-

Assange files complaint against Nobel Foundation over Machado win

Assange files complaint against Nobel Foundation over Machado win

-

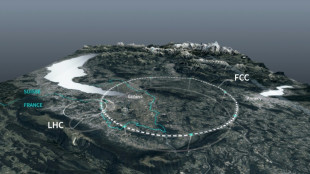

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

-

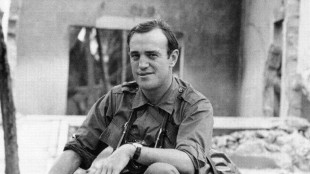

Pulitzer-winning combat reporter Peter Arnett dies at 91

Pulitzer-winning combat reporter Peter Arnett dies at 91

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Lyon humbled to surpass childhood hero McGrath's wicket tally

Lyon humbled to surpass childhood hero McGrath's wicket tally

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

England vow to keep 'fighting and scrapping' as Ashes slip away

England vow to keep 'fighting and scrapping' as Ashes slip away

-

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

-

Most Asian markets track Wall St lower as AI fears mount

Most Asian markets track Wall St lower as AI fears mount

-

Cambodia says Thailand bombs casino hub on border

-

Thai queen wins SEA Games gold in sailing

Thai queen wins SEA Games gold in sailing

-

England Ashes dreams on life-support as Australia rip through batting

-

Masterful Conway, Latham in 323 opening stand as West Indies wilt

Masterful Conway, Latham in 323 opening stand as West Indies wilt

-

Danish 'ghetto' tenants hope for EU discrimination win

-

Cricket Australia boss slams technology as Snicko confusion continues

Cricket Australia boss slams technology as Snicko confusion continues

-

Conway and Latham's 323-run opening stand batters hapless West Indies

-

Alleged Bondi shooters holed up in hotel for most of Philippines visit

Alleged Bondi shooters holed up in hotel for most of Philippines visit

-

Japan govt sued over 'unconstitutional' climate inaction

-

US approves $11 billion in arms sales to Taiwan: Taipei

US approves $11 billion in arms sales to Taiwan: Taipei

-

England battle to save Ashes as Australia rip through top-order

Stock markets, dollar steady before US jobs data

Stock markets and the dollar largely steadied Thursday before key US jobs data and as investors kept a close eye on President Donald Trump's bid to push through a tax-cutting budget.

London's stock market and the pound recovered, having taken a knock Wednesday on rumours that British finance minister Rachel Reeves faced losing her job.

Oil prices fell, with OPEC and the cartel's crude-producing allies expected to announce Sunday a rise to output.

"US stock markets made a fresh record high on Wednesday as we lead up to today's (non-farm) payrolls report," noted Kathleen Brooks, research director at XTB trading group.

"A weak jobs reading for June... could see the market step up rate-cut expectations for the US, which may weigh on the dollar," she added.

Thursday's report comes one day after a smaller survey showed the US private sector unexpectedly shed jobs last month for the first time since March 2023, suggesting the labour market was slackening in the world's biggest economy.

Traders widely expect the Federal Reserve to cut US interest rates twice this year but there is growing speculation that it could make three, with one possibly at the July meeting.

Bets on rates coming down -- possibly this month but more likely in September or October -- are supporting equities.

There was a muted response, meanwhile, to a US-Vietnam trade deal.

While the pact provided hope that other governments could reach agreements with Washington, dealers were cautious as it emerged that Vietnam must still pay levies of as much as 40 percent for certain exports.

The news means Hanoi will avoid paying the 46 percent levies applied on the April 2 tariff blitz, though the cost of goods going into America will still surge.

The stock exchanges in Ho Chi Minh City and Hanoi both dipped Thursday.

With less than a week left until Trump's July 9 deadline to avoid his "reciprocal" levies, only Britain has signed a deal with the US while China has agreed a framework that slashed sky-high tit-for-tat levies.

Trump has said he will not push back his deadline to make more deals, though he and some of his officials have said a number were in the pipeline.

Elsewhere, US Treasury yields rose amid fresh worries in the bond market over Trump's "Big, Beautiful Bill" that aims to cut taxes and spending on programmes such as Medicaid.

Independent analysis suggests the budget will add $3 trillion to the already-colossal US debt mountain, which observers warn could deal a fresh blow to the world's top economy.

Still, with some Republicans in the House of Representatives holding out over certain features of the bill, there is talk that lawmakers will not be able to get it to Trump's desk by Friday's deadline.

On the corporate front, France on Thursday announced a record 40 million-euro fine against Chinese e-commerce giant Shein over "deceptive commercial practices".

- Key figures at around 1040 GMT -

London - FTSE 100: UP 0.3 percent at 8,804.06 points

Paris - CAC 40: DOWN 0.1 percent at 7,731.61

Frankfurt - DAX: UP 0.1 percent at 23,810.41

Tokyo - Nikkei 225: UP 0.1 percent at 39,785.90 (close)

Hong Kong - Hang Seng Index: DOWN 0.6 percent at 24,069.94 (close)

Shanghai - Composite: UP 0.2 percent at 3,461.15 (close)

New York - Dow: FLAT at 44,484.42 (close)

Euro/dollar: DOWN at $1.1799 from $1.1801 on Wednesday

Pound/dollar: UP at $1.3665 from $1.3634

Dollar/yen: UP at 143.78 yen from 143.65 yen

Euro/pound: DOWN at 86.35 pence from 86.52 pence

West Texas Intermediate: DOWN 0.3 percent at $67.25 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $68.89 per barrel

F.Müller--BTB