-

'Catastrophic mismatch': Safety fears as Jake Paul faces Anthony Joshua

'Catastrophic mismatch': Safety fears as Jake Paul faces Anthony Joshua

-

Australia's Steve Smith ruled out of third Ashes Test

-

Khawaja grabs lifeline as Australia reach 94-2 in 3rd Ashes Test

Khawaja grabs lifeline as Australia reach 94-2 in 3rd Ashes Test

-

Undefeated boxing great Crawford announces retirement

-

Trump says orders blockade of 'sanctioned' Venezuela oil tankers

Trump says orders blockade of 'sanctioned' Venezuela oil tankers

-

UK experiences sunniest year on record

-

Australia holds first funeral for Bondi Beach attack victims

Australia holds first funeral for Bondi Beach attack victims

-

FIFA announces $60 World Cup tickets after pricing backlash

-

Maresca relishes support of Chelsea fans after difficult week

Maresca relishes support of Chelsea fans after difficult week

-

Players pay tribute to Bondi victims at Ashes Test

-

Costa Rican president survives second Congress immunity vote

Costa Rican president survives second Congress immunity vote

-

Married couple lauded for effort to thwart Bondi Beach shootings

-

Australia holds first funerals for Bondi Beach attack victims

Australia holds first funerals for Bondi Beach attack victims

-

Trump has 'alcoholic's personality,' chief of staff says in bombshell interview

-

Rob Reiner killing: son to be charged with double murder

Rob Reiner killing: son to be charged with double murder

-

Chelsea battle into League Cup semis to ease pressure on Maresca

-

Netflix boss promises Warner Bros films would still be seen in cinemas

Netflix boss promises Warner Bros films would still be seen in cinemas

-

Grok spews misinformation about deadly Australia shooting

-

Stocks mostly retreat on US jobs, oil drops on Ukraine hopes

Stocks mostly retreat on US jobs, oil drops on Ukraine hopes

-

Artificial snow woes for Milan-Cortina Winter Olympics organisers

-

Trump imposes full travel bans on seven more countries, Palestinians

Trump imposes full travel bans on seven more countries, Palestinians

-

New Chile leader calls for end to Maduro 'dictatorship'

-

Shiffrin extends slalom domination with Courchevel win

Shiffrin extends slalom domination with Courchevel win

-

Doctor sentenced for supplying ketamine to 'Friends' star Perry

-

Tepid 2026 outlook dents Pfizer shares

Tepid 2026 outlook dents Pfizer shares

-

Rob Reiner murder: son not medically cleared for court

-

FIFA announces $60 World Cup tickets for 'loyal fans'

FIFA announces $60 World Cup tickets for 'loyal fans'

-

Dembele and Bonmati scoop FIFA Best awards

-

Shiffrin dominates first run in Courchevel slalom

Shiffrin dominates first run in Courchevel slalom

-

EU weakens 2035 combustion-engine ban to boost car industry

-

Arctic sees unprecedented heat as climate impacts cascade

Arctic sees unprecedented heat as climate impacts cascade

-

French lawmakers adopt social security budget, suspend pension reform

-

Afrikaners mark pilgrimage day, resonating with their US backers

Afrikaners mark pilgrimage day, resonating with their US backers

-

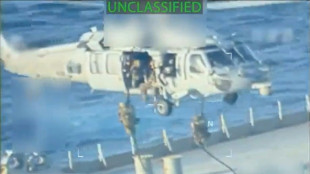

Lawmakers grill Trump officials on US alleged drug boat strikes

-

Hamraoui loses case against PSG over lack of support after attack

Hamraoui loses case against PSG over lack of support after attack

-

Trump - a year of ruling by executive order

-

Iran refusing to allow independent medical examination of Nobel winner: family

Iran refusing to allow independent medical examination of Nobel winner: family

-

Brazil megacity Sao Paulo struck by fresh water crisis

-

Australia's Green becomes most expensive overseas buy in IPL history

Australia's Green becomes most expensive overseas buy in IPL history

-

VW stops production at German site for first time

-

Man City star Doku sidelined until new year

Man City star Doku sidelined until new year

-

Rome's new Colosseum station reveals ancient treasures

-

EU eases 2035 combustion-engine ban to boost car industry

EU eases 2035 combustion-engine ban to boost car industry

-

'Immense' collection of dinosaur footprints found in Italy

-

US unemployment rises further, hovering at highest since 2021

US unemployment rises further, hovering at highest since 2021

-

Senators grill Trump officials on US alleged drug boat strikes

-

Filmmaker Rob Reiner's son to be formally charged with parents' murder

Filmmaker Rob Reiner's son to be formally charged with parents' murder

-

Shift in battle to tackle teens trapped in Marseille drug 'slavery'

