-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

-

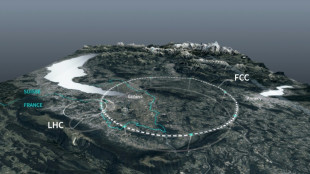

Private donors pledge $1 bn for CERN particle accelerator

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

Not enough evidence against Swedish PM murder suspect: prosecutor

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

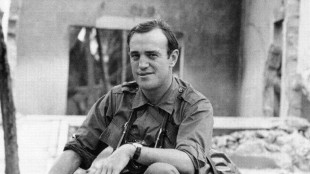

Pulitzer-winning combat reporter Peter Arnett dies at 91

-

EU kicks off crunch summit on Russian asset plan for Ukraine

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Lyon humbled to surpass childhood hero McGrath's wicket tally

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

England vow to keep 'fighting and scrapping' as Ashes slip away

-

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

-

Most Asian markets track Wall St lower as AI fears mount

-

Cambodia says Thailand bombs casino hub on border

Cambodia says Thailand bombs casino hub on border

-

Thai queen wins SEA Games gold in sailing

-

England Ashes dreams on life-support as Australia rip through batting

England Ashes dreams on life-support as Australia rip through batting

-

Masterful Conway, Latham in 323 opening stand as West Indies wilt

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

Cricket Australia boss slams technology as Snicko confusion continues

Most markets rise as Trump sends tariff letters, delays deadline

Most stocks rose Tuesday as traders cautiously welcomed Donald Trump's extension of his tariff deadline and indication he could push it back further, though uncertainty over US trade policy capped gains.

Days before the three-month pause on his "Liberation Day" tariffs was set to expire, the US president said he would give governments an extra three weeks to hammer out deals to avoid paying sky-high levies for exports to the world's biggest economy.

That came as he sent out letters to over a dozen countries -- including top trading partners Japan and South Korea -- setting out what he had decided to charge if they did not reach agreements by the new August 1 target date.

Investors tentatively welcomed the delay amid hopes officials will be able to reach deals with Washington, with some observers seeing the latest move by the president as a negotiation tactic.

The letters said Tokyo and Seoul would be hit with 25 percent tariffs, while Indonesia, Bangladesh, Thailand, South Africa and Malaysia faced duties ranging from 25 percent to 40 percent.

When asked if the new deadline was set in stone, the president said: "I would say firm, but not 100 percent firm."

And asked whether the letters were his final offer, he replied: "I would say final -- but if they call with a different offer, and I like it, then we'll do it."

While Wall Street's three main indexes ended down -- with the S&P 500 and Nasdaq back from record highs -- Asian markets mostly rose.

Tokyo and Seoul advanced, while there were also gains in Hong Kong, Shanghai and Singapore. Sydney, Wellington and Taipei fell. Manila and Jakarta were flat.

The White House has for weeks said that numerous deals were in the pipeline, with Treasury Secretary Scott Bessent claiming Monday that "we are going to have several announcements in the next 48 hours".

But so far only two have been finalised, with Vietnam and Britain, while China reached a framework to slash eye-watering tit-for-tat levies.

Asia Society Policy Institute Vice President Wendy Cutler said the levies on Japan and South Korea "will send a chilling message to others".

"Both have been close partners on economic security matters," she said, adding that companies from both countries had made "significant manufacturing investments in the US in recent years".

For his part, Japan's Prime Minister Shigeru Ishiba said Sunday that he "won't easily compromise".

National Australia Bank's Tapas Strickland said there remained a lot of uncertainty among investors.

"If the agreement with Vietnam is anything to go by, then countries... the US has a trade deficit with look destined to have a 20 percent tariff, and those... the US has a trade surplus with a 10 percent tariff," he wrote in a commentary.

"That could mean eventual tariff rates settle higher than what the current consensus is, which is broadly for a 10 percent across the board tariff with a higher tariff on China.

"Without further clarity, though, markets will have trouble pricing these different scenarios, especially given Trump's quick reversal following the market reaction in response to the initial Liberation Day tariffs."

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 0.3 percent at 39,711.29 (break)

Hong Kong - Hang Seng Index: UP 0.5 percent at 23,996.70

Shanghai - Composite: UP 0.2 percent at 3,479.65

Euro/dollar: UP at $1.1745 from $1.1710 on Monday

Pound/dollar: UP at $1.3634 from $1.3602

Dollar/yen: DOWN at 146.10 yen from 146.13 yen

Euro/pound: UP at 86.15 pence from 86.09 pence

West Texas Intermediate: DOWN 0.7 percent at $67.45 per barrel

Brent North Sea Crude: DOWN 0.6 percent at $69.16 per barrel

New York - Dow: DOWN 0.9 percent at 44,406.36 (close)

London - FTSE 100: DOWN 0.2 percent at 8,806.53 (close)

L.Janezki--BTB