-

New photo dump fuels Capitol Hill push on Epstein files release

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

Assange files complaint against Nobel Foundation over Machado win

-

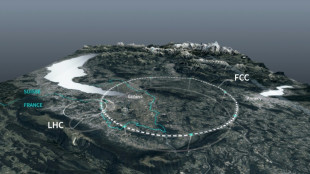

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

-

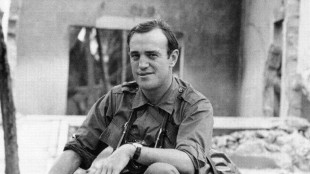

Pulitzer-winning combat reporter Peter Arnett dies at 91

Pulitzer-winning combat reporter Peter Arnett dies at 91

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Lyon humbled to surpass childhood hero McGrath's wicket tally

Lyon humbled to surpass childhood hero McGrath's wicket tally

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

England vow to keep 'fighting and scrapping' as Ashes slip away

England vow to keep 'fighting and scrapping' as Ashes slip away

-

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

-

Most Asian markets track Wall St lower as AI fears mount

Most Asian markets track Wall St lower as AI fears mount

-

Cambodia says Thailand bombs casino hub on border

-

Thai queen wins SEA Games gold in sailing

Thai queen wins SEA Games gold in sailing

-

England Ashes dreams on life-support as Australia rip through batting

-

Masterful Conway, Latham in 323 opening stand as West Indies wilt

Masterful Conway, Latham in 323 opening stand as West Indies wilt

-

Danish 'ghetto' tenants hope for EU discrimination win

-

Cricket Australia boss slams technology as Snicko confusion continues

Cricket Australia boss slams technology as Snicko confusion continues

-

Conway and Latham's 323-run opening stand batters hapless West Indies

-

Alleged Bondi shooters holed up in hotel for most of Philippines visit

Alleged Bondi shooters holed up in hotel for most of Philippines visit

-

Japan govt sued over 'unconstitutional' climate inaction

US Fed holds rates again and flags increased economic uncertainty

The US Federal Reserve paused interest rate cuts again on Wednesday and noted an increase in economic uncertainty, as it navigates an economy unnerved by President Donald Trump's stop-start tariff rollout.

Policymakers voted to hold the US central bank's key lending rate at between 4.25 percent and 4.50 percent, the Fed announced in a statement.

They also cut their growth forecast for 2025 and hiked their inflation outlook, while still penciling in two rate cuts this year -- in line with their previous forecast in December.

The Fed's vote was not unanimous, with one governor rebelling in opposition to his colleagues' decision to slow the pace at which the Fed shrinks the size of its balance sheet.

Since taking office in January, Trump has ramped up levies on top trading partners including China, Canada and Mexico -- only to roll some of them back -- and threatened to impose reciprocal tariffs on other countries.

Many analysts fear Trump's economic policies could push up inflation and hamper economic growth, and complicate the Fed's plans to bring inflation down to its long-term target of two percent while maintaining a healthy labor market.

"It's quite unclear how high the tariffs will get, how widespread they will be, and how long they will last," former Boston Fed president Eric Rosengren told AFP ahead of the rate decision. "And it's very hard to estimate what the impact on inflation or unemployment is going to be until they get a little more visibility into that."

- Slowing economy -

Until recently, the hard economic data had pointed to a fairly robust American economy, with the Fed's favored inflation measure showing a 2.5 percent rise in the year to January -- above target but down sharply from a four-decade high in 2022.

Economic growth was relatively robust through the end of 2024, while the labor market has remained fairly strong, with healthy levels of job creation, and an unemployment rate hovering close to historic lows.

But the mood has shifted in the weeks since Trump returned to the White House, with inflation expectations rising and financial markets tumbling amid the on-again, off-again rollout of tariffs.

Against that backdrop, Fed policymakers tweaked their economic forecasts. While they still have two rate cuts penciled in this year and next, they have revised other data points.

They now expect economic growth to increase by 1.7 percent this year, and by 1.8 percent next year -- a sharp decline from the last economic outlook in December.

They also raised their outlook for inflation in 2025 and 2026, and nudged up their forecast for the unemployment rate.

- 'Disaster' -

While Fed officials have sought to avoid criticizing the new administration, some analysts have been less restrained.

"US President Donald Trump's management of economic policy has been a disaster," Michael Strain, the director of economic policy studies at the conservative American Enterprise Institute, wrote in a recent blog post.

"Fed officials want to be careful not to overreact," Nationwide chief economist Kathy Bostjancic told AFP ahead of the rate decision, adding she expects the Fed to ultimately make just one rate cut this year.

"There's so much uncertainty," she said, adding that she hoped to have more clarity on the US economy after the planned rollout of Trump's retaliatory tariffs on April 2.

Fed chair Jerome Powell will address reporters later Wednesday, and is expected to face questions about how the Fed will chart a path through the ongoing turbulence caused by the rollout of Trump's economic policies.

H.Seidel--BTB