-

Stocks retreat on US jobs, oil drops on Ukraine hopes

Stocks retreat on US jobs, oil drops on Ukraine hopes

-

Manchester United 'wanted me to leave', claims Fernandes

Asian stocks drop after Fed warning, oil dips with Mideast in focus

Asian stocks fell Thursday after the Federal Reserve warned Donald Trump's trade war would likely reignite US inflation and dampen economic growth, while oil prices edged down as investors awaited developments in the Israel-Iran conflict.

While geopolitical tensions are the key focus for markets, traders were also watching the US central bank's latest meeting Wednesday as officials gathered to discuss monetary policy in light of the president's tariff blitz.

The Fed kept borrowing rates on hold for a fourth consecutive meeting, as expected, and said in a statement that "uncertainty about the economic outlook has diminished but remains elevated".

It later cut its economic growth forecast for this year and raised inflation and unemployment expectations, in its first updated projections since Trump unveiled his levies on most trading partners at the start of April.

Boss Jerome Powell called the economy "still solid" but added that "increases in tariffs this year are likely to push up prices and weigh on economic activity".

He said the bank was "well-positioned to wait to learn more" before considering changes to rates. Still, the Fed's so-called dot-plot chart predicted two cuts this year.

"Ultimately, the cost of the tariff has to be paid and some of it will fall on the end consumer," he added. "We know that's coming and we just want to see a little bit of that before we make judgements prematurely."

With Trump increasingly calling for the bank to slash rates, Powell said: "We'll make smarter and better decisions if we just wait a couple of months."

Hours before the decision, the president said: "We have a stupid person, frankly, at the Fed."

Speaking at the White House, he added: "We have no inflation, we have only success, and I'd like to see interest rates get down. Maybe I should go to the Fed. Am I allowed to appoint myself?"

"The Fed's assessment indicates that the economy is in good shape, aligning with current economic data," said Tai Hui at JP Morgan Asset Management.

"However, trade policy, fiscal policy, and unintended consequences of policies from the Trump administration are contributing to market volatility in the second half of this year."

After a tepid day on Wall Street, Asian markets turned lower.

Hong Kong led losses, falling more than one percent, while Tokyo, Shanghai, Sydney, Singapore, Seoul, Wellington, Taipei, Manila and Jakarta were also in the red.

The Fed comments compounded the already weak sentiment on trading floors as Trump considers whether to join Israeli strikes against Iran.

He indicated he was still looking into such a move and that Iran had reached out seeking negotiations, saying: "I may do it, I may not do it. I mean, nobody knows what I'm going to do."

Without providing more details, he added: "The next week is going to be very big."

Iran's supreme leader Ayatollah Ali Khamenei earlier sounded a defiant note, rejecting Trump's call for "unconditional surrender".

Still, with no concrete signs of escalation, oil prices edged down after another volatile day on Wednesday.

Analysts said the main worry for traders was the possibility Tehran will shut a key shipping lane through which an estimated fifth of global oil supply flows.

"We don't see it as a likely scenario at this time, but given the precarious state that the Iran regime is in right now, I think everybody should be watching" the Strait of Hormuz, Mike Sommers, president of the American Petroleum Institute, told Bloomberg television in an interview.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 0.7 percent at 38,597.16 (break)

Hong Kong - Hang Seng Index: DOWN 1.0 percent at 23,486.26

Shanghai - Composite: DOWN 0.3 percent at 3,377.19

Euro/dollar: DOWN at $1.1455 from $1.1485 on Wednesday

Pound/dollar: DOWN at $1.3396 from $1.3420

Dollar/yen: UP at 145.15 yen from 145.09 yen

Euro/pound: DOWN at 85.51 pence from 85.55 pence

West Texas Intermediate: DOWN 0.4 percent at $74.86 per barrel

Brent North Sea Crude: DOWN 0.4 percent at $76.40 per barrel

New York - Dow: DOWN 0.1 percent at 42,171.66 (close)

London - FTSE 100: UP 0.1 at 8,843.47 (close)

F.Müller--BTB