (close)

Shanghai - Composite: UP 0.5 percent at 3,402.32 (close)

New York - Dow: UP 0.3 percent at 42,866.87 (close)

Euro/dollar: UP at $1.1438 from $1.1426 on Tuesday

Pound/dollar: DOWN at $1.3495 from $1.3501

Dollar/yen: UP at 145.13 yen from 144.88 yen

Euro/pound: UP at 84.76 pence from 84.61 pence

Brent North Sea Crude: UP 1.2 percent at $67.68 per barrel

West Texas Intermediate: UP 1.5 percent at $65.94 per barrel

N.Fournier--BTB